The Quote-to-Revenue process

We’d be remiss if we didn’t define the Quote-to-Revenue process (AKA QTR). This approach encompasses the sales steps that start with generating a quote and end with capturing revenue. QTR encapsulates everything from configuring products, determining pricing, creating proposals, securing approvals, and invoicing (as well as collecting payment). This process is the heart of any revenue-generating organization and plays a pivotal role in shaping a company’s financial success. That’s why understanding and implementing an effective QTR process is integral to an organization’s bottom line.

Challenges in the Quote-to-Revenue process

Of course, as impressive as the QTR process is, it’s not without its unique challenges. Some real hurdles include:

- Workflow inefficiencies

- Manual errors

- Delays in approvals

- Lack of visibility in sales lifecycle

Sales teams that address these challenges early and often can avoid missed revenue opportunities, and, in doing so, ensure the business realizes its revenue potential.

For example, a billing software can streamline and automate the QTR process, eliminating inefficiencies and removing any likelihood of human error. It can also facilitate faster turnaround times that remove delays since pricing configurations for quotes are pre-approved.

Adopting a solutions-based QTR process improves visibility between sales and finance teams, and real-time visibility across the QTR process can unlock insights via dashboards and flexible reporting. This optimizes the entire workflow and can nurture cross-team collaboration.

Once again, everyone wins when we know how to use technology to our advantage! a billing software can overcome the challenges that a more manual approach to CPQ may provide. The end result: greater efficiency, speed, accuracy, and transparency across the entire quote-to-revenue process to ensure maximum revenue potential while enhancing customer satisfaction.

The importance of unifying Sales and Finance

Sales and finance teams must be on the same page to optimize the Quote-to-Revenue process. When these departments work together seamlessly, a company can expect improved accuracy and deals can close faster. Agile billing software basically acts as a bridge, facilitating collaboration and empowering teams to achieve revenue goals by working together.

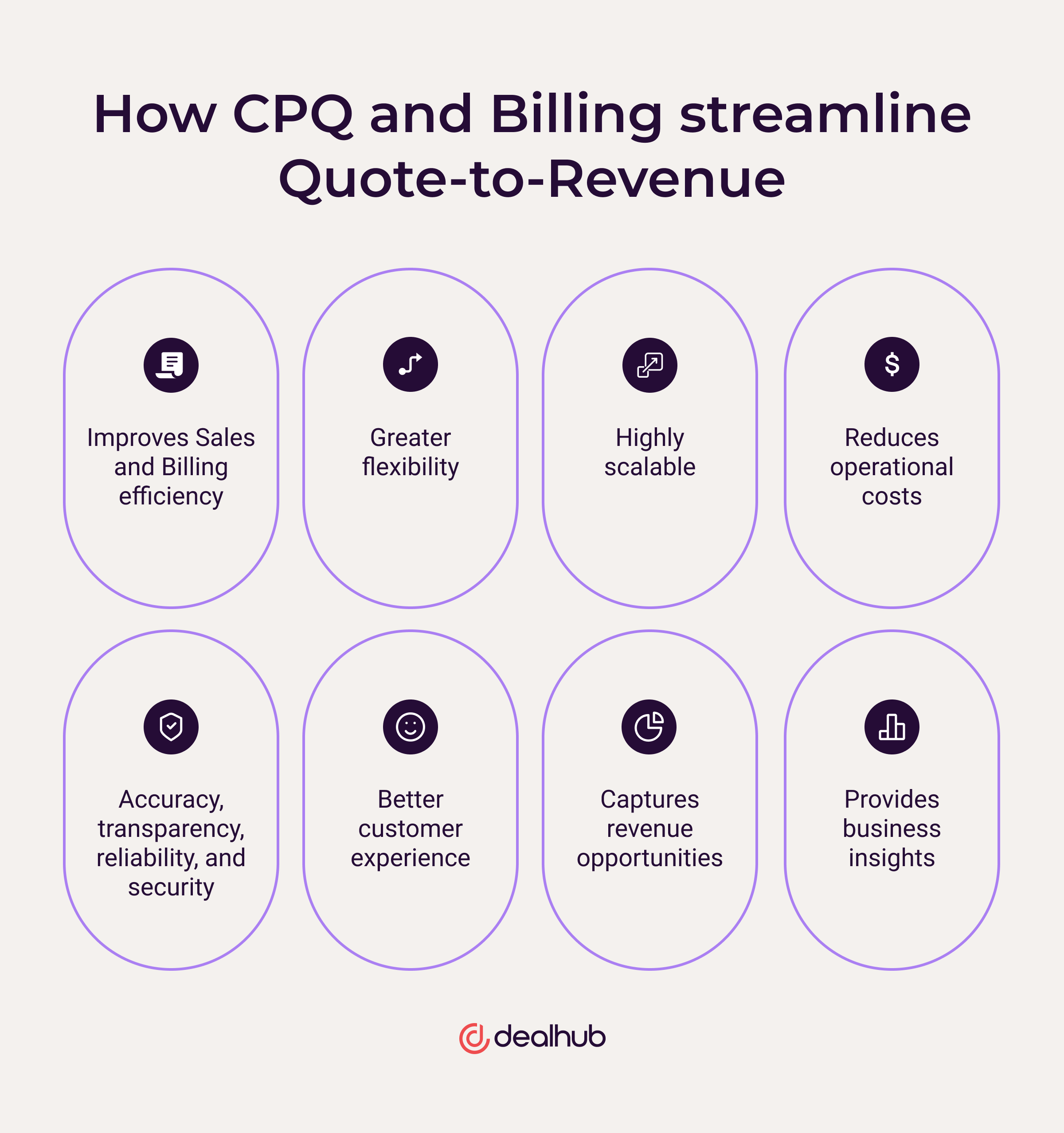

How CPQ and Billing streamline QTR

There are many tangible advantages to integrating agile CPQ and Billing solutions into business processes (as opposed to relying on traditional on-premises systems). Here, for example, are some key benefits that reveal increased revenue opportunities and accelerate future sales:

Improves Sales and Billing efficiency

Automating complex tasks, including quote generation, complex pricing calculations, and contract management, will streamline the sales and billing processes. With cloud-fueled automation, sales teams can create accurate quotes in minutes rather than days, while finance teams can swiftly generate invoices and collect payments.

Greater flexibility

CPQ and Billing ensures companies are more flexible and can adapt effortlessly to changing business needs. The solutions allow for quick adjustments to pricing, product configurations, and discounts. Responding swiftly to market demands enables businesses to stay agile and ahead of the competition.

Highly scalable

Remember the days when companies had to worry about physical infrastructure limitations? Thanks to the cloud, scalability matches the pace of business. That means teams working within the cloud can quickly expand a product catalog, increase sales volumes, or add new users as needed to fit a company’s growth trajectory.

Reduces operational costs

Unlike the cloud, on-premises solutions require room for sizeable hardware, often expensive maintenance, and come with high upgrade costs. Moving to cloud-based solutions removes a lot of traditional expenses and is way more cost-effective. Instead of capital investments and ongoing infrastructure maintenance, businesses can free up resources and invest in more lucrative revenue-generating initiatives.

Ensures data accuracy, transparency, reliability, and security

These days, everyone is concerned with data integrity. Cloud-based solutions prioritize transparency by offering robust data management systems. These systems ensure accurate pricing and streamlined approvals via reliable contract management. And, with advanced security measures and data encryption protocols, even the most sensitive information is protected.

Better Customer Experience

With better accuracy and faster quote delivery, cloud-based billing software improves the customer experience to wow clients. Think about it: sales trends are changing faster than ever. At the same time, customers expect white-glove service that aligns with their exact requirements. When teams can move more quickly than the competition without sacrificing quality or service, they score a competitive advantage while delighting clients.

Captures revenue opportunities

CPQ solutions can capture more revenue opportunities that may slip through the cracks. How? By eliminating manual errors and delays. With rocket-fast approvals, straightforward billing, and transparent, accurate pricing, potential revenue isn’t left on the table.

Provides business insights

Businesses that understand what’s working (or not) can quickly pivot towards new revenue streams or lean hard into what’s working for them. To do that, they need robust analytics and reporting capabilities. Billing software can provide unmatched insights into everything from trends to sales performance to the effectiveness of product pricing. When armed with data, teams can make informed decisions and refine their sales strategies for continuous growth.

Best practices for selecting an integrated CPQ and Billing solution

When choosing a CPQ and Billing solution, consider the following best practices to ensure the right fit for a business:

- Understand your business needs. Identify specific requirements and objectives before exploring available solutions. That way, the team is in the best position to know what they need from a product and if it has the right features in place to deliver results.

- Evaluate the features and functionality. Make time for a POC (Proof of Concept). Assess the solution’s capabilities during a POC, ensuring it aligns with current business processes. Demo a few options to see which one checks most/all of the boxes. Going for a test drive showcases the solution in action and can reveal its long-term usefulness.

- Consider security, compliance, and reliability. If a company’s data is ever compromised, it risks both reputational damage and a loss in revenue. Global cybercrime is also rising and is expected to grow by 15% a year over the next five years. It’s integral to prioritize solutions that can showcase robust security measures and maintain a track record of compliance.

- Research the vendor’s reputation for support & maintenance. When choosing a vendor, source a solution that can offer reliable support and prioritizes ongoing maintenance to ensure teams have access to the support they need every step of the way – even after onboarding.

- Compare pricing models & payment options. A good billing software is designed to be agile, and pricing structures should be too. Look at payment options and billing. Ask: does the pricing align with the company’s budget and business model? Are we getting everything we need for the associated cost?

- Analyze the platform’s scalability & flexibility. A business will change over time, and scalability is essential to consider before choosing a solution. Will the CPQ solution grow with the company, or does it have certain limitations? Consider future business needs beyond what’s necessary right now – or even six to 12 months down the line.

- Review integrations with external systems & applications. Companies use a variety of systems and solutions every day to deliver for their clients. When introducing a new solution, it’s crucial to determine how well it will integrate into what’s already in place – especially regarding ERP and CRM.

- Assess User Experience design (UX) quality. At the end of the day, multiple people will need to interact with the system that’s put in place. When assessing the capabilities of a CPQ and Billing solution, pay attention to the importance of ease of use. It will significantly impact team morale and the adoption rate!

- Explore customization capabilities to meet unique requirements. Every business is different. Therefore ensure the chosen solution can be tailored to business processes and requirements specific to the company.

- Ask questions about training resources & documentation availability. The easier teams can immediately adopt the solution, the faster a company sees results. Teams will also save time and money if they can avoid lengthy, expensive training sessions or onboarding processes. A solution that offers training materials, thorough onboarding documentation, and ongoing educational support will set a sales team up for success.

DealHub CPQ + Billing: A unified Quote-to-Revenue solution

CPQ and Billing solutions are revolutionizing the quote-to-revenue process by providing businesses unparalleled efficiency, scalability, and cost savings. When organizations unify sales and finance, streamline processes, and examine new/missed revenue opportunities, these solutions act as a powerful catalyst for growth.

DealHub understands the power of a unified CPQ and Billing solution in driving revenue growth. Our agile CPQ + Billing platform combines automation, efficiency, and control to provide businesses with a robust quote-to-revenue solution. Streamline processes, enhance collaboration between sales and finance teams, integrate your existing systems together, and unlock a business’s full revenue potential with DealHub.

With DealHub, companies get:

Increased control and compliance

By verifying end-to-end financial and operational process accountability, DealHub provides visibility and governance, ensures both SOC (internal) and SOX (external) compliance, and enables better revenue assurance and forecasting throughout the deal-making process.

Improved agility

Delivering the fastest time-to-value and accelerated offer creation, DealHub delivers the depth and robustness of a custom-coded CPQ solution with the agility of a business-oriented low-code configured environment. This makes for an easy setup and ongoing updates. Its agile pricing models are designed to drive revenue growth through its always up-to-date pricing, products, and subscription management, without the dependence on third-party implementation or IT partners.

Flexibility and efficiency

DealHub is continuously adding new functionalities to its already agile capabilities which empowers sales organizations to future-proof their quoting process. With adaptable pricing structures that support a dynamic sales environment, DealHub reduces revenue leakage while driving sales productivity.

A personalized CX

DealHub provides a virtual collaborative environment for sharing all deal-related documents and materials in one centralized location, to deliver a fully immersive and tailored customer experience that is secure, engaging, and on-brand.

By following best practices when seeking out an integrated cloud-based solution, you’ll be able to integrate a product that aligns with your sales team’s unique requirements. And, when you work with DealHub’s CPQ + Billing platform, you’ll have unparalleled access to a comprehensive option that supercharges revenue for sales teams worldwide.