Billing Process

Table of Contents

What is the Billing Process?

The billing process is how a company or individual charges for their goods or services. The billing process will generally start with the company or individual providing an estimate, or quote, of the cost of the goods or services. After purchase, the billing process typically includes creating an invoice, sending it to the customer, and tracking payments.

Synonyms

- Invoicing process

- Billing procedure

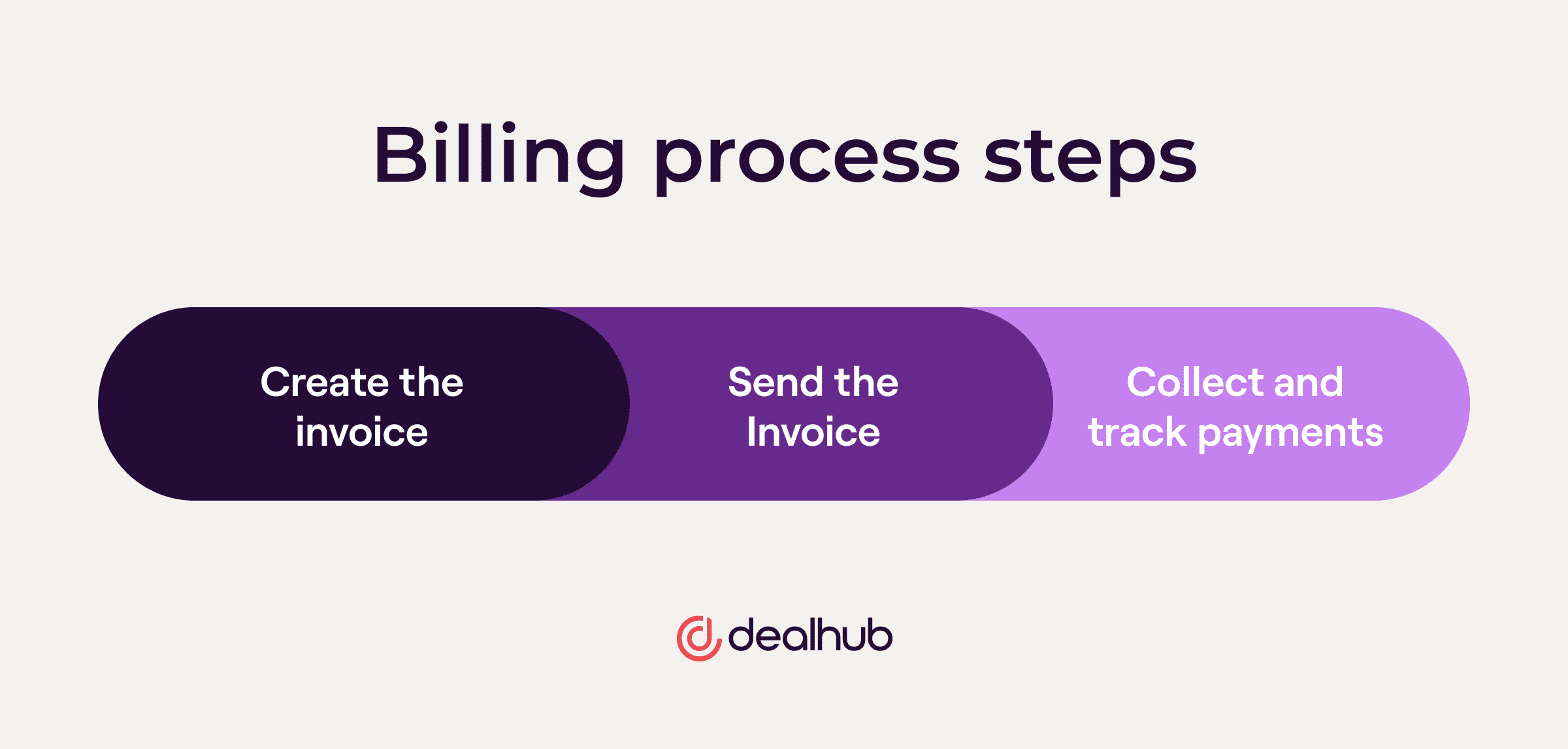

The Billing Process: 3 Main Steps

The billing cycle has three main steps: creating the invoice, sending the invoice, and collecting payment from customers.

Create the Invoice

The first step in the billing process is to create the invoice. An invoice lists the products or services a business has provided to a customer and the price for each item. The invoice must be accurate and include all the information the customer will need to pay for the items on the bill.

Several factors go into creating an accurate invoice, such as ensuring that the correct items are included, calculating the correct totals, and applying for any discounts or credits.

The invoice must also be formatted in a way that is easy for the customer to understand. This may include providing explanations of any charges, listing payment terms, and including contact information.

Send the Invoice

The second step in the billing process is to send the invoice to the customer. Once it has been created, the invoice must be sent to the customer in a timely manner. This can be done in several ways, such as by mail, email, or fax. If billing and payments are automated, customers may enroll in auto-payments, eliminating the need to send invoices and wait for payments.

Collect and Track Payments

The final step in the billing process is to collect payment from the customer. Once the invoice has been sent, the business waits for the customer to pay. This can be done through various methods, such as online payments or over the phone.

Additionally, companies need to track payments. Payment tracking can be accomplished by keeping track of payments in a ledger or by using billing software. This information can help determine revenue, late payments, and outstanding invoices.

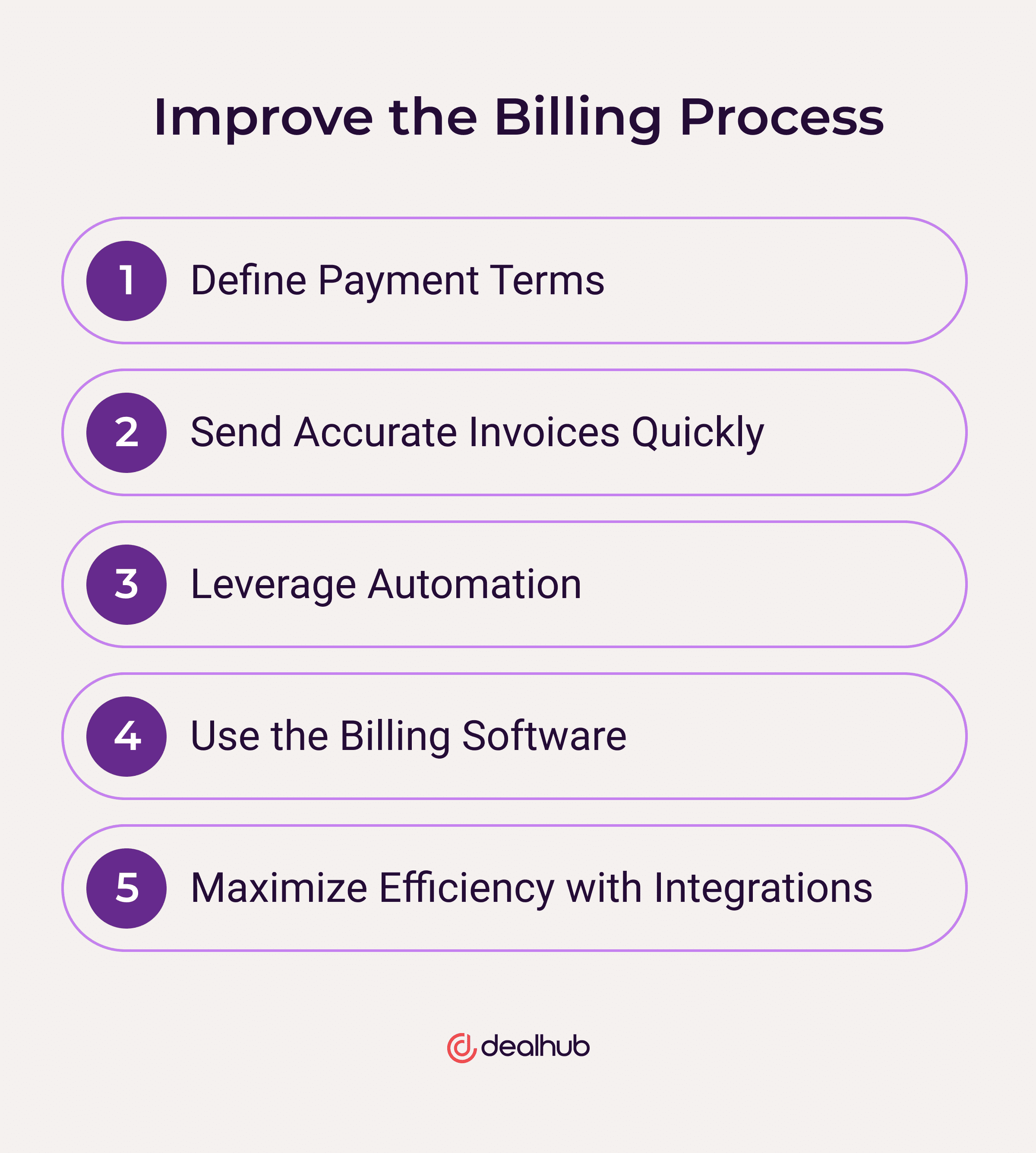

How to Improve the Billing Process

The billing process is a key part of any business. It’s how businesses collect money for the products and services they provide. However, the billing process can often be slow and cumbersome, leading to missed opportunities and revenue leaks. Here are a few tips on how to improve the billing process:

1. Define Payment Terms

Specifying payment terms is an important part of invoicing. It lets the customer know what to expect and helps ensure the company is paid on time. Standard payment terms include net 30 (due in 30 days), net 60 (due in 60 days), and net 90 (due in 90 days).

It is also essential that invoices are easy to understand and include clear descriptions of the products or services and prices in simple language that everyone can understand.

2. Send Accurate Invoices Quickly

There are a few reasons why companies should send invoices out accurate invoices quickly. One reason is that it can help ensure the company gets paid on time. This can be especially important for maintaining positive cash flow.

Another reason why it’s important to send invoices quickly is that it can help reduce accounting and administrative costs. When invoices are delayed, it can create more work for employees who have to process and track payments. By sending invoices out promptly, companies can reduce the time and resources spent on accounting and administrative tasks.

3. Leverage Automation

To improve the billing process, businesses should consider automating as much of the process as possible. Automating the process eliminates manual input, which can lead to mistakes. It also eliminates the need for someone to spend time processing bills, which can free up employees to do other tasks. Automation can also help ensure that bills are processed accurately and on time, reducing late fees and penalties.

4. Use the Billing Software

To ensure an efficient billing process, it is important to use reliable and effective billing software. Billing software (or invoicing software) automates many of the tasks involved in billing, such as creating invoices, tracking payments, and issuing refunds. This can save time and reduce the chances of mistakes. Zycus reports that automated billing reduces companies’ service-to-payment cycle by 80%. Additionally, well-designed billing software can help businesses track expenses and revenue more closely, resulting in better business decisions.

When choosing a billing software package, consider the needs of the business. Does the software have the features required? Is it easy to use and reliable? If not, it may not be worth the investment. A good billing software package can save the company time and money, making it an essential part of an efficient billing process.

5. Maximize Efficiency with Integrations

Businesses of all sizes rely on accurate and up-to-date billing information to make sound financial decisions. Billing software is integral to this process, and the software must seamlessly integrate with the other systems the business uses. This allows for a more streamlined and efficient workflow, resulting in cost savings and improved customer service.

When looking for a billing software solution, consider the available integrations. The best solutions will offer integrations with other software used in business operations. These include, but are not limited to, inventory management software, point-of-sale (POS) software, customer relationship management (CRM) software, and configure price quote (CPQ) software.

Inventory management software helps businesses track the quantity and types of products they have in stock. This information can be used to generate invoices for customers and to make sure that the correct items are being shipped to them.

POS software is used by businesses to process sales transactions. This software can interface with billing software to ensure that sales data is correctly captured and updated.

CRM software helps businesses manage their customer relationships. This software can be used to track customer interactions, including payments made and received. This information can be used to generate invoices and understand customer spending habits.

CPQ software automates the process of configuring products and generating price quotes. Once the quote is generated, an order can be sent to fulfillment, and an invoice can be created based on the quote.

Integrating Billing with CPQ for a Smoother Order-to-Cash Process

Order-to-cash (OTC) can be a time-consuming and arduous process when departments are not properly communicating with each other. This often leads to lost orders, increased bureaucracy, and mistakes. Therefore, companies should consider integrating CPQ with their billing software to work more efficiently and avoid these issues.

Overview of the Order-to-Cash Process

The order-to-cash process is the process companies use to track and manage orders and includes all the steps involved in fulfilling an order, from receiving the order to shipping the product to the customer. It also includes invoicing and collecting payments from customers.

The five main steps in the OTC process are:

- Receiving customer orders

- Creating and shipping orders

- Invoicing customers

- Depositing payments

- Recording payments and reconciling accounts

Each step is vital to ensure that cash is collected from customers promptly.

Unifying CPQ and Billing

When CPQ and billing are connected, it unifies a company’s sales and finance functions for a seamless customer experience. For example, orders are placed within the CPQ system and then forwarded to the billing system for invoicing. Furthermore, integrating the two technologies automates invoicing, payments, and revenue recognition.

To leverage CPQ and billing software for an efficient order-to-cash process, it is important first to understand the benefits of using these tools. CPQ software can help improve the accuracy of sales quotes, while billing software can automate the invoicing process and help track payments. Using these tools together enables a business to create a more efficient and accurate OTC process.

One key advantage of using CPQ and billing software together is it helps reduce the chances of errors occurring during the order-to-cash process. CPQ software can help ensure that quotes are accurate and are based on the correct product configuration, updated pricing, and any discounts applied, while billing software can help ensure that invoices are accurate. Integrating these two systems reduces the need for manual input and corrections, which saves time and improves efficiency.

Another advantage of integrating CPQ and billing software is that it automates payment tracking. For example, billing software can track when payments are due based on the contract signed during the sales process, as well as how much has been paid so far. This information can be helpful in budgeting and revenue forecasting.

Additional benefits of billing and CPQ software integration include:

- Reducing order errors and lost orders

- Eliminating orders of out-of-stock items

- Reducing invoicing and billing errors

- Tracking lost, misfiled, and uncollected payments

People Also Ask

What are the types of billing processes?

There are three types of billing methods: time-based, usage-based, and feature-based. Time-based billing is the most common type, where the customer is billed based on the duration of the service. Usage-based billing charges the customer based on the amount of resources or bandwidth they use. Feature-based billing charges the customer based on specific features or modules they use in a service.

What is the difference between billing and collection?

The main difference between billing and collection is that billing is invoicing customers for the goods or services they have received, while the collection process involves pursuing payments from customers who have not yet paid their outstanding invoices.

Billing is often seen as a precursor to the collection, as it provides customers with a formal invoice detailing what they owe. On the other hand, collection is responsible for pursuing payments from customers who have failed to pay their bills. This can involve contacting them directly, issuing legal threats, or taking other measures to recover the money owed.

Why is the billing process important?

The billing process is extremely important to business operations because it helps to ensure that companies are paid for the goods and services they provide. The billing process also helps to track payments and invoices, which is crucial to a business’s financial performance.

Additionally, the billing process can help companies evaluate their sales performance and make changes if needed. Overall, the billing process is an essential part of any company’s operations and revenue growth.