Signs of billing inefficiencies

Picture a hypothetical SaaS company, AcmeStream, on the cusp of market leadership. Despite their innovative product, a hidden snag lurks beneath the surface: their billing system is a patchwork of outdated processes and disconnected data. It’s not uncommon for invoices to go out late, or worse, not at all. In the whirlwind of missed billing cycles, AcmeStream starts to hemorrhage revenue, a slow trickle that could soon become a flood.

In this scenario, the repercussions of these billing inefficiencies are multifaceted. Revenue leakage becomes a silent predator, eating away at the company’s financial health. Late payments, stemming from incorrect or delayed invoicing, disrupt cash flow, a vital lifeblood for any business’s growth and stability. Beyond financial losses, customer data, disjointed and scattered, leads to billing inaccuracies. These errors erode the most valuable asset of AcmeStream: customer trust. When subscribers receive erratic bills, their confidence wavers, giving competitors a window of opportunity to lure them away.

In SaaS, where recurring revenue is king, inefficiencies directly threaten the business’s viability and growth trajectory. Studies show that many companies experience revenue leakage, which can result in a substantial loss of potential earnings. For instance, MGI Research found that 42% of companies face revenue leakage. According to EY, this is a significant issue because revenue leakage can lead to a loss of 1 to 5 percent of realized EBITDA. For larger companies, this could mean millions of dollars lost each year.

The challenges faced by AcmeStream, such as revenue leakage and customer trust issues, highlight common problems for many SaaS businesses. These inefficiencies can significantly impact a company’s financial stability and growth.

Is automated billing the answer?

In SaaS, automated billing systems are increasingly recognized as a transformative solution to operational challenges. These systems help address issues such as revenue leakage, billing process inefficiencies, and managing recurring revenue streams effectively, especially in an environment where agility and accuracy are critical.

At the core of billing automation is the streamlining of the entire billing cycle. These systems automate the creation and distribution of invoices, manage subscription renewals, and ensure timely revenue collection. This automation significantly reduces errors, leading to more accurate billing and improved financial health for the company.

The variety of automated billing tools available caters to the diverse needs of SaaS businesses. Some are adept at managing complex, multi-tiered billing cycles, adapting to usage-based or hybrid pricing models. Others excel in integrating crucial business data from sales, finance, and customer service, providing a comprehensive view of the financial operations and facilitating better decision-making.

A key feature of effective billing automation is subscription management. Tools equipped with robust subscription management capabilities allow businesses to efficiently handle varying subscription levels, customize billing cycles, and easily manage customer accounts. This is particularly critical for SaaS companies, where the subscription model is often at the heart of the revenue stream.

Implementing an automated billing system can significantly improve operational efficiency and profitability. Businesses report reduced time spent on manual billing tasks, fewer invoice errors, and a more predictable cash flow. This efficiency bolsters the company’s financial position and enhances the overall customer experience, as clients receive accurate and timely bills.

Ultimately, the effectiveness of these tools lies in their alignment with the specific needs of a business. The right system can transform a cumbersome billing process into a strategic advantage, positively impacting the company’s bottom line and enhancing customer satisfaction.

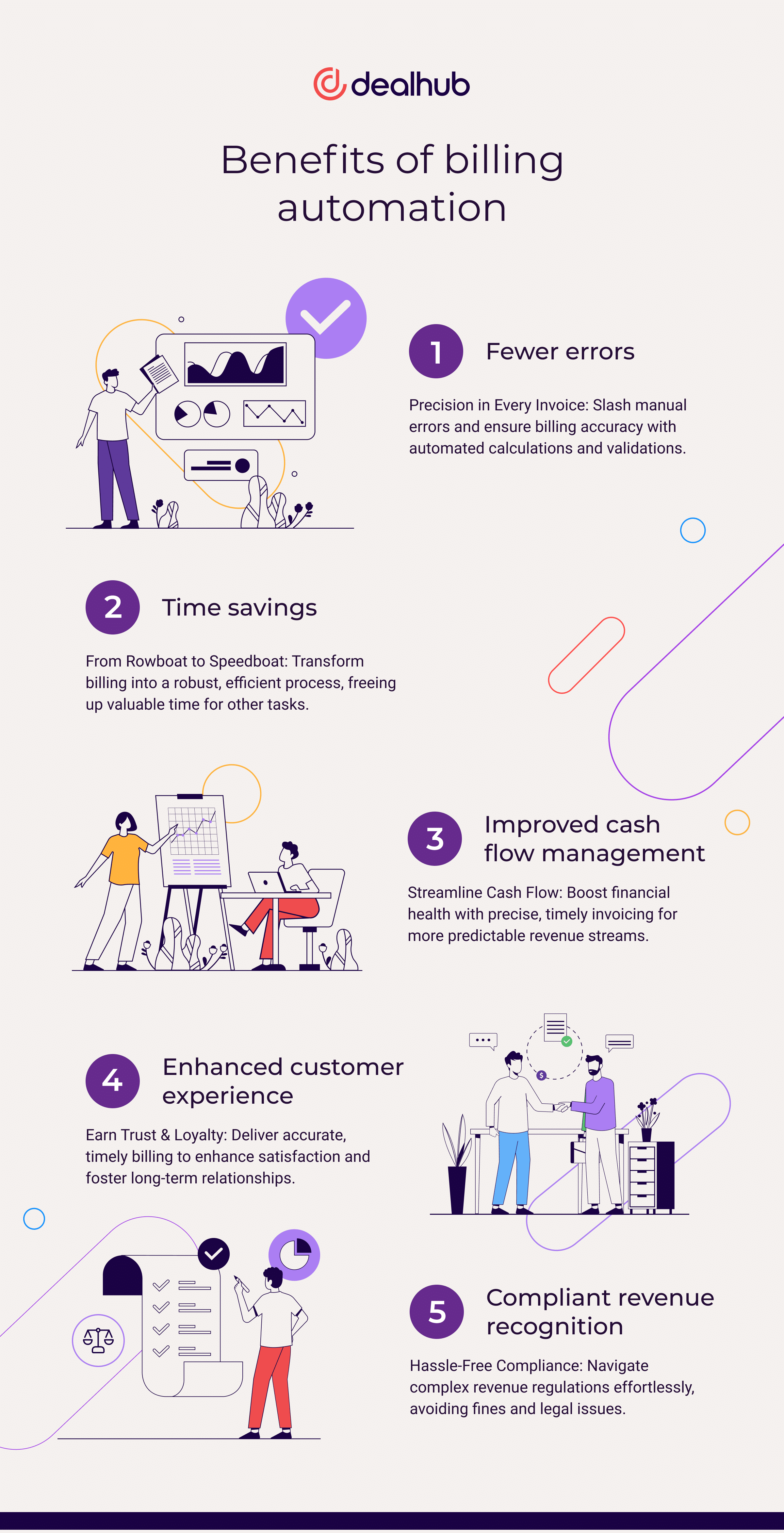

Benefits of billing automation

Implementing billing automation provides numerous benefits that improve business operations, making them more efficient and customer-centric.

Fewer errors

Billing automation reduces the risk of manual errors, such as undercharging due to decimal discrepancies. It ensures accuracy by automating calculations and validations in every invoice. Automated systems eliminate human errors that may occur in complex billing models, making accuracy essential in billing processes.

Time savings

Moving from manual to automated billing is like upgrading from a rowboat to a speedboat. Tasks that used to take hours of painstaking work can now be done much quicker. This increased efficiency turns billing from a complicated process into a smooth operation. Businesses that switch to automated billing significantly cut their billing time, giving them more time each month for other necessary tasks.

Improved cash flow management

Inaccurate billing, a common pitfall of manual processes, can severely impede a company’s cash flow. Automation introduces a level of precision and timeliness in invoicing that significantly improves cash flow management. This transformation is crucial for maintaining the financial health and stability of a growing business, as automation aids in sustaining positive customer experiences and ensures more predictable cash influxes.

Enhanced customer experience

Accurate and timely billing, a hallmark of automated systems, is pivotal in customer satisfaction. It fosters trust and reliability, which are essential for building long-term customer relationships. Companies using automated billing often report higher levels of customer satisfaction and loyalty, as evidenced by the ability of automated systems to handle diverse pricing models and maintain customer satisfaction.

Compliant revenue recognition

Adhering to revenue recognition standards can present challenges for businesses in regulated industries. Automated billing systems are designed to ensure compliance with these complex regulations, thus mitigating the risk of costly fines and legal complications. This makes compliance an integrated, hassle-free component of the billing process.

Getting billing automation right

Implementing billing automation successfully is a journey that requires careful planning and execution. Here’s a step-by-step guide to ensure a smooth transition:

- Assess Your Needs: Begin by analyzing your billing processes. Identify the challenges your business faces, whether it’s handling complex subscription models or managing customer data.

- Choose the Right Tool: Not all billing automation tools are created equal. Select one that aligns with your business needs, particularly in subscription management. Look for features like flexible pricing models and easy integration with your existing systems.

- Plan the Implementation: Develop a clear roadmap for the rollout. This should include timelines, key milestones, and designated team members responsible for each implementation stage.

- Train Your Team: Ensure your staff understands how to use the new system. Proper training is crucial for a smooth transition and will help mitigate resistance to change.

- Go Live and Monitor: Once up and running, monitor its performance to ensure it meets your billing needs and adjust as necessary.

- Seek Feedback and Improve: Regularly solicit feedback from your team and customers. Use this feedback to refine and optimize your billing processes.

By following this guide, businesses can expect a billing automation system that streamlines operations and enhances subscription management, increasing efficiency and customer satisfaction.

The end goal: efficient billing

As you transition to automated billing, you’re poised to experience a complete reversal of the inefficiencies associated with manual processes.

Imagine a world where your billing cycle is streamlined, where the anxiety of manual errors is replaced with the precision of automation. This change enhances your invoicing accuracy and substantially diminishes the risk of revenue loss due to inaccuracies. Expect your cash flow to rejuvenate, thanks to quicker invoicing and more efficient payment processing.

This newfound efficiency translates into more predictable and stable financial health for your business. But the benefits don’t stop there. Your customers will likely notice and appreciate the improvement, too. Timely and accurate billing fosters stronger trust and loyalty, elevating their overall experience with your brand. Moreover, the shift to automation also means significant cost savings. Freed from the time-consuming tasks of manual billing, your team can redirect their focus to more strategic initiatives, thus driving productivity and efficiency.

Reflect on the potential for reduced errors, time savings, improved cash flow, and enhanced customer experience that automated billing can bring. Could these benefits be the catalyst for growth and success in your business? Consider implementing a system like DealHub’s automated billing, it can change the game for you.

The future of efficient, accurate, and customer-centric billing is here. The question now is, are you ready to step into this new era and embrace the opportunities it brings? The journey toward streamlined financial operations and the growth it fosters begins with your decision to act. Let this be the moment you choose to innovate and thrive.