Decoding consumption-based and subscription-based billing: What’s the difference?

The best place to start is by understanding the fundamental differences between consumption- and subscription-based billing.

Consumption-based billing charges customers based on product or service usage, providing cost transparency, flexibility, and scalability. Customers pay for what they use, and the pricing structure can be more flexible. On the other hand, subscription-based billing involves customers paying a fixed recurring fee for ongoing access to a product or service. It offers predictable revenue, customer loyalty, and simplicity in budgeting but may have limitations in accommodating usage variations and revenue fluctuations.

Let’s dig a bit deeper into each to better understand their unique value propositions.

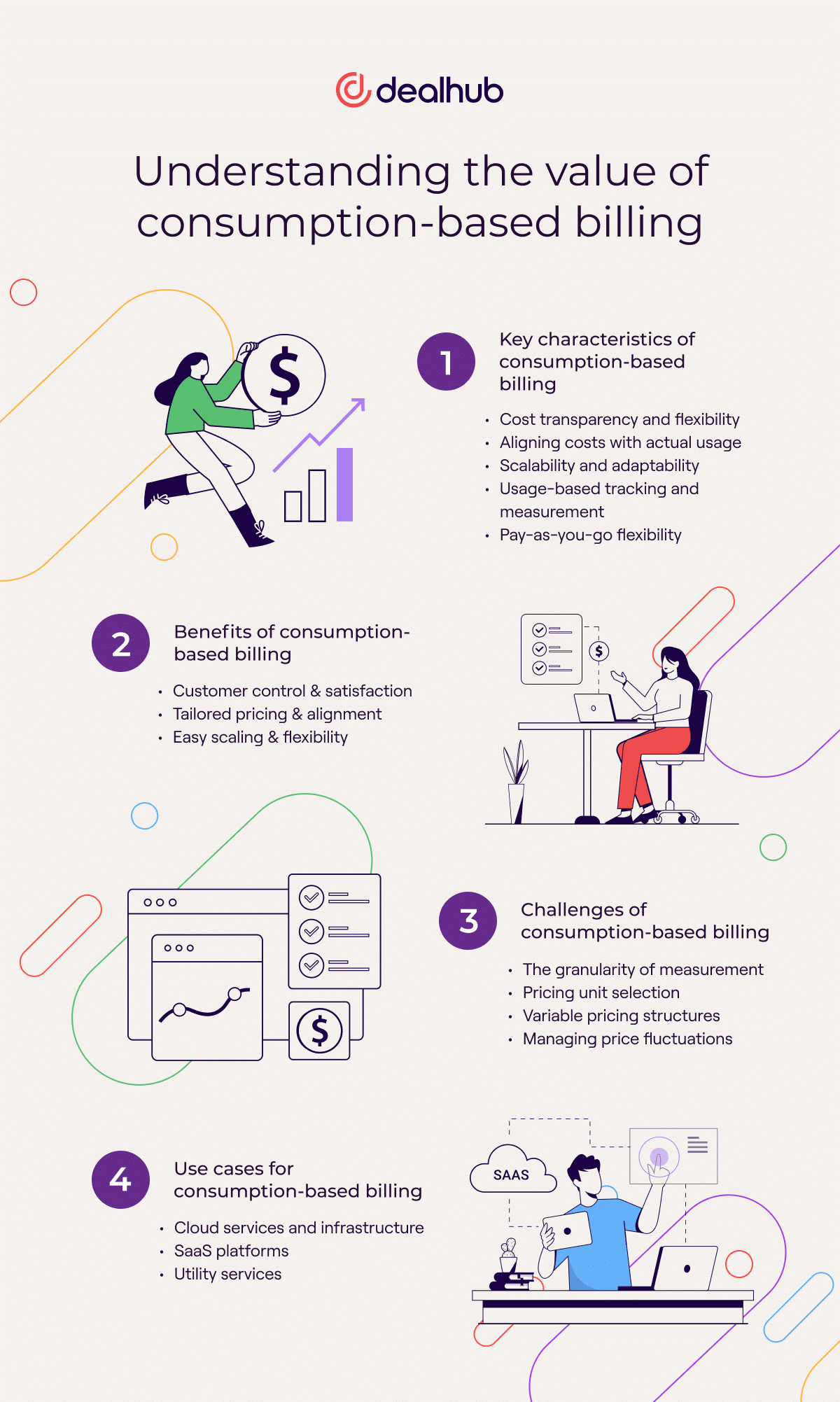

Understanding the value of consumption-based billing

Key characteristics of consumption-based billing

Consumption-based billing has some key differentiators companies need to understand. The model comes with specific benefits and include:

- Cost transparency and flexibility. This model provides customers with clear visibility into the costs associated with their actual usage. It offers flexibility in pricing structures, allowing businesses to create customized plans based on specific needs.

- Aligning costs with actual usage. It promotes fair pricing, as customers are charged based on the value they receive.

- Scalability and adaptability. Consumption-based billing can easily scale with business growth or accommodate fluctuating demands.

- Usage-based tracking and measurement. Consumption-based billing relies on accurate tracking and measurement of usage metrics, enabling businesses to generate accurate customer invoices and reports.

- Pay-as-you-go flexibility. Customers can adjust their usage and associated costs on a pay-as-you-go basis.

Benefits of consumption-based billing

Consumption-based billing is great for empowering customers by giving them control over their spending. They can adjust their usage and associated costs based on their needs, creating a more satisfactory experience. Businesses can also provide tailored pricing plans by charging based on actual usage, increasing customer satisfaction and loyalty.

Another advantage to consumption-based billing is the ease of scaling. Businesses experiencing rapid growth or seasonal fluctuations can simply scale their offerings and pricing without constraints.

Challenges of consumption-based billing

Consumption-based billing, similar to usage-based billing, can also present challenges related to the complexity of pricing structures. For example, here are some specific difficulties in consumption-based billing and its impact on pricing complexity:

The granularity of measurement. Consumption-based billing often requires tracking and measuring usage at a very granular level. This means capturing data on consumption across time, quantity, or specific features used. Determining the appropriate level of granularity and measuring it can be complex.

Pricing unit selection. Different consumption dimensions may have varying relevance and value to customers. Determining the most meaningful unit of measurement that aligns with customer expectations and reflects the cost structure is crucial but can be complex.

Variable pricing structures. Determining pricing breakpoints, and establishing reasonable pricing levels for each tier can be complex. Ensuring that pricing tiers are well-defined, transparent and appropriately incentivize higher consumption without becoming cost-prohibitive can be a delicate balance.

Managing price fluctuations. Consumption patterns can vary over time. Addressing these fluctuations and providing customers with tools or mechanisms to manage their consumption and associated costs can help mitigate this challenge.

Use cases for consumption-based billing

Consumption-based billing makes a lot of sense in various scenarios, such as:

- Cloud services and infrastructure. Paying for cloud resources based on usage ensures optimal cost management and flexibility.

- SaaS platforms. Charging customers based on the number of active users or the volume of data processed encourages efficient resource utilization.

- Utility services. Electricity, water, and gas providers can adopt consumption-based billing to promote conservation and fair pricing.

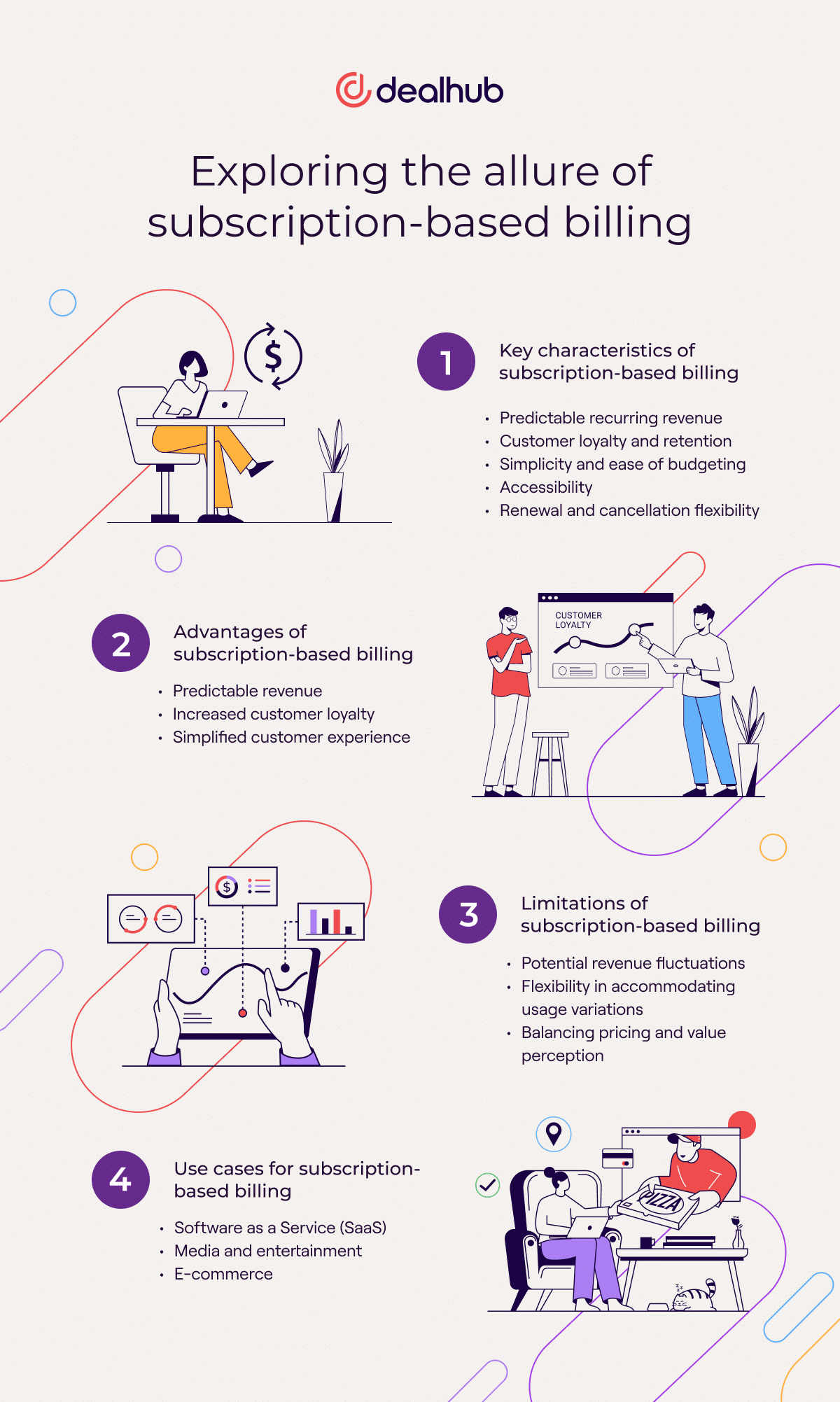

Exploring the allure of subscription-based billing

Subscription-based billing has long been a popular model across industries, offering several advantages for businesses.

Key characteristics of subscription-based billing

- Predictable recurring revenue. Subscription-based billing provides businesses with a steady, predictable revenue stream, with customers paying a recurring fee regularly.

- Customer loyalty and retention. Subscriptions foster ongoing customer relationships and offer continuous access to a product or service.

- Simplicity and ease of budgeting. Subscription billing simplifies the customer experience. Customers pay a fixed amount regularly, making budgeting easier.

- Value bundling and pricing tiers. Subscription models often offer value bundling, combining multiple products or services into a single package at a discounted price. This allows businesses to provide added value and cater to different customer segments.

- Accessibility. Subscriptions grant customers continuous access to a product or service for their subscription period.

- Renewal and cancellation flexibility. Subscriptions allow customers to renew or cancel their subscriptions based on changing needs or preferences, allowing them complete control over their subscription commitments.

Advantages of subscription-based billing

Subscription-based billing brings a lot to the table. For example, by offering subscriptions, businesses can count on a reliable, recurring revenue stream, which provides stability and allows for better financial planning and revenue forecasting.

Customers who subscribe to a product or service are more likely to stay engaged and committed to the brand, resulting in increased loyalty and higher customer retention rates.

Subscription billing simplifies the customer experience by providing a predictable monthly cost. Customers can easily budget for the subscription fee, eliminating the need to make individual purchase decisions regularly.

Limitations of subscription-based billing

While subscription-based billing offers several advantages, it’s essential to be aware of certain limiting factors, including:

Potential revenue fluctuations. If a business heavily relies on subscriptions, revenue fluctuations may occur if there are unexpected customer cancellations or a decline in new subscriptions. It’s crucial to diversify revenue streams to mitigate this risk.

Flexibility in accommodating usage variations. Subscription models can struggle to address customers’ varying usage needs. Some customers might feel limited by fixed subscription plans that don’t align with their requirements.

Balancing pricing and value perception. Setting the right subscription price can be challenging. Finding the balance between a price that accurately reflects the value of your offering while remaining attractive to customers is essential.

Use cases for subscription-based billing

Subscription-based billing can be a suitable choice for various businesses and industries, including:

- Software as a Service (SaaS): Offering subscription-based access to software tools and platforms is standard in the SaaS industry.

- Media and entertainment: Streaming services, news outlets, and digital content providers often utilize subscription models to offer ongoing access to their content.

- E-commerce: Some businesses offer subscription boxes or services where customers receive regular shipments of curated products or exclusive perks.

Factors to consider in choosing the right billing model

Now that we’ve explored the characteristics and advantages of both consumption-based and subscription-based billing, let’s discuss the factors you should consider when choosing the right model for your business. Before choosing one or the other, evaluate whether your product or service is better suited for consumption- or subscription-based billing. Consider factors like frequency of use, demand patterns, and the ability to track usage accurately.

You must understand your target market and their preferences. Some customers may appreciate the flexibility of consumption-based billing, while others may prefer the simplicity and convenience of subscriptions.

Consider scalability carefully at the outset. If the organization anticipates significant growth or seasonal variations in demand, consumption-based billing might provide the necessary flexibility. However, subscription-based billing may be more suitable for a stable customer base and a predictable market.

Be sure to also take time to analyze the impact of each billing model on operational processes and cost structure. Ensure that the chosen model aligns with existing systems and resources.

Lastly, never ignore the competition or industry norms! If consumption-based billing is becoming the industry standard, adopting it can give you a competitive edge. Conversely, if subscription-based billing is widely accepted, it may be a safer option.

Best practices for successful billing implementation

Regardless of the billing model you choose, there are several best practices to ensure successful implementation:

- Conduct market research and customer analysis. Do you fully understand your target market’s preferences, pain points, and willingness to adopt new billing models? Gather insights through surveys, interviews, and market analysis.

- Design pricing and packaging strategies. Develop pricing plans and packaging strategies that align with customer needs and maximize the perceived value of your offering. Consider offering different tiers or add-ons to cater to various customer segments.

- Leverage technology and billing platforms. Invest in robust billing technology and platforms supporting your chosen billing model. Automation and integration capabilities can streamline your billing processes while enhancing the customer experience.

- Communicate value and manage customer expectations. Be sure to prioritize transparency and clearly communicate the benefits and value of your chosen billing model. Manage customer expectations by providing clear, accessible pricing information and directly addressing customers’ concerns.

Which billing model is right for your business?

Deciding how to choose the right billing model ultimately depends on your unique business needs and goals. Consider the nature of your product or service, target market preferences, scalability, operational considerations, and industry standards to weigh both options. In some cases, a hybrid model or a custom solution that combines consumption-based and subscription-based billing elements may be the ideal choice.

At the end of the day, your billing model can significantly impact your revenue and customer relationships. That’s why it’s crucial to take the time to evaluate all options, conduct thorough research, and consider seeking expert advice if needed. Once you’ve done the legwork, choose the billing model that best aligns with your business to ensure success in an ever-evolving marketplace.