Chargebacks

Table of Contents

When a customer files a payment dispute, the issuing bank may forcibly take the payment amount back from the merchant. This is called a chargeback, and it can be a costly and time-consuming issue for businesses.

What are Chargebacks?

A chargeback (also called a reversal) happens when a customer disputes a transaction and their card-issuing bank reverses it.

The chargeback process usually begins when the customer contacts their issuing bank directly to dispute the validity of a transaction or to report fraudulent activity.

This can happen for various reasons, including refund requests, billing process errors, and unauthorized purchases.

Chargebacks occur in a variety of forms, including:

- Fraudulent card-not-present (CNP) transactions

- Failed authorization attempts

- Credit card processing errors

- Customer dissatisfaction with a purchase

- Duplicate billing or customer invoices

- Delivery or service quality issues

- Unauthorized charges from young children or family members

From the business side, chargeback management can be strenuous. The merchant loses the money and must then take steps to dispute the chargeback and recover their funds if they feel it is an incorrect or fraudulent claim.

Synonyms

- Payment Disputes: Chargeback requests initiated by customers as a result of a perceived problem with the product or service they purchased.

- Retrieval Requests: A request by card issuers to provide additional information about a transaction prior to processing the payment.

- Reversal Requests: A request from the processor for reimbursement of funds already sent to the merchant due to an incorrect authorization decision, fraud, or technical issue.

- Reversed Credit Card Charges: When a customer’s card issuer requests or forces the reversal of a previously authorized charge.

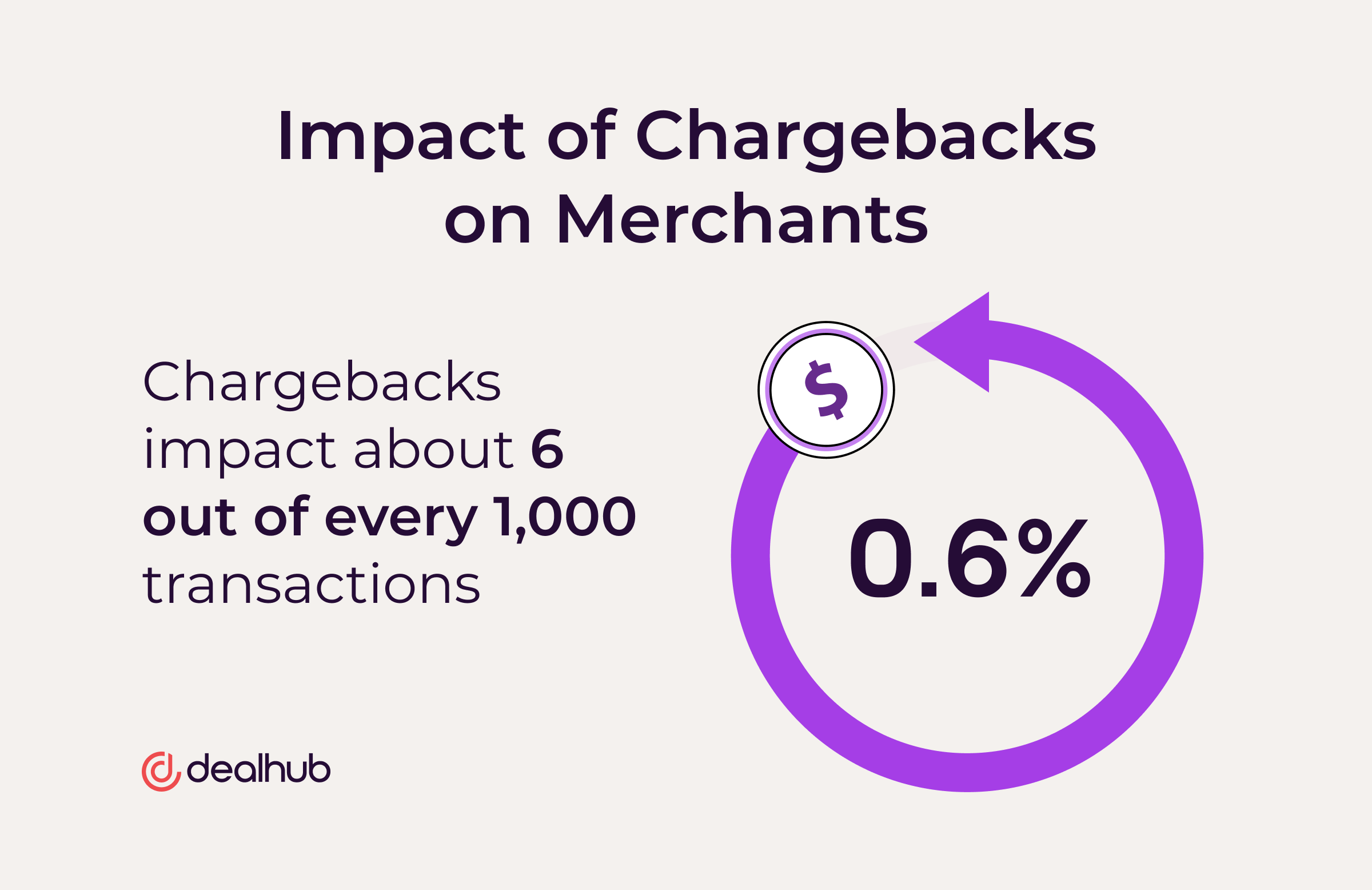

The Impact of Chargebacks on Merchants

Across all industries, chargebacks impact about 6 out of every 1,000 transactions.

At their best, chargebacks inconvenience businesses, requiring manual effort and wasting valuable time. In their worst cases, they can be expensive and damaging to a business’s reputation.

When a card issuer mandates a chargeback, merchants also have additional problems with revenue management by adding more complexity to the finances of a business

Chargebacks are also a big concern for payment processors, as they can hurt their “chargeback ratio”—a key metric used by credit card networks in determining the fees that merchants pay. Companies with high chargeback rates are looked at as “unsafe”—a label no business wants to have.

Illegitimate chargebacks (also called “friendly fraud”) are a growing problem for merchants. These are chargebacks initiated by customers who do not have a valid reason for disputing the transaction but take advantage of the process to get their money back.

Friendly fraud is like virtual shoplifting—it’s difficult to prove and costly for merchants. Unfortunately, it’s an increasing practice as more businesses move online and credit card companies favor their customers’ business over in-depth investigation.

Common Reasons for Chargebacks

There are several reasons a customer may want funds put back on their payment card, and they range in severity from simple errors in billing operations to fraudulent and predatory practices.

Unfortunately, it is usually the seller that bears the brunt of chargeback costs.

Customer Dissatisfaction

Dissatisfaction with the customer experience is one of the most common reasons for chargebacks.

Several factors can cause a drop in customer satisfaction:

- Disagreement with the refund policy

- Undelivered or incorrect items

- Shipping delays

- Miscommunication

- Lack of understanding of the product or service

Since most credit card companies have easily accessible chargeback claim forms on their websites and customer portals, it is becoming increasingly easy for customers to start the dispute process and receive a refund without ever contacting the merchant.

And since customers have little consideration for what should actually constitute a chargeback, they often misrepresent their situation to their card issuer in order to get their money back.

Incorrect Charges

Processing errors, duplicate billing, and customer invoices can all lead to chargebacks.

Sometimes, a processor or automated billing platform will mistakenly double-bill a customer, or the transaction data may be incorrect.

When this happens, customers often take the issue directly to their card issuer to recover the funds quickly.

Unauthorized Transactions

Unauthorized transactions occur when customers claim they did not approve the transaction in question and thus should not be liable for the payment.

This is especially common with online transactions, as customers may not recognize the merchant name or associated address.

In these situations, card issuers usually side with the customers and reverse the funds back to them unless presented with compelling evidence from merchants to prove authorization.

Fraud

Fraud can happen to a business’s customers or to the business itself. In either case, the customer’s card issuer will often reverse the transaction in favor of the consumer.

Legitimately fraudulent transactions can include:

- Stolen or cloned cards

- Compromised bank or card information

- Identity theft

- False refunds

- Theft of goods/services

- Account takeover

In the above cases, businesses should take their chargeback seriously and do everything they can to work with their customers, whose sensitive information or finances have been compromised.

Some customers may attempt friendly fraud or chargeback abuse to manipulate the system and get a refund.

The only defense against this type of chargeback is to develop a strong fraud prevention and dispute management program that can identify and prevent illegitimate purchases from occurring in the first place.

Family Fraud

Family fraud is a bit of a combination between an unauthorized transaction and a fraudulent charge.

It happens when a family member (e.g., a child) uses another’s (e.g., a parent’s) credit card and makes a purchase without permission.

This type of chargeback is particularly difficult to dispute since it involves a personal relationship between the two parties.

Companies that sell video games, streaming services, apps with in-app purchases, and one-click ecommerce platforms like Amazon are especially susceptible to family fraud.

The Chargeback Process

Understanding the chargeback process is essential to successfully defend against them and manage the revenue lifecycle.

Although it varies from company to company, the chargeback process typically looks like this:

- A customer contacts their card issuer to dispute a purchase and initiates a chargeback request.

- The card issuer reviews the case and submits it to the merchant’s acquiring bank for review.

- The merchant’s acquiring bank debits the merchant’s account for the amount of the disputed transaction plus any applicable fees.

- The merchant is notified of the chargeback and allowed to respond with evidence proving the transaction was legitimate.

- If the merchant can make a compelling case, then the chargeback may be reversed in their favor.

- If no agreement is reached, or if the card issuer sides with the customer, then the chargeback is upheld and the merchant must accept the loss of funds.

- The merchant can choose to pursue further legal action against the customer if they feel it is warranted.

How do Chargebacks Work?

In simple terms, chargebacks work by allowing customers to dispute a transaction with their card issuer to get their money back.

The chargeback process typically involves the customer contacting their payment provider via an online form on its website, which is easily accessible.

Based on the information provided, the card issuer will review the case and decide on whether to proceed with the chargeback.

Who Initiates a Chargeback?

Customers initiate a chargeback when they believe that a transaction was unauthorized or fraudulent.

If the billing department were to initiate a similar process, it would be considered a refund.

Who Pays for a Chargeback?

Chargebacks and disputes are part of the order-to-cash cycle, meaning they are inevitable in any business.

Since the customer receives their money and the payment provider makes its cut either way, the merchant usually absorbs the cost.

Even if the merchant successfully defends against the chargeback by providing proof of delivery, the merchant bank may still incur a chargeback fee for filing a dispute. Legal action against the customer, will also incur legal fees, which might or might not be covered.

For this reason, it’s important for merchants to be proactive about consumer protection and chargeback prevention in the first place.

Reason Codes

A chargeback reason code is a distinctive two-to-four-character combination of letters and numbers issued by the involved bank to identify why a dispute was initiated.

Visa, Mastercard, and other leading card companies each have their own respective set of codes for this purpose.

These reason codes allow merchants to better understand the underlying cause of a dispute and develop strategies for preventing future chargebacks.

For example, if a customer disputes a credit or debit card transaction with code 4837 (Mastercard’s code for “Fraudulent Multiple Transactions”), then the merchant should review their fraud prevention policies and procedures to determine what can be improved.

Searching the chargeback reason code database can help organizations manage chargebacks as they occur, understand their implications, and react accordingly.

Arbitration

If the merchant does not agree with the chargeback decision, they may choose to pursue arbitration.

In the arbitration process, an independent third-party mediator reviews the dispute and makes a binding decision on the outcome.

The arbitrator typically charges fees for their services, which are usually passed on to the customer who initiated the dispute.

How to Prevent Chargebacks

Preventing chargebacks is a critical part of revenue assurance—the process of ensuring that all transactions are legitimate and all revenue is secure.

In order to do this, merchants should implement the following best practices:

Having strong customer service and communication policies in place

Prioritizing customer retention and a positive experience is critical to preventing chargebacks.

To do this, merchants should offer customer service through multiple channels and communicate regularly throughout the customer’s journey.

This includes:

- Providing transparent pricing, billing, and package information upfront

- Offering omnichannel customer support (phone, email, live chat)

- Sending emails to confirm orders and provide updates on shipping

- Contacting customers if there is a potential problem with their order

To limit the number of claims filed on the credit card issuers’ side, sellers should also include a section of their website that clearly outlines their return/refund policy and instructs customers on how to cancel an order.

For these policies to be effective, the business must respond to all orders as quickly as possible. Chatbots and automated emails can help with this.

Developing a strong fraud prevention strategy, including a chargeback policy

Every business needs a fraud prevention strategy. It should include the following:

- Implementing anti-fraud measures, such as 3D secure authentication, geo IP verification, and address verification

- Developing a comprehensive chargeback policy that outlines specific steps for handling disputes and fraud claims

- Working with payment providers to leverage their data and analytics capabilities to detect fraudulent transactions in real-time

- Educating customers on how to use the payment method securely

For fraudulent chargebacks, companies should also have additional solutions (e.g., implementing an automated dispute process, obtaining insurance coverage).

Ensuring billing information is accurate and up-to-date

The easiest way to prevent lower chargeback rate is to ensure up-to-date customer information. Merchant errors are often in the business’s control, but they are frequently overlooked.

To maintain accurate records, companies should:

- Keep billing information up-to-date by regularly validating contact information

- Monitor and react quickly to customers’ account changes

- Offer flexible payment options (e.g., ACH transfers) for customers who prefer not to use credit cards

Updated information also ensures faster order fulfillment, earlier customer service response times, and fewer customer complaints.

Providing detailed product or service information to new customers

A critical but often-overlooked part of the customer journey is providing sufficient product or service information.

Companies should make sure that new customers are fully aware of what they are signing up for and have all the necessary information to make an informed decision.

During customer onboarding, organizations should set clear product expectations, outline terms of service, and provide an estimate of any fees associated with the purchase.

This can help reduce the likelihood of customers filing chargeback claims due to misunderstanding, confusion, or a feeling of “lack of value.”

Offering secure payment processing options with fraud protection

Most payment processors offer fraud protection solutions that can help prevent chargebacks.

These could include:

- Address verification system (AVS)

- Card security code check (CVV2)

- Fraud scoring to detect suspicious transactions in real-time

Merchants should also take the necessary steps to ensure compliance with industry regulations, such as PCI DSS and GDPR, to reduce fraud risk. Depending on the industry, additional compliance steps may be necessary.

Technology for Managing Chargebacks

Chargeback processing and management would be almost impossible without the right business software.

There are two main software solutions designed to help companies manage chargebacks and other payments-related issues.

Billing Platform

A billing platform can help companies detect revenue leaks (which could be caused by chargebacks or refunds), ensure customer information is up-to-date, and streamline the billing cycle and accounting process should chargebacks occur.

Billing platforms can come as standalone software, or they can be included in CPQ software, ERP systems, or ecommerce platforms.

Automated billing usually has fraud prevention tools built in as well, so customers can verify the security of their payments, and companies can verify a legitimate purchase.

Dispute or Chargeback Management Software

Chargeback management software manages the entire chargeback process, providing a single platform for tracking and resolving disputes as well as protection from chargebacks.

It provides end-to-end visibility into each chargeback’s status and details about the customer and transaction involved.

It also provides insight into customer behavior and patterns, allowing companies to identify common sources of chargebacks, as well as any potential areas of fraud.

For dispute resolution, chargeback management tools offer automated dispute filing, tracking, and notifications.

People Also Ask

What is the difference between a chargeback and a refund?

Customers typically initiate chargebacks, and their card providers are the ones who return the money on the debt or credit card statement. A refund, on the other hand, is ks a voluntary return of funds initiated by the merchant as a courtesy to the customer.

What are the time limits for initiating a chargeback?

Each card and bank sets its own limits for chargeback initiation, typically ranging anywhere from 30 days to 120 days after the purchase or transaction. If a customer tries to initiate a chargeback after the time limit has passed, the card provider may deny it.