Average Deal Size

Table of Contents

In business, the relative value of a deal is proportional to its size—a business with hundreds of small deals could be just as valuable as a company that closes just a few large contracts per year.

In revenue intelligence, the size of a deal is a significant factor in determining its profitability. Understanding average deal size can be a crucial indicator for measuring success in sales and operations teams.

What is Average Deal Size?

Average deal size is a key performance indicator used to measure the financial impact of sales transactions. It’s a valuable tool for businesses, as it provides an overarching snapshot of how their products and services are doing in terms of sales volume, cost, and revenue growth.

By tracking average deal size, companies can uncover trends in their customer base, understand how much customers are willing to invest in their offerings, and compare performance from one year to the next.

It also helps determine revenue targets, forecast earnings, and allocate resources where needed.

In short, understanding average deal size allows companies to make more informed decisions regarding budgeting and growing their business.

Synonyms

- ADS – The abbreviation for average deal size.

- Average Deal Value – A comprehensive look at a company’s sales performance that considers the volume of deals, their size, and average sale price.

- Average Contract Value (ACV) – A metric used to compare the relative value of contracts. It considers not only deal size but also terms such as usage and duration.

- B2B Deal Size – In business-to-business (B2B) transactions, deal size refers to the total value of all items sold in a single transaction.

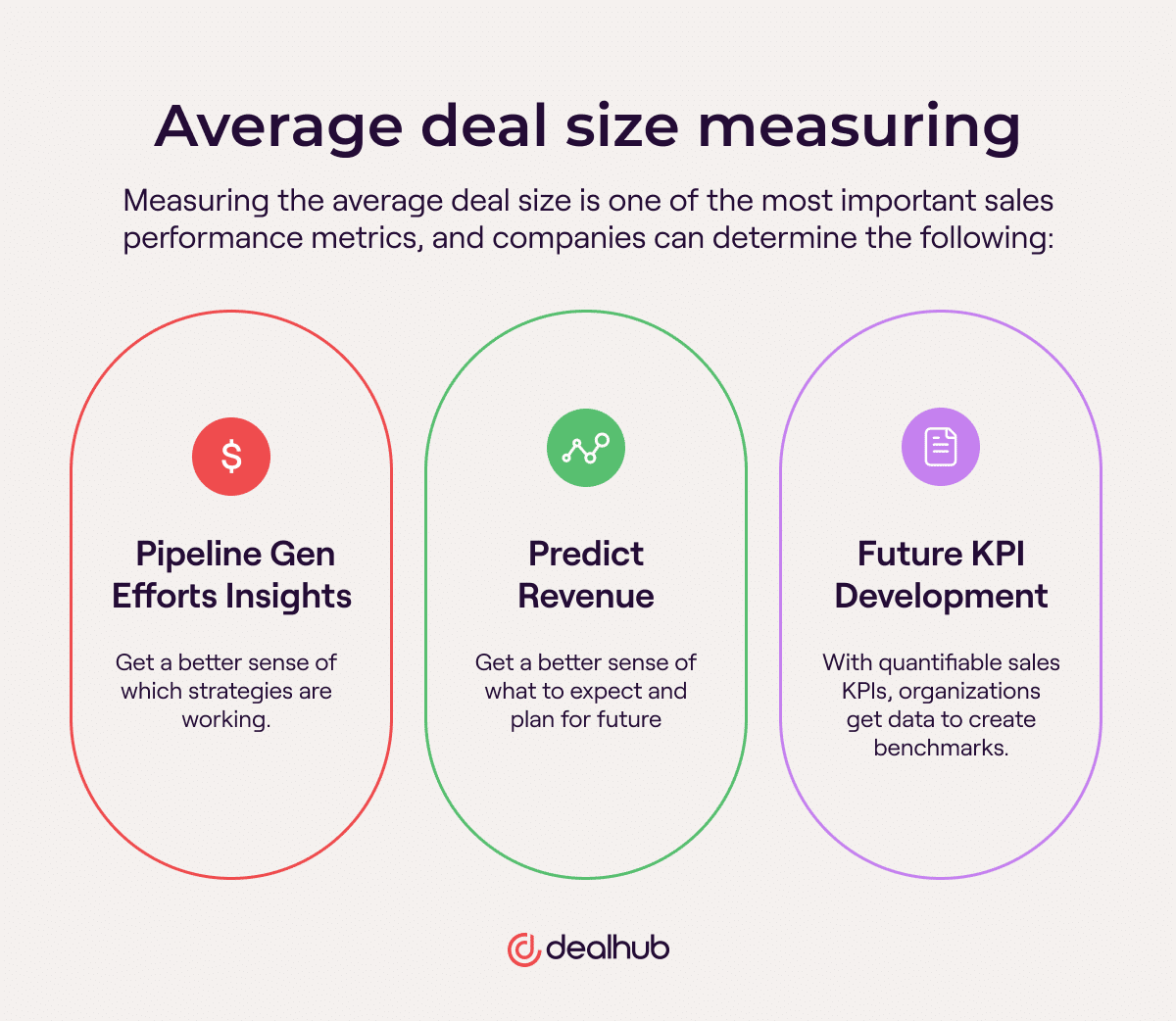

Importance of Measuring Average Deal Size

Average deal size is one of the most important sales performance metrics because it helps businesses understand their current performance and plan for future growth.

By evaluating average deal size, companies can determine what products are selling well, which customers drive the most sales revenue, and how much they make per sale.

Insights Into Pipeline Generation Efforts

The most essential use of average deal size is to measure the success of sales and marketing efforts.

By tracking this over time, companies can get a better sense of which strategies are working and which are not. If businesses want to fine tune their sales pipeline generation, average deal size can help them identify which tactics should be prioritized.

On an individual level, sales management can compare individual sellers’ average deal size to the team’s overall performance to identify areas for improvement.

Predict Revenue

Revenue forecasting is critical in budgeting and managing cash flow—it’s how businesses plan for expansions, investments, and other growth initiatives.

By analyzing sales history and averaging the size of deals, companies can get a better sense of what to expect from the current quarter and plan for future quarters.

Future KPI Development and Tracking

To come up with quantifiable sales KPIs, organizations need data to create benchmarks.

Average deal size tells sales managers and stakeholders how many deals need to be closed, what size they should be, and how much revenue can be expected to reach revenue targets.

Average Deal Size Formula

The formula for calculating average deal size is:

Average Deal Size = Total Value of Closed Won Opportunities / Number of Total Closed DealsFor example, if a company has closed 10 deals and five of them were $5,000 each and the other five were $10,000 each, then their average deal size would be ($50,000 + $100,000) / 10 = $7,500.

How to Increase Average Deal Size

Increasing average deal size is one way to increase sales and revenue. There are a few ways that companies can increase average deal size.

1. Sell value, not features

When companies sell prepackaged software, services, or products, they often undervalue them because they focus on the features rather than the value they bring to customers.

Instead of highlighting features, emphasize how these will help the customer reach their goals and objectives (e.g., more money, greater convenience, improved efficiency).

2. Cross-sell and upsell

Cross-selling involves selling complementary products or services to existing customers. Upselling customers is when a seller tries to persuade them to purchase a more expensive product during sales conversations.

By increasing the value and cost of what customers can buy, businesses can increase their average deal size. However, it’s important to only do this when there is a genuine value in the purchase.

3. Bundle your products and services

Bundling involves offering groups of items or services at a discounted rate, which is popular among companies that offer multiple complementary products.

Especially in the Software-as-a-Service (SaaS) space, where companies offer multiple product offerings for different types of customers, product bundling is one of the best ways to reach a revenue goal.

4. Set up an approval process for discounting

Sales discounting is a common tactic to get customers to buy, but it can also have a major impact on average deal size.

One study found that SaaS companies that discount their products see a decrease in customer lifetime value (LTV) by around 30%. Even though pricing often makes or breaks a deal, setting a process for when discounts are allowed can help increase the average deal size over time.

5. Prioritize annual contracts over monthly ones

A monthly contract usually results in a higher monthly recurring revenue (MRR), but it also comes with an inherent risk—customers can choose to stop the service anytime.

When possible, prioritize annual contracts, which will result in a larger upfront payment and, therefore, larger deals.

Technology to Improve Average Deal Size

Companies can use all kinds of tools to improve critical sales metrics, including average deal size.

Marketing Automation

Marketing automation tools allow companies to create automated campaigns that target the right customers at the right time.

These tools can be used to send personalized emails, texts, and other messages that pitch higher-priced products or services based on customer data.

Buyer Intent Software

Throughout the buying process, buyers research and compare different products.

By leveraging buyer intent software, sales teams can better understand the buying journey to identify qualified leads who are likely to purchase. This accelerates the sales process and helps close larger deals faster.

CRM

CRM software is useful for tracking customers through the sales funnel. Although this doesn’t directly equate to larger deal sizes, integration with marketing automation software can help sales reps craft more effective campaigns and focus on value-added selling and personalization—two tactics that can lead to larger and more frequent deals.

CPQ

Shorter sales cycles, higher customer satisfaction, and more accurate pricing estimates are just a few benefits that CPQ software can bring to companies looking to increase their average deal size.

By automating the configuration, pricing, and quoting process, CPQ software helps sales teams close bigger deals faster.

People Also Ask

What is a typical deal size?

The deal size a business can expect from a closed-won opportunity varies wildly based on the industry, company size, and many other factors. Enterprise deals can be worth millions, but SMBs can expect to close deals from a few hundred dollars up to several thousand.

How do you calculate average deal size?

Average deal size is calculated by dividing the total revenue from closed deals during a given period of time by the number of deals closed in that same period.