Quote-to-Cash (Q2C)

Table of Contents

What is Quote-to-Cash?

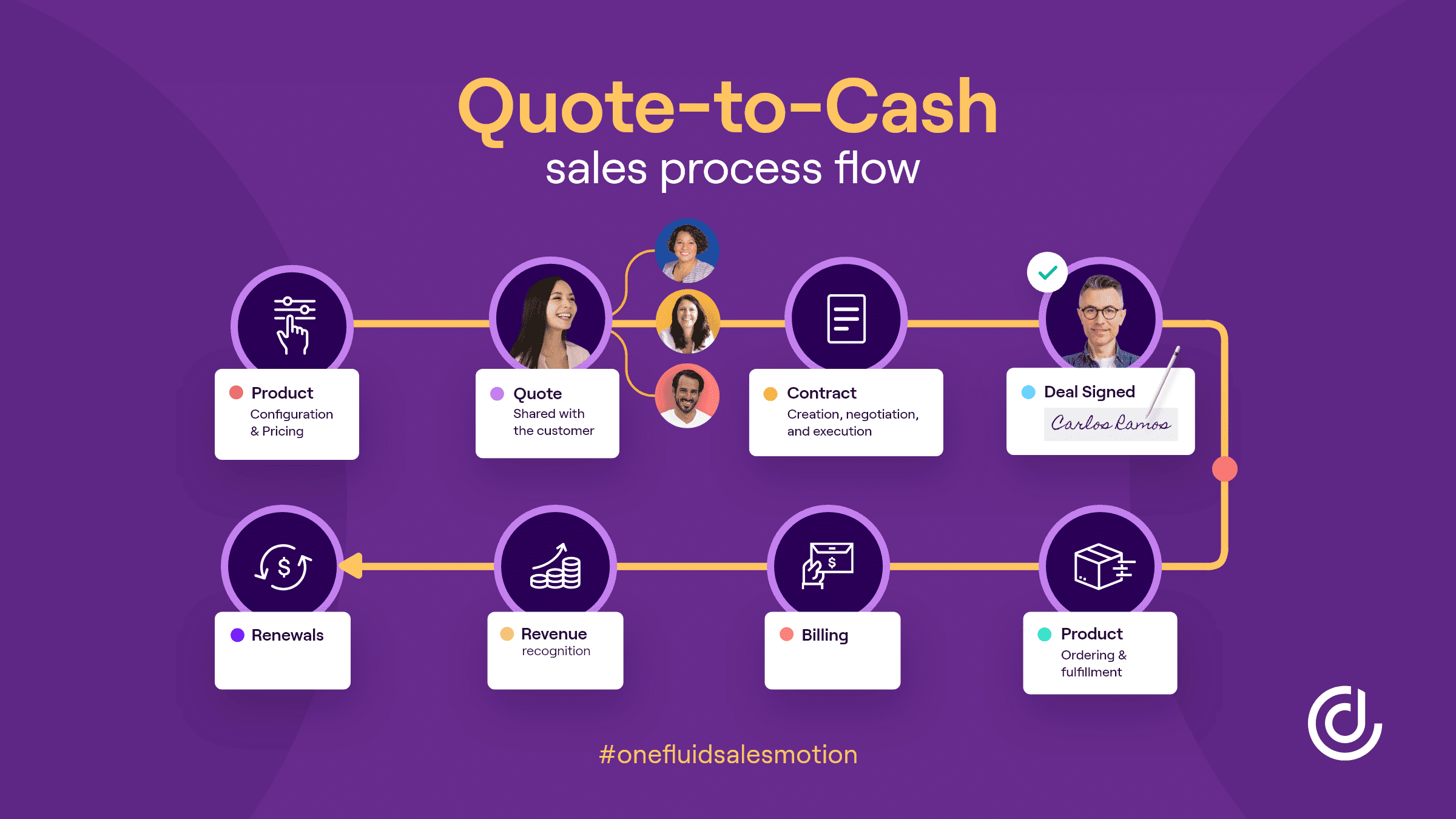

Quote-to-cash (Q2C) is a term that represents the entire sales cycle from product configuration and quote generation to closing the deal and managing revenue. It includes the following aspects of the sales process:

- Product configuration and pricing

- Sharing the quote with the customer

- Contract creation, negotiation, and execution

- Customer acceptance of the deal

- Product ordering and fulfillment

- Billing

- Revenue recognition

- Renewals

Synonyms

- Q2C

- Quote to cash processing

Current Trends in Quote-to-Cash

Quote-to-cash, also known as quote to cash processing, is a key component of sales enablement in many businesses today. This process involves turning quotes and estimates into actual billable transactions, and it has become an important part of the modern business landscape due to its ability to help companies manage their operations more effectively.

There are several trends in Q2C that are driving its growth today. One is the increasing use of automation tools, which helps to streamline quote-to-cash processes and reduce the time and resources needed to complete them. Another trend is the evolution of quoting software, which offers a wide range of capabilities that allow businesses to handle their quote-to-cash needs more efficiently.

Another key trend in Q2C is the increasing focus on customer experience. Companies are working to provide a seamless quote-to-cash process that keeps customers informed and engaged throughout the buying journey, improving satisfaction and retention rates. Overall, quote-to-cash is becoming an essential part of many businesses, and its importance is only likely to grow in the years ahead.

The Benefits of Implementing Quote-to-Cash

There are several benefits to quote-to-cash, including improved revenue recognition and reduced risk of error. By streamlining the Q2C process, businesses can more easily track their sales performance and collect their outstanding invoices in a timely manner. Additionally, by having detailed financial records for each sale, companies can better manage their inventory and forecast future sales.

For organizations that implement a quote-to-cash process that integrates siloed operations (e.g., sales, legal, fulfillment, and finance), the entire sales cycle is seen as a single journey. This integration of disparate systems enables revenue operations to better analyze and improve processes and eliminate inefficiencies.

In addition, quote-to-cash capabilities can also improve customer experience with CPQ. Customers appreciate having a quote or agreement in hand that outlines all the details of their purchase. This helps to avoid misunderstandings and provides greater clarity for both parties.

How Quote-to-Cash Impacts Revenue Recognition

The QTC process is a key part of any organization’s revenue recognition strategy. This process includes the creation of customer quotes, invoices, and other financial documents related to the sale of goods or services. The goal of this process is to ensure that all revenue is properly accounted for in the company’s financial statements.

In order to properly recognize revenue, businesses must capture all of the necessary data. This data includes the date of sale, the customer’s information, the product or service sold, and the price charged. Without this data, it would be difficult to determine when revenue should be recognized.

Benefits of Quote-to-Cash for Sales Teams

There are many benefits of quote-to-cash for sales reps. Perhaps most importantly, it streamlines the sales process and makes it more efficient. It enables sales teams to generate accurate sales quotes, leverage upselling and cross-selling, offer approved discounts, and produce professional sales proposals easily and quickly. Having all parts of the sales process connected enables one fluid sales motion that helps salespeople close deals faster.

How to Improve the Quote-to-Cash Process

There are many ways to improve the quote-to-cash process, including automating as much of the process as possible, streamlining communication between sales and finance teams, and ensuring that pricing is accurate.

Automation can help to speed up the quote-to-cash process by reducing the number of manual tasks and paperwork required. For example, CPQ software that integrates with your CRM will allow your sales team to quickly generate quotes based on the product and pricing data stored in the CPQ.

Communication is also vital when it comes to improving the quote-to-cash process. Ensuring that sales and finance teams are on the same page and have clear, regular communication about the status of quotes can help to reduce confusion and delays.

Finally, it is important to ensure that pricing is accurate throughout the quote-to-cash process. Using sophisticated pricing models or price optimization software will enable you to set prices based on real-time data about customer demand and market trends.

By incorporating these strategies into your quote-to-cash process, you can help to streamline and optimize this critical business function. Whether you are looking to improve efficiency or meet revenue goals, taking steps to improve the quote-to-cash process can significantly impact your bottom line.

How to Streamline Quote-to-Cash with Technology

While Q2C processing is a crucial part of many businesses’ sales processes, it can also be time-consuming and complex. There are several different software solutions available that can help streamline quote-to-cash processing, making it easier for your business to manage customer orders efficiently and with minimal hassle.

Some key features to look for in quote-to-cash software solutions include the ability to automate quote creation and delivery, the ability to integrate seamlessly with your existing sales and billing systems, and the ability to scale easily as your business grows. Other useful features may include tools for managing customer quote approval workflows, analyzing quote conversion metrics over time, or tracking and reporting quote-to-cash progress across different teams or regions.

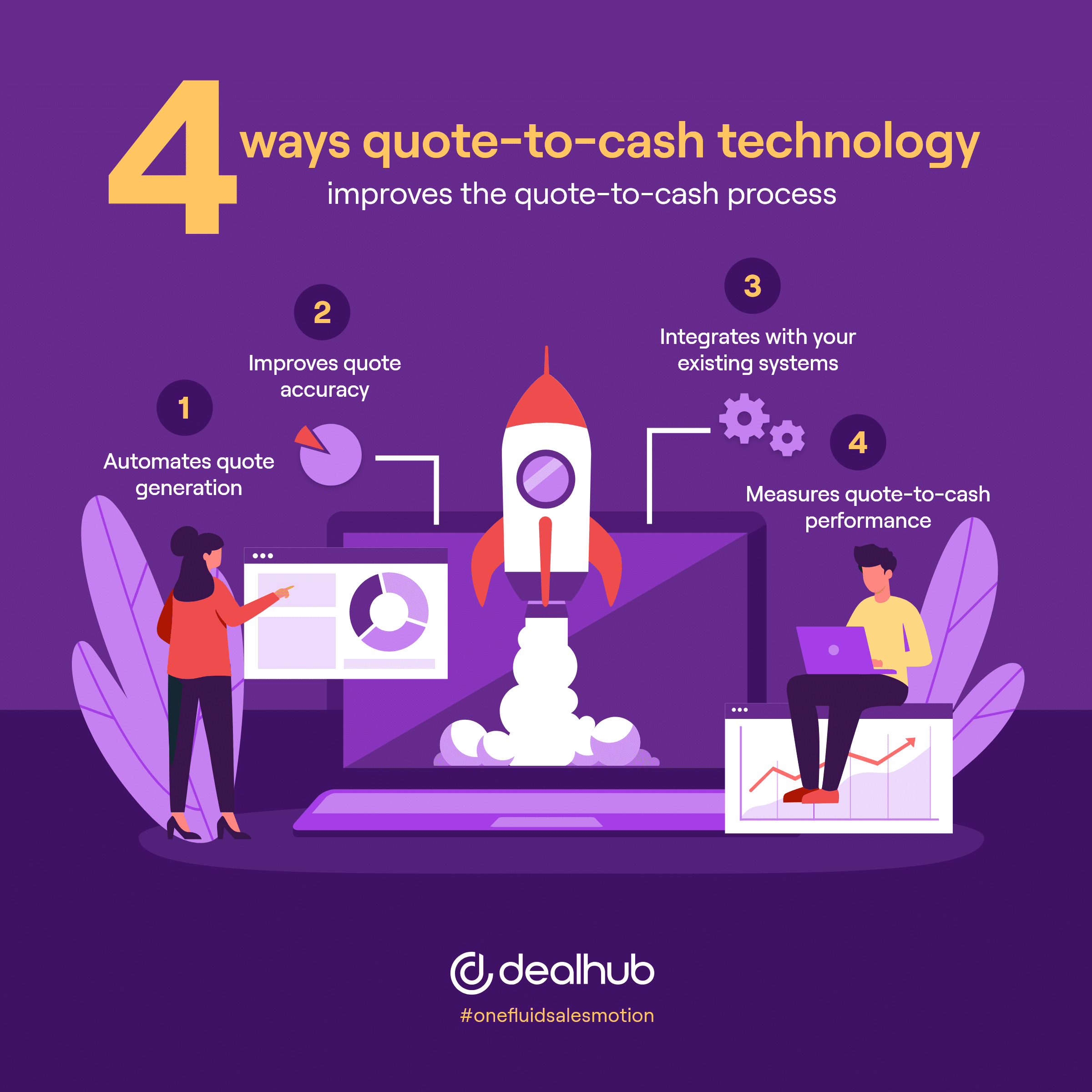

There are many quote-to-cash solutions on the market, so it is important to do your research and select the one that is right for your business. The following are four ways quote-to-cash technology improves the quote-to-cash process and helps businesses grow revenue. Look for a solution that has these capabilities:

1. Automates quote generation

One of the main benefits of using quote-to-cash software is the ability to automate quote generation with CPQ software. This can save sales reps a significant amount of time, as they no longer need to manually create quotes.

2. Improves quote accuracy

Another benefit of using quote-to-cash software is that it can help to improve quote accuracy. This is because the software can automatically populate quote details based on customer information, order details, and other data sources.

3. Integrates with your existing systems

Many quote-to-cash solutions integrate with other business systems, such as CRM platforms, fulfillment systems, and accounting software, to provide an end-to-end solution. This ensures various parts of the system are communicating, orders are shipped in a timely manner, and accurate data is available to revenue operations teams.

4. Measures quote-to-cash performance

Finally, it is important to measure the performance of your quote-to-cash solution. Accurate data from all touchpoints in the quote-to-cash system will help identify areas where the solution is working well and areas where there is room for improvement. Using data-driven insights, you can make changes to optimize quote generation and increase quote-to-cash efficiency.

Quote to Cash vs. CPQ

There are notable differences between quote to cash (Q2C) and configure price quote (CPQ) processes. Perhaps the most significant difference is that CPQ generally encompasses a broader range of activities than Q2C. While Q2C focuses primarily on the financial aspects of closing a deal and generating revenue, CPQ also includes other essential steps, such as configuring products or services and creating pricing proposals.

Another difference between Q2C and CPQ is that the former is typically more manual and time-consuming than the latter because CPQ systems often come with built-in automation and workflow capabilities that can help streamline the entire process.

Finally, it’s worth noting that Q2C and CPQ are not mutually exclusive; in many cases, organizations will use both processes to ensure a smooth and efficient sales cycle. However, depending on the specific needs of a business, one process may be more suitable than the other.

Ultimately, the difference between quote to cash and configure price quote comes down to scope and automation. CPQ is generally more comprehensive and automated than Q2C, making it a popular choice for businesses that want to streamline their sales cycles. However, Q2C should not be overlooked as it remains an integral part of the revenue generation process.

People Also Ask

What are the steps in the quote-to-cash process?

The quote-to-cash process consists of these steps:

1) Configure price quote (CPQ), which is a process of guiding the buyer through product configuration based on their specifications, determining pricing and discounting, and generating a quote.

2) Creating and sharing the sales proposal. The proposal includes the quote and additional content to help buyers reach a decision. It also includes the payment terms and contract.

3) Legal review, negotiation of the terms of the sale, and contract signature.

4) Order fulfillment based on the agreed-upon terms of the sale.

5) Invoicing and revenue recognition.

6) Payment processing.

7) Reporting and analysis to spot inefficiencies and opportunities for improvement.

8) Renewal of contracts or subscriptions.

Is order to cash the same as quote to cash?

While both terms may seem similar, they actually refer to two different processes. Order to cash (O2C) is the process of fulfilling a customer’s order, while quote to cash (Q2C) encompasses the entire sales cycle from creating a quote or estimate to receiving payment for the products or services sold.

O2C begins when an order is placed and ends when the customer pays for the goods or services received. This process includes creating invoices, processing payments, and issuing refunds or credits as needed. On the other hand, Q2C starts with generating a quote or estimate and ends when the payment is received. In between, there are a few steps, such as creating contracts, sending invoices, and collecting payments.

Is CPQ the same as quote-to-cash?

CPQ is the beginning step in the quote-to-cash process, and it sets the foundation of the deal. Generating accurate quotes in a timely manner is essential to closing sales.

What is QTC in CPQ?

Quote-to-cash (Q2C) is the entire sales cycle, from product configuration and quote generation to revenue recognition. CPQ is part of the Q2C process.

What are the three elements of quote-to-cash software?

Quote-to-cash software automates three elements of the deal process: configure-price-quote, contract management, and revenue management. When these systems are integrated, the result is a seamless quote-to-cash process.

Who owns the quote-to-cash process?

The quote-to-cash process is cross-functional and is owned by sales, legal, fulfillment, and finance. Each team owns a specific part of the process, but all departments work collaboratively to ensure revenue growth.