Quote-to-Revenue (Q2R)

Table of Contents

What is Quote-to-Revenue?

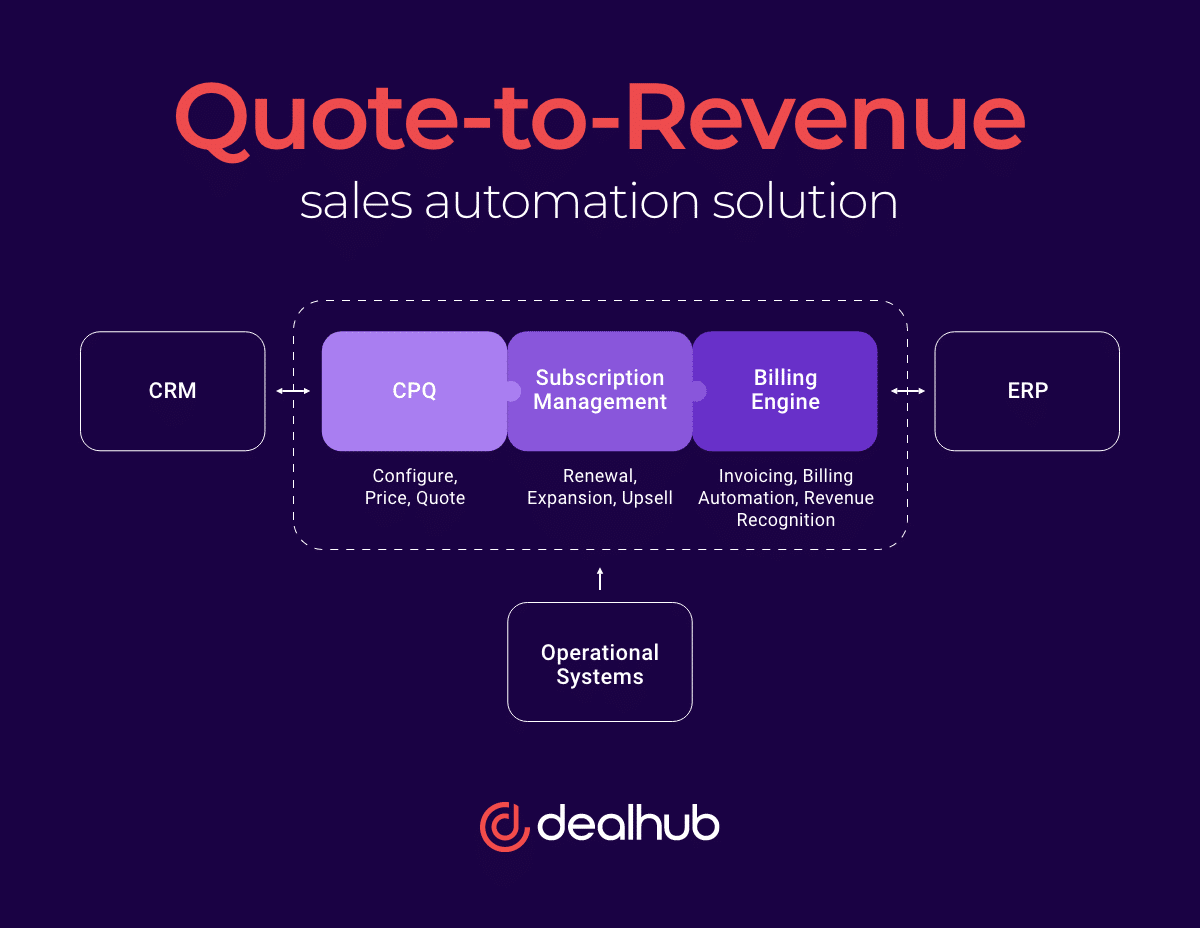

Quote-to-revenue (QTR) is the process of generating a sales quote, managing the subscription, billing for the order, and then recognizing the revenue from the contract. Quote-to-revenue has become increasingly important to operationalize in recent years with the growth of the software-as-a-service (SaaS) industry. SaaS companies can only recognize the revenue from their sales once they have delivered the service, increasing the complexity of an already complicated business model. Quote-to-revenue integrates quoting, subscription management, and billing, reducing complexity and eliminating the need to reconcile orders with revenue manually.

Synonyms

- Q2R

- QTR

The Quote-to-Revenue Process

Quote

Sales teams use a CPQ system to configure products and services and generate price quotes based on customer needs. Then, a contract is generated from the quote. Once accepted, the customer will sign the contract for the product or service. In the case of SaaS companies, the contract is typically for recurring or consumption-based subscription services.

Subscription Management

Businesses that are dependent on a subscription-based business model need to effectively manage their subscriptions to retain customers and secure sustainable recurring revenue. A subscription management solution, synced with CPQ and Billing, ensures invoices for subscription contracts are accurate. It also enables customer support and sales teams to amend contracts and update customer credit as needed over the lifetime of the contract.

Billing

Subscription billing is based on a contract for recurring services. Billing within the QTR framework automates invoices and accepting payments based on a single data source. Connecting CPQ, Subscription Management, and Billing within a unified platform ensures real-time, efficient billing automation, compliant revenue recognition, and accurate forecasting and analytics.

QTR can be a complicated process for companies with complex business models, such as subscription- and consumption-based businesses.

The Importance of Integrated CPQ, Subscription Management, and Billing in the QTR Cycle

Subscription management plays an essential role in the quote-to-revenue process. It is how companies continue to grow recurring revenue.

When customers accept a quote and purchase a subscription, the billing information is collected as part of the quote-to-revenue cycle. This data is then used to set up the customer’s subscription. Once set up, the system will track how long a customer has a valid subscription and how much time is left before it expires. If a customer does not renew their subscription within a specific time frame, their account can be suspended or canceled to avoid any potential fraud or misuse of services.

When a customer’s subscription is amended or renewed, the billing information can be updated to reflect any changes in rate or duration that may have occurred since their initial purchase. This ensures that customers are always being billed accurately while ensuring that companies receive accurate revenues from their subscribers each month or year.

The renewal process can be automated with the help of subscription management tools by setting up prompts and reminders before renewal dates come due so customers don’t forget to renew their service subscriptions. Automated notifications can also be sent out in case there are any payment delays on the customer’s part so companies can follow up with them immediately if needed and ensure the timely collection of payments owed to them from their customers.

Syncing contracts and usage data with invoicing, revenue schedules, and ERP provides accurate billing and compliant revenue recognition, which is essential for SaaS businesses.

Why Revenue Operations Needs a Unified Quote-to-Revenue Platform

SaaS companies using separate CPQ, subscription management, and billing software often experience challenges using disconnected solutions as they scale. Each part of the process is typically handled by a different department, with unreliable data transfer. A quote-to-revenue platform manages quoting, subscription management, and billing in one unified system. This integrated approach increases visibility into subscription revenue, eliminates costly data errors, and streamlines compliance with ASC 606 and IFRS 15.

Let’s explore the reasons RevOps require an end-to-end quote-to-revenue software solution.

Agility in Quoting

SaaS businesses require agility in their quoting solution. They need to be able to update their products and pricing easily so their sales team can create quotes seamlessly, regardless of deal complexity.

Complex Pricing

Using a unified quote-to-revenue process is especially critical for SaaS businesses. They need to bill correctly for complex invoices that include:

- Dynamic deals

- Bundled products

- Metered and consumption-based pricing

- Tiered pricing

Cost and Efficiency

Using different platforms for quoting, subscription management, billing, and revenue recognition means paying for several software applications. This disconnected approach creates inefficiencies, inaccurate data, reconciliation issues, duplicate data, and time wasted on manual tasks that could be automated within one unified platform.

Duplicate Product Catalogs

Updating multiple product catalogs within the CPQ and billing software inevitably leads to errors and requires considerable effort to maintain. Having one central product catalog mapped to all three modules is much more efficient and eliminates mistakes.

Reliable Metrics

A unified quote-to-revenue platform ensures accurate data across quotes, subscriptions, invoices, and revenue. Accurate data means more reliable metrics regarding pricing, sales performance, payments, contract performance obligations, and revenue growth.

Revenue Recognition for SaaS

The recognition of revenue is highly impacted by how a company designs/negotiates sales contracts (like terms and discounts) and the billing parameters (such as what and when to invoice). SaaS companies need to be able to track revenue throughout the contract lifecycle reliably. Bringing quoting, billing, and revenue recognition into one platform ensures subscription-based businesses have compliant revenue operations.

A unified quote-to-revenue platform enables companies to:

- Audit revenue back to line items on contracts

- Accurately track performance obligations remaining on a contract per line item

- Reallocate revenues to offset free products or services

- Sync customer and product details across quoting and billing

- Accurately track revenue when contracts are updated

Challenges of Implementing a Quote-to-Revenue Solution

Businesses must use automated revenue management throughout the customer lifecycle to maximize QTR performance. By implementing a single-source solution, Finance and Sales teams can manage one-time, recurring, and usage-based contracts, generate accurate invoicing data and produce accurate revenue recognition and revenue forecast reports.

However, implementing a QTR solution poses many challenges for businesses. They often face limitations in their current technology and resources that prevent them from fully realizing the value of the software.

Some common challenges include:

- Integration with existing systems: Integrating a new Quote-to-Revenue platform with existing systems can be complex and time-consuming and may require specialized technical skills and resources.

- Compatibility: For the quote-to-revenue solution to function properly, it must be compatible with existing systems and processes within the organization.

- Cost and budget constraints: Implementing a new platform can be expensive and require a significant upfront investment, which can be a challenge for smaller businesses.

- User adoption: Adopting a new platform requires a significant change in the way work is done, and getting all users on board can be a challenge.

- Data quality and accuracy: Ensuring data quality and accuracy is critical for the success of a QTR platform, and businesses may face challenges in maintaining accurate data and ensuring data integrity, especially when transferring data from disparate systems into one unified platform.

- Security risks: As with any technology-based solution, there are potential security risks associated with integrating an automated quote-to-revenue solution. Proper safeguards must be implemented to mitigate potential threats, such as data breaches or fraudulent activities related to financial transactions linked through the system.

- Scalability: As businesses grow, their needs may change and a platform suitable in the past may no longer be adequate. It is vital to choose a platform that can scale as the business grows.

People Also Ask

What’s the difference between quote-to-cash and quote-to-revenue?

Quote-to-Cash and Quote-to-Revenue are two different concepts used in business for managing the sales process. Both approaches share the goal of helping companies to streamline operations, but they have some distinct differences.

At a high level, quote-to-cash refers to managing the entire order process from quote to cash collection. It covers everything from creating quotes and orders to ensuring accuracy in pricing and inventory availability through the billing process and payment processing. Automating this process eliminates any manual errors or delays in processing orders. In addition, quote-to-cash provides more visibility into customer data, allowing better forecasting of future demand based on insights gained from historical data.

In contrast, quote-to-revenue manages the sales cycle from quote to revenue recognition. This approach is designed to automate how organizations recognize sales in their financial statements by streamlining processes related to delivering goods/services to customers. This includes subscription management, price book creation and maintenance, billing process setup, and integration with existing systems such as order management or enterprise resource planning (ERP).