Navigating the revenue maze: revenue recognition challenges

Recognizing revenue both efficiently and accurately is fundamental to business. However, many companies need assistance to unlock value in this area.

For example, many companies struggle to adapt to ASC 606, new revenue recognition standards that affect all businesses entering into contracts with customers to transfer goods or services. Both public and privately held companies need to be ASC 606 compliant based on the 2017 and 2018 deadlines.

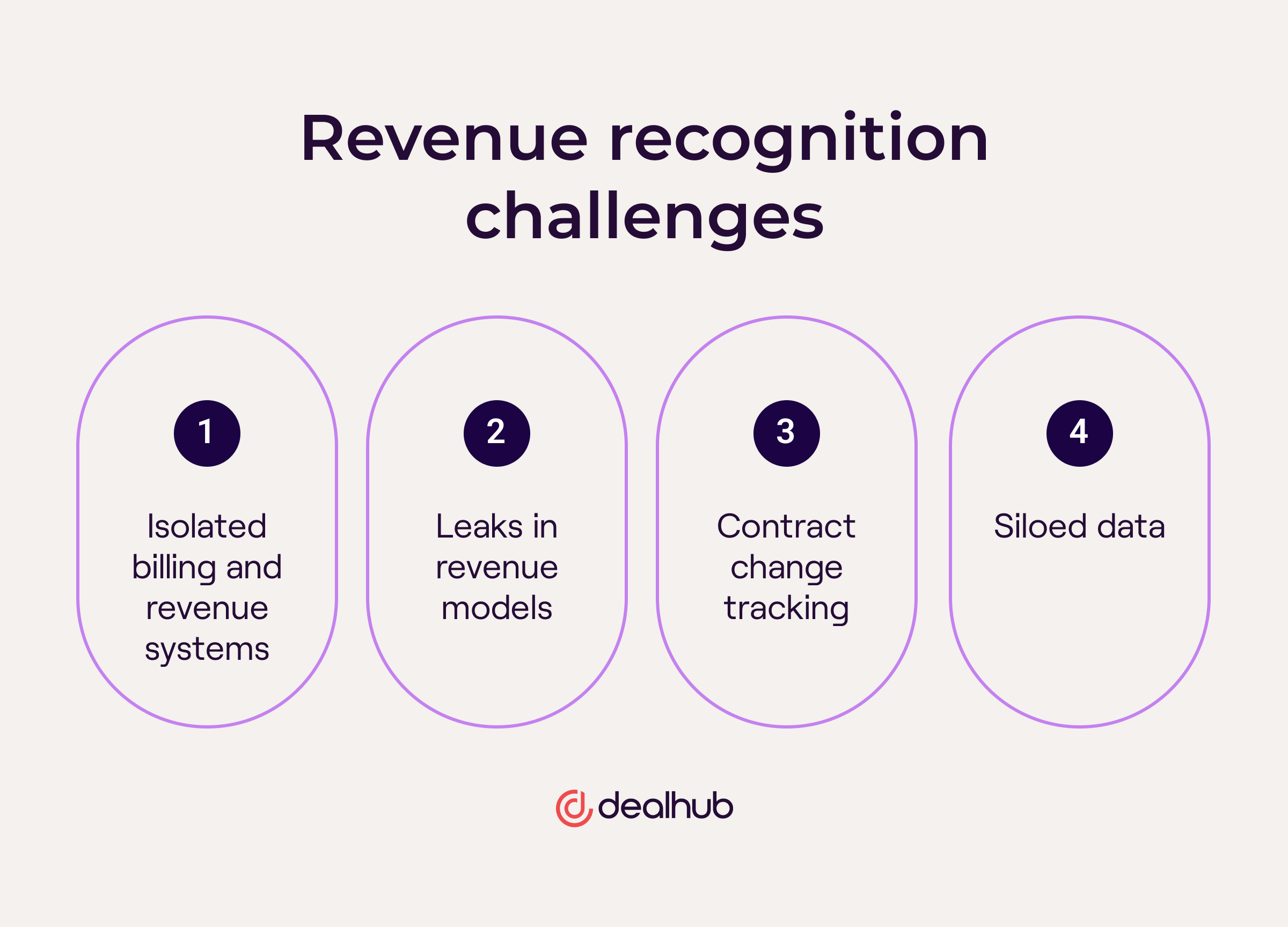

However, there are other challenges. Companies must also contend with:

- Disconnected billing software and revenue recognition systems

- Leaks in revenue models

- Contract change tracking

- Siloed data

Out with the old: traditional billing and revenue recognition practices

In the past, the billing cycle and revenue recognition relied heavily on manual processes. Inefficiencies common to manual processes directly impacted the bottom line, leading to financial discrepancies and compliance issues.

Manual processes

Before revenue recognition automation software changed the game, processes involved:

- Manually sifting through financial statements and paperwork

- Updating spreadsheets

- Managing multiple documents related to revenue recognition

The manual nature of these processes is time-consuming. It also introduces a high risk of errors and inefficiencies. Inevitably, employees make mistakes when manually entering data, updating spreadsheets, or calculating revenue figures, resulting in inaccurate financial reporting, compliance issues, and revenue leakage.

Limitations of traditional methods

Even when companies shift towards technological solutions, traditional billing and revenue recognition methods need more cohesive processes and a cumbersome tech stack to manage them. Businesses often rely on multiple disconnected systems and tools to handle different billing and revenue recognition aspects. These disparate billing process systems make it challenging to track and manage revenue-related information cohesively.

Traditional methods also require businesses to invest in complex and costly technology stacks to manage billing and revenue recognition. These stacks may include separate accounting software applications for:

- Invoicing

- Contract management

- Revenue recognition calculations

- Financial reporting

Managing and maintaining a complex tech stack becomes cumbersome and resource-intensive, often requiring specialized IT support and constant updates to ensure alignment with changing regulations.

Common errors and inefficiencies

When relying on manual data entry and calculations, human error is an inherent risk. Simple mistakes can significantly affect revenue recognition accuracy, financial reporting, and compliance. With inaccuracies common, basing forecasting and decision-making on findings becomes problematic. And, since manual reconciliation of data happens across different systems, errors may compound, further undermining the reliability of revenue recognition processes and running the risk of non-compliance with accounting standards.

In with the new: billing and revenue recognition automation

Technological advances in billing and revenue recognition

Thanks to technology-based solutions, the way businesses handle billing and revenue recognition has been revolutionized. Billing automation software has become integral to managing billing and revenue. With it, companies can streamline their operations while eliminating the limitations associated with traditional methods.

Why automate?

The importance of automation in billing and revenue recognition cannot be overstated. First and foremost, automation ensures compliance with accounting regulations like ASC 606 (a revenue recognition standard) and IFRS 15 (which establishes principles for reporting revenue and cash flows from contracts with customers). Automation reduces the risk of errors by reducing manual intervention, ensuring accurate financial reporting. It also enables seamless data synchronization between departments, eliminating data silos and revealing collaboration opportunities.

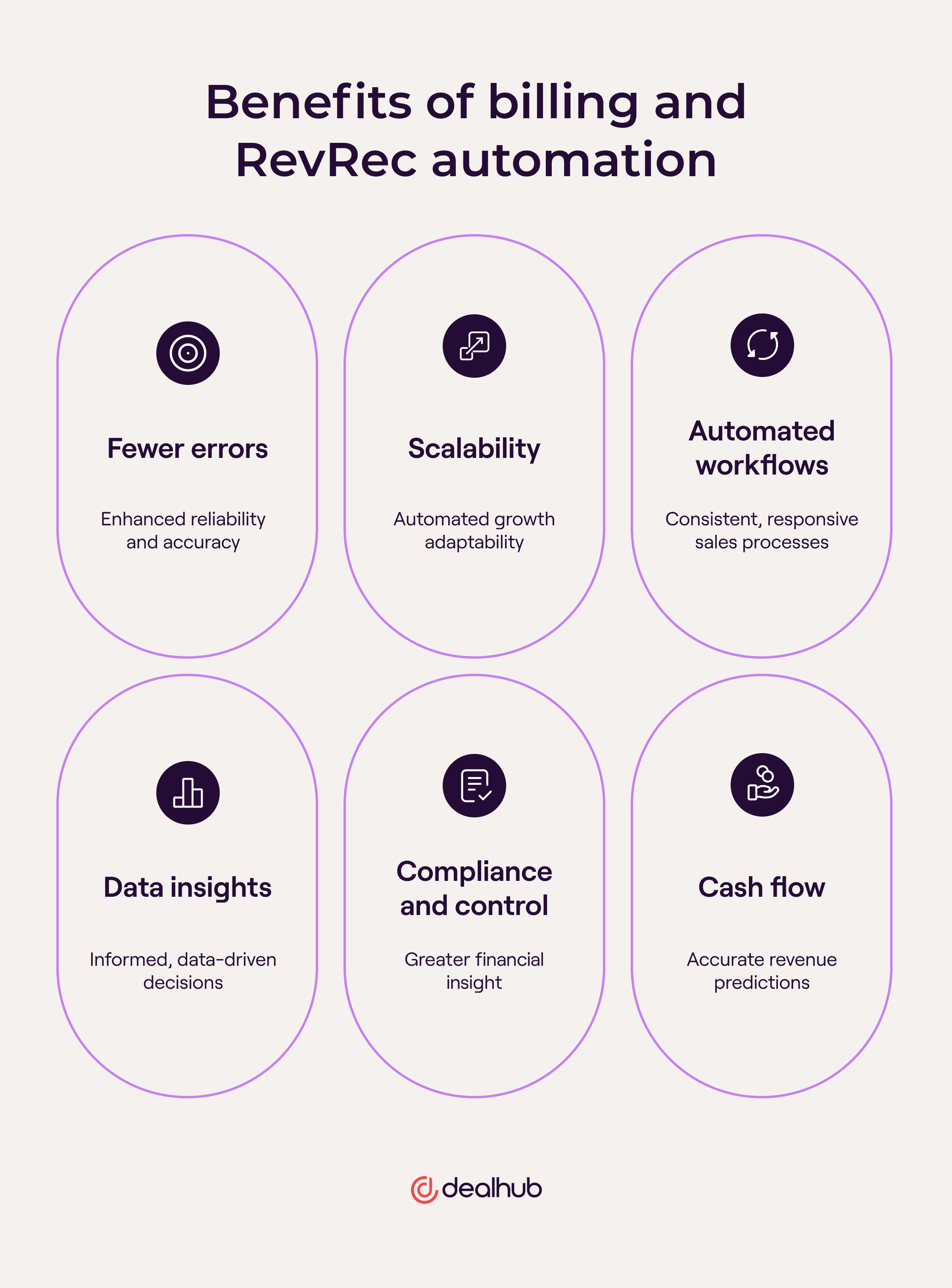

Benefits of billing and RevRec automation

Automating billing and revenue recognition processes allows businesses to streamline operations, save time, and reduce manual effort. Repetitive tasks are programmable, freeing valuable human resources for more strategic activities.

The benefits of billing and RevRec automation are numerous and include the following:

Fewer errors

With billing automation software, the risk of human error is greatly minimized. Since automated systems follow predefined rules, they maintain consistency and accuracy in revenue recognition. The result: more reliable financial reporting and increased customer trust.

Scalability

Aligning growth with resources used to be a challenging endeavor. With subscription billing automation, billing and revenue recognition processes can scale accordingly. Automation provides the flexibility to handle increased volumes without compromising accuracy or efficiency. Businesses can seamlessly adapt and expand their operations without worrying about being short on resources.

Automated workflows

Automation allows for the standardization of sales processes. That streamlines the workflows for team members while enforcing accountability. With automated workflows, sales teams can be responsive and ensure that every step of the revenue recognition process is consistently executed.

Data insights

When companies leverage subscription billing automation, they gain valuable data insights to better understand their revenue streams, identify trends, and make data-driven decisions. Insights provided by recurring billing automation tools can drive strategic planning and optimize revenue generation.

Compliance and control

Automation enables end-to-end financial and operational process accountability to ensure full compliance with accounting standards and regulations. Companies have greater control and visibility over their financial processes, mitigating non-compliance risk and associated penalties.

Cash flow

One of the key benefits of automated billing and revenue recognition is the ability to predict incoming revenue accurately. By clearly understanding projected revenue, businesses can plan ahead, make informed financial decisions, and safeguard their revenue.

As you can see, leveraging the power of automation helps teams boost productivity, maintain compliance, reduce errors, and so much more.

Trends in billing and revenue recognition automation technology

The world of recurring billing automation is constantly evolving, and emerging technologies are pivotal in shaping the future of billing and revenue recognition. Let’s explore some of these exciting trends:

- Artificial Intelligence (AI). AI is revolutionizing the way businesses handle billing and revenue recognition. AI-powered systems can analyze large volumes of data, identify patterns, and make intelligent predictions. They can automatically detect revenue recognition anomalies or flag potential revenue leaks, enabling businesses to take proactive measures. AI also powers chatbots and virtual assistants, providing real-time customer support and automating routine tasks like the invoicing process and payment reminders.

- Machine learning (ML). ML algorithms enable automated systems to learn from data and improve over time. They can analyze historical data to identify revenue patterns, customer behavior, and potential revenue risks so businesses can make accurate revenue forecasts, identify growth opportunities, and optimize pricing strategies.

- Robotic process automation (RPA). RPA involves using software “bots” to automate repetitive tasks. RPA can handle invoice generation, data entry, and reconciliation tasks. Automating these manual tasks allows businesses to free resources for more strategic activities while ensuring accuracy and efficiency.

- Blockchain technology. Blockchain technology provides secure and transparent transactions, making it a promising billing and revenue recognition technology. With blockchain, businesses can create a tamper-proof and auditable record of transactions, ensuring trust and transparency between parties. Blockchain smart contracts can automatically execute predefined revenue recognition rules, streamlining the process and reducing errors and will likely gain further traction.

- Data analytics and business intelligence (BI). The growing availability of data analytics and BI tools assists businesses with analyzing and interpreting revenue-related data. Advanced analytics techniques like predictive analytics can forecast revenue outcomes, identify potential risks, and guide revenue optimization strategies.

- Integration and cloud solutions. Integrated billing platforms and cloud-based solutions are crucial in automating billing and revenue recognition processes by enabling seamless data exchange between systems and departments. Cloud-based solutions offer scalability, flexibility, and accessibility – all important for managing billing and revenue recognition processes from anywhere, anytime.

Staying up-to-date with emerging billing and revenue recognition automation technologies is critical for businesses seeking to thrive in a rapidly evolving marketplace. In the future, technological adoption will be even more critical to revenue management and sales success.

For businesses invested in maintaining an edge on the competition, DealHub’s innovative solutions harness these trends, empowering firms to embrace automation, streamline their financial processes, and unlock the full potential of their revenue recognition capabilities. When businesses adopt these technologies, they position themselves as agile, efficient, and forward-thinking revenue leaders all while strengthening client relationships.

Conclusion

Billing and revenue recognition automation for software companies has revolutionized the business management of financial processes and ensured compliance with accounting regulations. By embracing automation, companies can overcome traditional challenges, reduce errors, enable scalability, standardize workflows, and unlock valuable data insights. As technology evolves, businesses must seize the opportunity it presents. DealHub provides cutting-edge solutions that empower businesses to navigate the revenue maze effectively and revolutionize revenue recognition. Stay ahead of the game by embracing automation and transforming your financial operations.