Complex Billing

Table of Contents

What is Complex Billing?

Complex billing describes the process of invoicing customers for multiple line items that are priced or need to be accounted for differently or products that are priced according to multiple variables.

Factors contributing to billing complexity may include taxes, fees, discounts, shipping costs, or other factors with varying pricing structures.

Complex billing can also describe the invoicing process used by companies that frequently invoice their customers for more than one kind of product or service.

This complexity requires an accurate system to ensure customers are billed accurately according to the pricing model(s) of the items sold. This type of billing may also involve recurring fees or subscription-based services, which require a unique method of tracking and billing customers.

Complex billing is complicated because it requires multiple data inputs to produce an invoice accurately.

This requires comprehensive invoicing solutions designed to streamline the process and ensure data accuracy. Without a system designed for complex billing, B2B companies that offer variably priced products and services can struggle to keep their customers billed correctly.

Synonyms

- Complex billing process

- Complex billing model

- Billing for complex pricing models

The Need to Manage Complex Billing

Business models and pricing strategies come in all shapes and sizes today. From tiered subscription plans to usage-based services, modern pricing models enable businesses to develop competitive product offerings and grow recurring revenue.

Meanwhile, customers are demanding customized products and services that require intelligent invoicing.

To manage the complexities of these pricing models, B2B companies need to have equally sophisticated billing solutions that can manage the multitude of variables, data, and inputs required to produce accurate invoices.

Complex Billing Examples

Complex billing is a system of charging customers based on various factors that are not easily calculated through traditional methods of invoicing and collecting payments.

Examples of complex billing systems can include:

- subscription-based services, such as SaaS

- tiered pricing models, such as mobile phone services

- usage-based models, such as utilities

- hybrid models that combine different pricing schemes

Subscription-based services are what many online businesses use when they offer a recurring service with varying price points according to the number of customers signed up, the duration of their subscription, what features are included, or what type of support is being offered.

Tiered pricing models offer different levels of service at different prices and can be used for monthly services such as internet access or phone plans.

Usage-based models charge customers based on how much they consume of a product or service, such as electricity or water.

Hybrid models combine two or more pricing approaches to provide the most benefit for both the customer and the business.

Why Complex Billing Software

The primary function of software for a complex billing environment is to automate the process of creating and managing account-level customer information and invoices.

Complex billing systems store customer data and generate detailed reports on customer spending habits and activity.

In addition, complex billing systems can track payments, calculate taxes owed and generate customized invoices.

Software for complex billing can also integrate with other applications, such as accounting software or enterprise resource planning (ERP) systems, to further automate processes and consolidate financial data in the billing and accounts receivable processes.

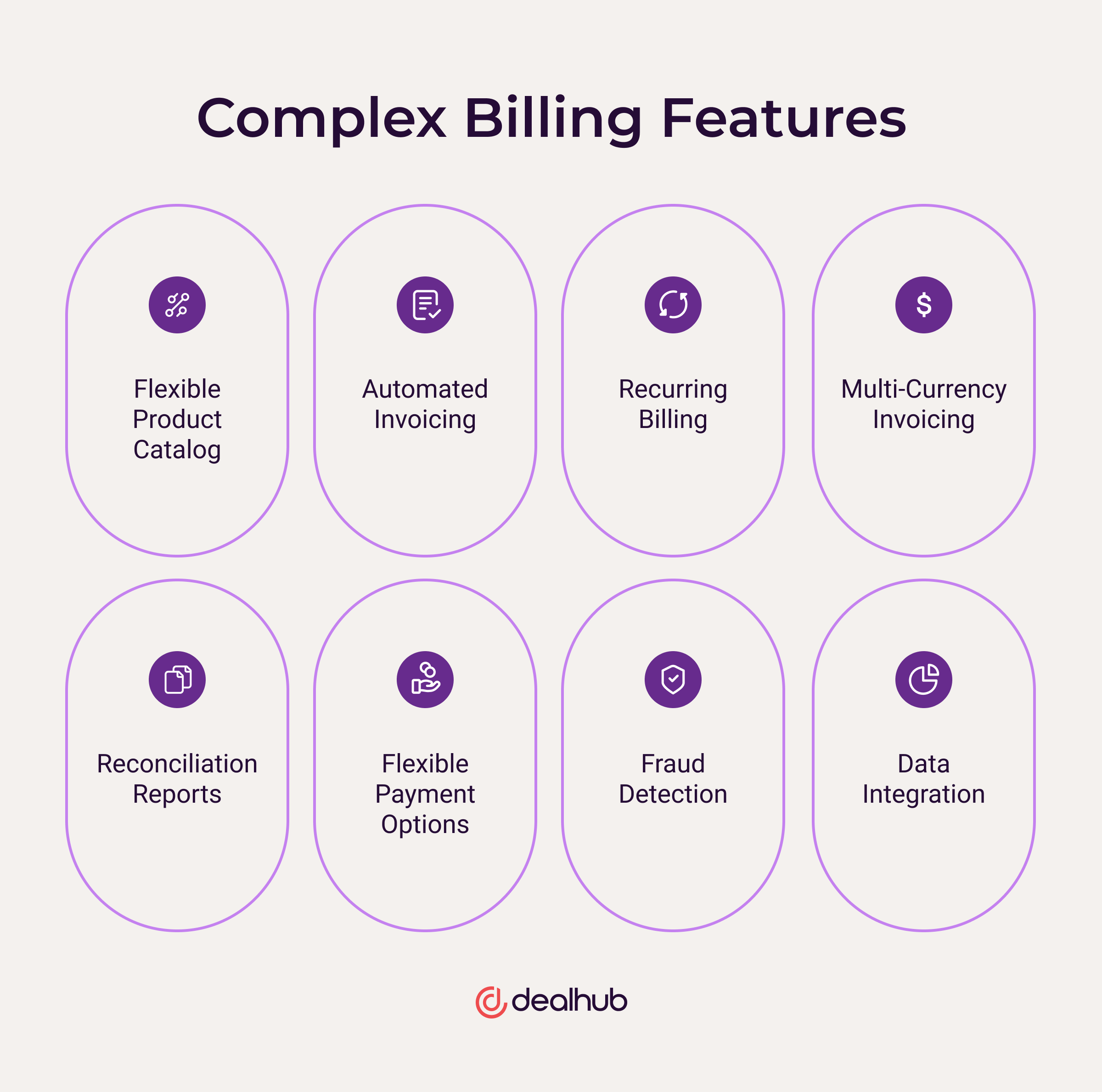

Complex Billing Solution Features

A billing system that supports complex pricing models can help streamline operations, reduce costs, improve accuracy, and manage customer data more efficiently.

Features such as automated invoicing and recurring payment schedules are often included to make bill paying easier for customers and more efficient for accounting teams.

Other elements necessary for complex billing transactions include support for multiple currencies or payment options, flexible discounts, customization of invoices and statements, reconciliation reports, and data integration with other systems.

Flexible Product Catalog

One of the primary benefits of using a billing solution designed for complex pricing is the ability to build quotes and invoices from a flexible product catalog.

Individual line items, bundles, and packages can be created and billed accurately from a product catalog that is updated in real-time. This minimizes errors in sales quotes and incorrect invoices.

Automated Invoicing

Automated invoicing is an essential feature of any billing system that supports complex billing.

Features such as automatic generation of invoices from existing records, integration with third-party systems for real-time updates, customizable templates, and automated emails or text messages to customers about overdue payments, among others, make life easier for both customers and businesses alike.

Recurring Billing

Recurring payment schedules are also valuable features in a complex billing system.

Recurring billing allows businesses to charge customers regularly without manually setting up individual monthly payments.

Features include setting thresholds before charging customers late fees and sending out reminders for upcoming renewals.

Multi-Currency Invoicing

Modern billing systems increasingly support multi-currency payments due to the rise of global e-commerce transactions and international business partnerships.

Multi-currency invoicing allows businesses to send invoices in different currencies based on their customer’s country or region.

Reconciliation Reports

Detailed reconciliation reports should be available, which present all transactions in a way that makes it easy to organize financial information while keeping accurate cash flow records.

Flexible Payment Options

The system should also support flexible payment options, including credit cards, PayPal, bank transfers, ACH payments, money orders, cash on delivery (COD), purchase orders (POs), and more.

Fraud Detection

These billing systems make it easy to detect fraudulently submitted invoices due to advanced analytics capabilities that scan through datasets looking for patterns associated with fraudulent activities such as duplicate entries or incorrect address information.

Complex invoicing solutions can even alert administrators when suspicious activities are detected so they can review the activity before processing payments or filling orders.

Data Integration

Finally, data integration with other systems like CRM and CPQ should be supported for the billing system to collect information from different sources to generate meaningful insights into customer behavior and spending habits over time.

People Also Ask

How can I improve my billing system?

Improving its billing system is an essential process for any business. The billing system handles the payment and invoicing of customers, and ensuring it runs smoothly can help maximize a company’s sales operations efficiency. A well-functioning billing system can help to streamline the administrative tasks associated with customer purchases, increase customer satisfaction, and reduce operating costs.

One of the first steps in improving your billing system is to review its current design and ensure that it meets your business needs. Does it contain all of the features you need? How easy is it for customers to understand how to use it? How well does it integrate with existing software? Are there any potential areas of improvement that could be addressed if you had more resources or expertise available? Answering these questions can provide insight into what changes may be necessary.

In addition to reviewing its design, taking steps to improve the security of your billing system is also essential. Implement strong password protection protocols and encrypt user data whenever possible. Consider using multi-factor authentication when users access their accounts, which requires a second form of authentication (such as a code sent to their phone) before they are allowed access. Finally, regularly review your systems for vulnerabilities and patch any gaps quickly.

Consider automating certain aspects of your billing system, such as scheduling automated email reminders for overdue invoices or payment confirmations once received — as this can save time and money in the long run. Automation also helps reduce human error and ensures that processes are carried out consistently across multiple clients, helping you maintain control over financial transactions while freeing up time for more value-added tasks like marketing or product development instead of administrative work.

In addition to increasing automation, improving a billing system includes offering discounts to customers who pay early or setting up an automated subscription plan where customers get billed regularly. Enhancing its billing system is critical for any business wanting to optimize its sales operations and increase revenue growth.

What should I look for in a billing system?

When considering a billing system, it is essential to find a solution that is scalable and will help the company adapt to new markets. A billing system should be able to effectively keep track of customer data, payment information, and invoices and maintain accurate records of financial transactions and performance. It is also essential to consider the security and privacy requirements of your organization and the types of services you need from a billing system.

When shopping around for an agile billing platform, ensure it meets all essential requirements and fits within the company’s budget. Some key features to look out for include:

– Customization options, such as the ability to tailor the product catalog

– Ability to calculate pricing of individual line items and invoice totals based on multiple variables

– Flexibility and scalability for future growth

– Automated recurring payments for subscription billing

– Comprehensive reporting

– Integration capabilities with other software solutions

– Support for different payment methods

– Ability to calculate taxes based on customer location

– Ability to incorporate discounts into invoices

– Access control for customers by assigning special permissions or restrictions

– Accurate and compliant revenue recognition capabilities

– Customer service options that provide quick responses and helpful advice

In addition, consider how user-friendly the software is – ease of use is crucial when selecting a billing system. This includes intuitive navigation, an attractive UI design that displays data clearly, mobile compatibility so users can access information on their phones or tablets, and online help desk support if users have difficulties understanding or using a particular feature.

Finally, make sure you do ample research into any potential vendors before committing to them. Check out customer reviews online and inquire about previous experiences with their systems to gauge reliability and satisfaction levels. Make sure all contracts are carefully read before signing, paying close attention to fees related to setup costs or additional services that may be required down the road.