However, this impressive expansion has not been without its challenges, especially in billing management. As customer bases burgeon and product offerings diversify, SaaS companies confront the intricate puzzle of managing recurring billing. This task becomes increasingly complex, with complexities around variable pricing models, usage-based billing, and multi-currency transactions. Accuracy and efficiency in billing processes become paramount to maintaining customer satisfaction and financial integrity.

Enter automated billing software – a beacon of hope in this complex financial world. These sophisticated tools promise to streamline the billing process, ensuring accuracy, consistency, and scalability. They are designed to handle the complexities of modern SaaS business models, offering reactive and proactive solutions in managing the dynamic nature of subscription-based services.

Below, we unravel the intricacies of SaaS billing and guide you through the best practices in the age of automation, ensuring your billing process is as innovative and efficient as your software services.

The complexities of subscription billing

Transitioning to subscription models can be challenging due to billing complexities like accuracy, subscription management, revenue leakage, and scalability.

Billing accuracy

Maintaining billing accuracy is a tightrope walk in SaaS. The challenge lies in the precision required for various billing cycles, prorated charges, add-ons, and discounts. A minor error can snowball into a significant customer dissatisfaction issue or a financial discrepancy. Consider a SaaS provider with tiered pricing; an incorrect charge due to a tier mismatch can lead to customer trust issues and administrative headaches in rectifying the error.

Subscription management

Handling subscription management effectively is like juggling multiple balls simultaneously. Each customer’s journey – from onboarding to upgrade, downgrade, or cancellation – brings unique billing implications. For instance, a customer upgrading mid-cycle demands a seamless transition in billing, avoiding any service disruption or billing errors, which can be a complex task to automate correctly.

Revenue leakage

The specter of revenue leakage looms large in SaaS billing. It stealthily seeps through cracks like unmonitored discounts, unapplied surcharges, or untracked usage overages. For instance, failing to bill for additional features used by customers can result in significant revenue loss over time. Implementing robust tracking and automated alerts is vital in plugging these leaks.

Scalability

As a SaaS business grows, so does the complexity of its billing requirements. Scalability in billing is not just about handling a larger volume of transactions; it’s about adapting to new pricing models, global markets (with different tax regulations and currencies), and evolving customer needs. A small SaaS startup might manage with simple billing processes, but as it grows, the demands for more sophisticated, scalable solutions become critical. For example, expanding into new markets might require integrating local tax laws and currency conversions into the billing process.

The challenge lies in managing the current complexity and designing a system that can foresee and adjust to future requirements.

Automated billing solutions supercharge SaaS revenue

Automated billing solutions in SaaS boost revenue potential by streamlining billing, preventing revenue leakage, and aiding in decision-making for growth and customer loyalty.

Billing accuracy

Automated billing systems are the linchpins of precision in SaaS revenue models. They meticulously handle complex billing scenarios, effectively eliminating human errors. Consider the case where a customer switches from a basic to a premium plan; automation seamlessly manages these transitions, ensuring every billing cycle reflects the correct amount. It’s like having a vigilant, error-free sentinel overseeing every transaction.

Efficient time management

Time, the most finite resource in business, is conserved significantly with automated billing. This shift from manual to computerized processes frees up valuable team hours, redirecting focus towards strategic tasks rather than administrative ones. Imagine reallocating hours spent on manual billing to refining your product or enhancing customer experiences – that’s a direct contribution to revenue growth.

Preventing revenue leakage

Automation acts as a gatekeeper against revenue leakage. It ensures every chargeable service is accurately billed and collected. Automated systems can detect and rectify underbilling, missed renewals, and overlooked usage fees. This vigilance plugs the previously unseen holes, directly impacting the bottom line.

Gain insights

One of the unsung heroes of automated billing is its ability to provide real-time insights into financial performance. These platforms offer a comprehensive view of revenue streams, allowing for data-driven decisions. For instance, analyzing customer usage patterns can reveal upsell opportunities or underperforming services, guiding strategic adjustments.

Churn rate reduction

Automated billing plays a subtle yet impactful role in customer retention. Ensuring accurate, timely, and transparent billing enhances customer trust. Automated communication – like renewal reminders and payment confirmations – nurtures a positive customer relationship, reducing churn. This consistent engagement is key to fostering long-term customer loyalty.

Quick pricing changes

The agility of automated billing platforms in implementing pricing changes is invaluable in the fast-paced SaaS industry. Whether it’s a promotional discount or a new pricing structure, these systems can adapt quickly, ensuring the business remains competitive without overwhelming the billing team.

Scalability

As SaaS businesses grow, their billing systems must evolve in tandem. Automated solutions scale effortlessly, handling increased transaction volumes and more complex billing scenarios without a hitch. This scalability ensures that the billing process remains a smooth, invisible engine driving revenue, regardless of business size.

Accurate revenue recognition

Finally, accurate revenue recognition is the pillar of any robust financial operation. Automated billing ensures compliance with accounting standards and provides reliable data for performance metrics. This accuracy is crucial not just for internal assessments but also for maintaining transparency with investors and stakeholders.

Automated billing systems are strategic assets that help SaaS businesses grow revenue by streamlining processes and allowing them to focus on innovation and service delivery. When implementing SaaS billing, a few best practices should be followed.

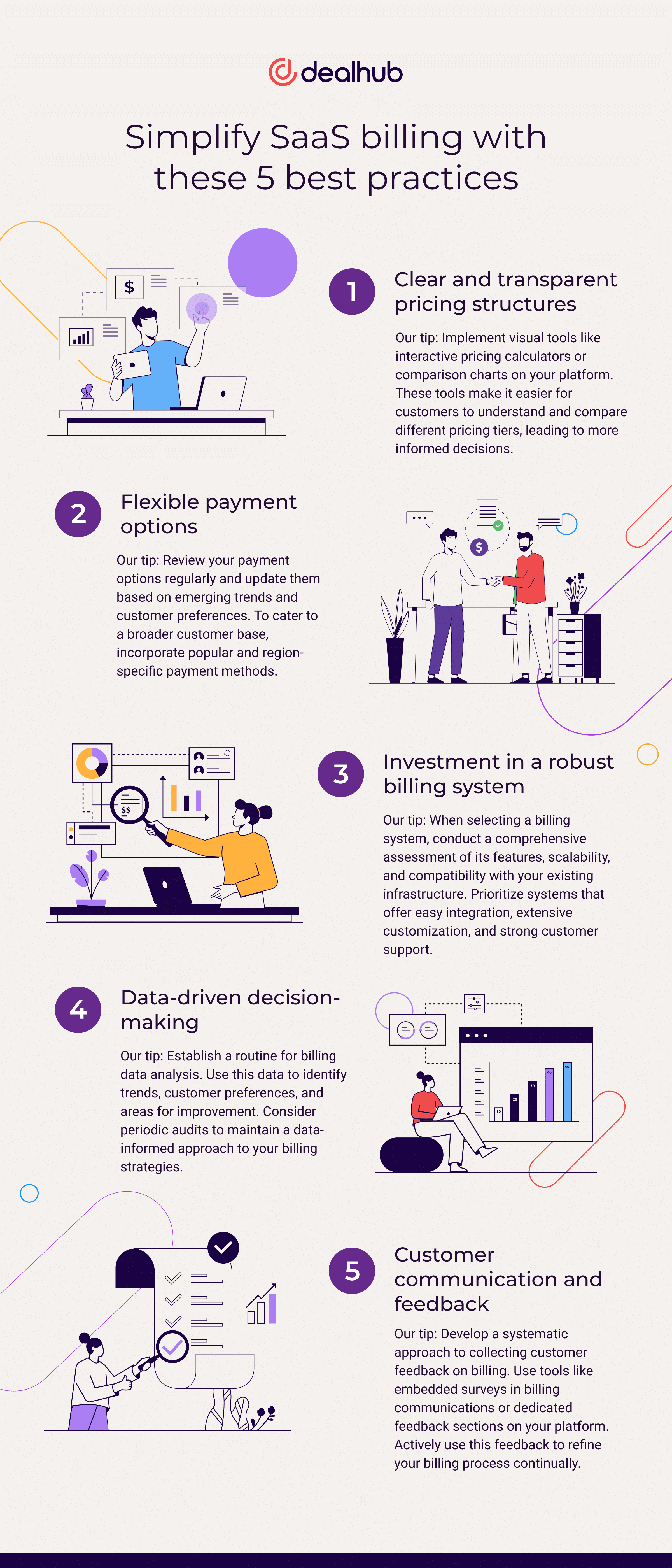

Simplify SaaS billing with these 5 best practices

SaaS companies can improve customer relationships and business performance by prioritizing clarity, flexibility, reliability, data-driven strategies, and proactive communication in billing processes. Our top best practices to ensure the highest ROI from your billing solution are:

1. Clear and transparent pricing structures

Implementing clear and transparent pricing structures is foundational in SaaS billing. This clarity helps customers understand exactly what they’re paying for, reducing confusion and disputes. A prime example is offering tiered pricing plans that are easy to differentiate, ensuring customers can effortlessly select the plan that best fits their needs. Transparency in pricing builds trust and simplifies the billing process by reducing the need for extensive customer support.

Our tip: Implement visual tools like interactive pricing calculators or comparison charts on your platform. These tools make it easier for customers to understand and compare different pricing tiers, leading to more informed decisions.

2. Flexible payment options

Offering a variety of payment options caters to a diverse customer base and enhances user convenience. Integrating multiple payment methods – from credit cards to digital wallets – allows you to accommodate global customers with varying preferences. For instance, a European customer might prefer SEPA direct debit, while another in the US opts for PayPal. Flexible payment options ease the transaction process and reduce the likelihood of payment delays.

Our tip: Review your payment options regularly and update them based on emerging trends and customer preferences. To cater to a broader customer base, incorporate popular and region-specific payment methods.

3. Investment in a robust billing system

Investing in a robust automated billing system is critical for operational efficiency and scalability. Reliable billing software streamlines the billing process and minimizes errors, ensuring accurate invoicing. For instance, a SaaS company experiencing rapid growth will find that a scalable billing system can effortlessly handle an increasing number of transactions without compromising on performance, thereby supporting business expansion.

Our tip: When selecting a billing system, conduct a comprehensive assessment of its features, scalability, and compatibility with your existing infrastructure. Prioritize systems that offer easy integration, extensive customization, and strong customer support.

4. Data-driven decision-making

Utilizing customer data for billing optimization is a key strategic move. Analyzing billing data can reveal insights into customer behavior, like preferred plans or common upgrade paths. This understanding can guide pricing adjustments and feature enhancements. For example, if data shows a high uptake of a specific feature, it could be bundled into a popular pricing plan, potentially increasing its appeal and value.

Our tip: Establish a routine for billing data analysis. Use this data to identify trends, customer preferences, and areas for improvement. Consider periodic audits to maintain a data-informed approach to your billing strategies.

5. Customer communication and feedback

Effective communication and actively seeking feedback regarding billing are crucial for customer satisfaction. Transparent communication about billing changes or updates prevents surprises and fosters trust. Furthermore, soliciting input on the billing process can uncover areas for improvement. For example, a customer survey might reveal that clients find the invoice layout confusing, prompting a redesign for clarity. This proactive approach in billing-related communication ensures that customers feel heard and valued, contributing to higher satisfaction and retention rates.

Our tip: Develop a systematic approach to collecting customer feedback on billing. Use tools like embedded surveys in billing communications or dedicated feedback sections on your platform. Actively use this feedback to refine your billing process continually.

SaaS billing has come a long way. Are you ready to redefine the role of billing in your company?

Agile SaaS billing at scale

As a RevOps leader, transitioning to automated billing is a game-changing strategy. Set new industry standards instead of just following them. Automated billing isn’t merely an operational shift; it’s a catalyst for innovation. Picture a system that enhances transaction precision and unlocks a world of data for smarter strategic decisions, builds lasting customer relationships, and scales effortlessly with your growing business. Imagine a case where implementing such a system leads to measurable growth and customer satisfaction.This is your moment to steer your company toward efficiency and leadership. Consider adopting automated billing solutions like DealHub to optimize your operational processes and step into a future where your business sets industry benchmarks. By leveraging this advanced solution, you can focus on growth and innovation, knowing your billing system is a robust, agile, and scalable engine driving your revenue forward.