Automated Billing

Table of Contents

What is Automated Billing?

Automated billing is a system that enables businesses to streamline and automate their billing, invoicing, and payment processes, making them faster, simpler, and more efficient. Using automated billing systems helps organizations save time and money by pulling data from disparate systems into one platform to create accurate invoices, reducing errors and ensuring timely invoice delivery and bill payment.

Synonyms

- Automated billing operations

- Auto-billing system

- Automated billing software

- Automatic billing system

- Automated invoicing

- Billing automation

Billing Challenges

Organizations face many challenges ensuring their billing operations run smoothly and error-free, especially when relying on manual processes to generate and send invoices and process payments.

Some common challenges include:

- High costs

- Inefficient processes

- Lack of visibility into data

- Difficulty in tracking invoices and payments

- Challenges with scalability

- Data accuracy issues

- Increased risk of fraud and errors

- Inefficient customer service processes

As a result of these issues, many organizations are digitally transforming their invoicing processes by automating billing.

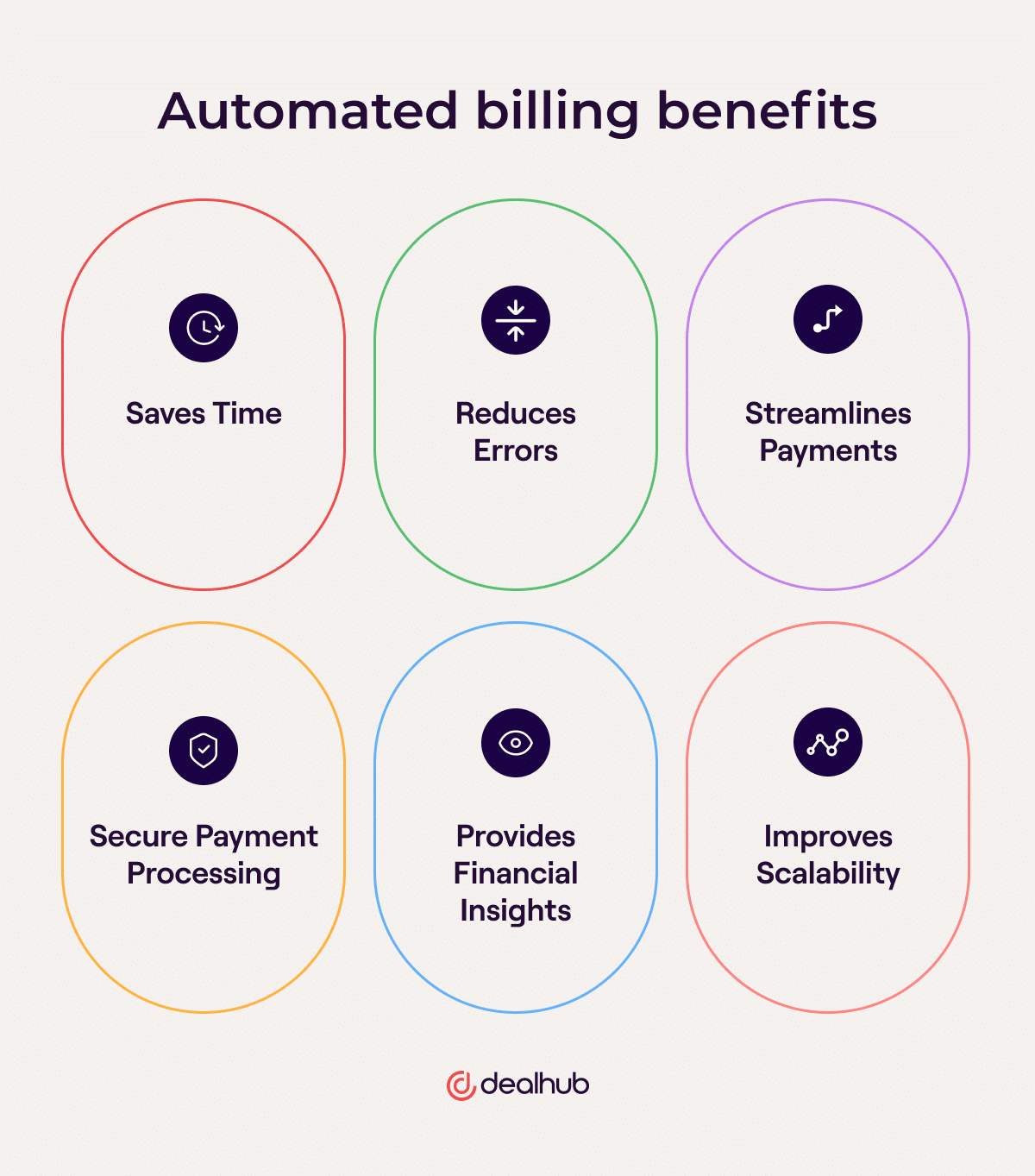

Benefits of Automated Billing

Automated billing is an invaluable tool for businesses to ensure invoicing accuracy and timely receipt of payments. It helps companies to streamline their billing process, minimize errors, and maximize efficiency. Below are a few of the benefits of automated billing. Below are a few of the benefits of automated billing.

Saves Time

Automated billing helps businesses save time and money by reducing the manual labor involved in creating invoices, sending out bills, collecting payments, and tracking customer payments. With automated billing, businesses no longer have to manually enter customer information into their system or create invoices individually. Instead, they can set up systems that automatically generate invoices based on specific criteria set by the business. As a result, companies can save costs associated with manual processes and become more efficient in managing their billing operations.

Reduces Errors

Automated invoicing improves accuracy by eliminating errors that could occur during manual data entry processes. For example, incorrectly entering customer and order information leads to invoicing errors, resulting in costly mistakes and revenue leakage. Automation automatically performs tasks such as entering data into invoices, ensuring accuracy by reducing the possibility of manual entry errors.

Streamlines Payments

Customers can pay bills online or through automated systems. This eliminates the need for accounts receivable to manage the billing cycle and send invoices and process checks manually. In addition, customers receive their invoices according to a billing schedule which helps ensure timely payment.

Secure Payment Processing

Automated billing provides more secure payment options than traditional methods such as checks. This helps protect customers from fraud by requiring strong authentication measures such as two-factor authentication or biometric scans before allowing customer payments to be processed. With these measures in place, businesses can rest assured that only authorized individuals are making transactions, reducing the risk of fraudulent activity against customers’ accounts.

Provides Financial Insights

Automated billing systems provide businesses with detailed insights into their financial performance, helping them identify opportunities for growth and improvement. With real-time analytics available at the click of a button, companies can make informed decisions on managing their finances better while working towards long-term success.

Improves Scalability

Automated billing provides better scalability by allowing organizations to experiment with different business models and change pricing models easily. This ultimately gives businesses greater control over how they handle their financial structure and how they scale up depending on changing market conditions or customer demands.

Features of Automated Billing Software

Automated billing systems use software and technology to automate the typical manual processes involved in invoicing clients and collecting payments. This invoicing system automates the entire billing process, from sending out invoices, accepting payments, and tracking customer payments, to generating statements and reports.

Automated billing software should be capable of performing many different tasks, including but not limited to:

- Generating billing statements: This is done by collecting customer information such as names, addresses, and payment methods to generate accurate invoices or other billing documents. These documents can be sent via email or through a secure web portal.

- Processing payments: The software should have integrated payment processing solutions that will automatically process credit cards and other forms of payment quickly and securely. This eliminates manual transaction fees and makes it easier for businesses to get paid in a timely manner.

- Automating recurring payments: Recurring payments help businesses save time by eliminating the need for repetitive manual data entry or follow-up calls with customers about their bill due dates. With recurring billing in place, business owners can easily set up monthly or yearly subscription plans for their customers, which will automatically process payments according to the predetermined schedule.

- Notifying customers about overdue invoices: Customers who have missed their payment deadlines should receive an automatic reminder from the system, which can help prevent late fees and dunning notices from being issued. Additionally, automated billing software should also offer options such as partial payments or setting up customized payment plans for customers struggling with financial hardship.

- Generating reports: An effective automated billing system should also offer detailed reports regarding customer activity and other pertinent information that businesses can use to make better decisions related to finances and customer service strategies.

- Support: Automated billing software should always come with round-the-clock support so businesses don’t have to worry about any technical issues they might encounter while using it. The right system should also integrate seamlessly into existing applications, such as accounting software so that users can manage all aspects of their business in one place without switching between multiple programs.

Automated Billing System Implementation

Implementing automated billing software is a great way to streamline and simplify the billing process for any organization. Automated billing software facilitates the entire process, from invoicing to payment collection, saving time and money in the long run.

Here’s how to implement an automated billing system:

Consider Your Needs

When implementing automated billing software, it’s essential to consider the organization’s specific needs and business requirements before selecting a system. Many different automated billing software solutions are available on the market, so it’s important to research and compare features before deciding. Some automated billing systems are designed for large businesses with complex needs, while others may be more suitable for small businesses or entrepreneurs. Consider the company’s business model, pricing strategy, discounting, and need to scale over time.

Manage Integrations

Once the billing solution has been identified, the technology team must ensure the company has the necessary hardware and software components to implement it properly. This includes other software integrating with the billing solution, such as accounting software, ERP, CRM, and CPQ software that provide customer and order data needed to produce invoices. The tech team will want to ensure the company’s existing software and infrastructure are compatible with the automated billing system of choice.

Configure the Software

After everything is set up and ready to go, it’s time to configure the automated billing system. This means setting up all of the necessary accounts, such as customers, vendors, banks/payment processors, taxes, etc., and creating any forms or templates needed for invoices or other documents related to accounting processes. Additionally, this includes configuring the customers’ payment portal.

Set Up the Pricing Automation Workflows

Set up also includes configuring the automation workflows such as schedules for billing reminders, sending invoices, automatic payments, and dunning. Once this configuration step is complete and tested successfully on a trial basis, the accounting department can officially launch the automated billing system.

Train the Team

It’s also crucial to provide training for anyone using the billing software, so they understand how it works and how to use it most effectively. Finally, the accounting and accounts receivable managers must regularly review the automated billing setup to ensure its performance levels remain high. This includes checking transaction times and accuracy rates, and ensuring that security measures are kept up-to-date since cyber threats constantly evolve.

People Also Ask

What are the advantages of automating an invoice?

Automated billing ensures invoicing accuracy and efficiency. It can help reduce human errors associated with the manual processing of invoices and help streamline the entire process. Automated billing works by tracking all transactions and generating automated invoices based on customer data and orders for goods and services sold. Several features make automated billing advantageous to businesses looking to streamline their billing operations, including:

Improved communication between customers and businesses: Automated billing ensures both parties receive notifications when payments are due, reducing missed payments and late fees.

Flexible payment options: Automated billing often allows for multiple payment methods such as credit card payments, PayPal transfers, or direct bank transfers, giving customers more choices regarding how they pay their bills.

One source of truth: Automated billing systems allow companies to store customer data in one central location for easy access when needed. This makes it easier for businesses to track how payments were received and how much was paid at any given time by whom. In addition, users can view customer payment history in real-time to determine whether or not customers have paid or have outstanding invoices.

How do you automate a billing process?

Automated billing processes enable businesses to invoice and collect customer payments automatically. After the billing software is implemented, the process involves the customer providing their payment details (such as credit card or bank account information) and the merchant’s system generating an invoice with the customer’s due date and payment amount. This invoice is then sent to the customer by email, text message, or an online portal, depending on how the business has chosen to accept payments.

When the due date for payment arrives, the automated billing system will automatically attempt to deduct the agreed-upon amount from the customer’s account. This eliminates much of the manual work associated with invoicing and collecting payments since it eliminates manual intervention when sending out invoices or collecting payments. Automated billing also helps reduce late payments since customers are notified about upcoming due dates in advance.

Businesses can use automated billing systems in conjunction with other methods of collecting payments, such as direct debit, ACH transactions, wire transfers, and more. This allows businesses to provide customers greater flexibility when paying their bills while taking advantage of automated processes. Additionally, many billing solutions enable automatic late fees if a payment is not made on time and detailed reporting so businesses can easily track their income and expenses.