Accrued Revenue

Table of Contents

Multiple different kinds of revenue go on a company’s income statement.

How businesses recognize and report revenue depends largely on when and how it was earned or received. Accrued revenue differs from other types of income, as it represents revenue that has been earned but not yet received.

What is Accrued Revenue?

Accrued revenue is a type of income that has been earned but not yet received. It is reported as a current asset on the balance sheet under the assumption that the company will receive it in the near future, often within one year.

This approach to reporting revenues follows Generally Accepted Accounting Principles (GAAP) and gives investors a better understanding of the company’s financial health.

To illustrate, let’s consider an example.

A retail store is due to receive a payment from its suppliers for goods that have already been delivered.

The invoice is dated March 1, but the payment will not be received until April 15.

In this case, the accrued revenue is reported on the balance sheet as of March 1, even though the payment hasn’t been received yet.

This is why revenue recognition can sometimes be tricky—businesses must understand how to recognize and report revenue correctly, even when it hasn’t been paid yet.

By properly accounting for accrued revenues, businesses can ensure accuracy in their financial records and provide investors with transparent information about the company’s performance.

Synonyms

- Accrued Sales: The amount of revenue earned by a company but not yet collected, based on all sales-related revenue streams.

- Accrued Receivables: The amount of money a company is due to receive, but has yet to collect, from customers in exchange for goods or services already provided. This can include invoices that have been sent, but payment has not yet been received.

- Accounts Receivable: The amount of money a company is due to receive from customers that have purchased goods or services and are currently on credit terms.

Accrued Revenue and Cash Flow

It’s important to note that accrued revenue does not affect a company’s cash flow.

As mentioned earlier, it is reported as an asset on the balance sheet instead of revenue on the income statement. This means that a company can sometimes report higher revenue growth without actually receiving the cash.

Though it’s not ideal for most businesses, accrued revenue can temporarily bolster a company’s financial position until they receive the actual payments.

This could be done to secure additional financing or to meet short-term obligations (e.g., payroll or debt payments).

When Does Accrued Revenue Occur?

Accrued revenue is earned revenue (i.e., the company is entitled to receive it at some point in the future). Unearned revenue is revenue that will be accrued as soon as services or goods are provided to the end customer.

Generally, companies should recognize accrued revenue when they have performed the services they were obligated to do or delivered the goods they agreed to provide.

This means that if a company has already provided its services or products and the customer is only waiting to pay for them, it can report this as an accrued revenue on its balance sheet.

Accrued revenue can also occur when a company is still obligated to provide services or goods but has not yet done so. This could be the case when a customer orders products from a company and makes payment upfront, even though the products have not been delivered yet. In this situation, the company can recognize the revenue as accrued revenue on its balance sheet.

For service contracts that operate under ASC 606 guidelines, accrued revenue occurs once all contract obligations have been met, not when an invoice is sent or payment is received.

Accrued Revenue Criteria

How a business accrues revenue sometimes depends on the company and its specific revenue streams.

Some companies may use “accrual accounting” to recognize and report revenue, while others use different criteria such as customer credit terms, invoice payment records, and delivery notes.

When properly recognizing accrued revenue, there are several key criteria that businesses should consider:

- Delivery Notes: Companies must keep accurate records of all the goods that have been delivered (e.g., number of items, date of delivery). For Software-as-a-Service (SaaS) companies, digital agencies, and other businesses that don’t sell tangible goods, delivery notes may include installation, administration, and usage records.

- Invoice Records: Organizations should maintain accurate records of all invoices sent, including any payment terms and deadlines. Most accounting and bookkeeping tools keep records of invoices automatically, so businesses using accounting software don’t have to worry too much about this.

- Customer Credit Terms: Understanding a customer’s credit terms is essential for proper revenue recognition. Companies should be familiar with the payment schedule and any sales discounts or deductions that may be taken.

Each of these systems helps businesses recognize and report accrued revenue, whether it is from goods or services that have already been delivered or goods and services that will be delivered in the future.

Revenue Recognition Principle

The revenue recognition principle is the gold standard for revenue recognition. It states that revenue should be recognized when it is earned, not when they receive cash or send an invoice.

In practice, this means that businesses should recognize their accrued revenues when they have earned them, regardless of when any money is physically received.

The reason companies need to report revenue this way is to ensure that the reported financial results provide an accurate representation of a company’s monthly revenue generation.

If companies could recognize their revenues based solely on when invoices were sent or payments were received, this wouldn’t accurately reflect the total value of a company’s performance.

For example, if a business sent out an invoice for services provided in March but didn’t receive payment until April, reporting the revenue in April wouldn’t accurately reflect the performance of the business for that month.

How to Record Accrued Revenue

The key to recording accrued revenue is to ensure that all criteria for recognizing it have been met.

This means making sure that the goods or services have been delivered, any invoices sent out have been tracked, and any customer credit terms are understood.

To capture accrued income with cash basis accounting, you must debit it on the balance sheet under current assets as an adjusting journal entry.

Your income statement will reflect the accrued revenue as “earned revenue” and will be recorded in the revenue account as an adjusted entry after you receive payment.

Аccrued Revenue vs. Deferred Revenue

Accrued revenue and deferred revenue are both important concepts when it comes to managing a company’s finances. While they are related, they are also opposites.

Accrued revenue is income that has been earned but not yet received in cash or recorded on an invoice. This can happen if goods or services have been delivered, but invoices have not been sent out.

Deferred revenue, on the other hand, is income received from sales transactions but not yet earned by delivering goods or services.

This typically happens when customers pay for products before they are delivered. The funds received are then recorded as deferred revenue until the goods or services have been delivered and the income can be recognized as revenue.

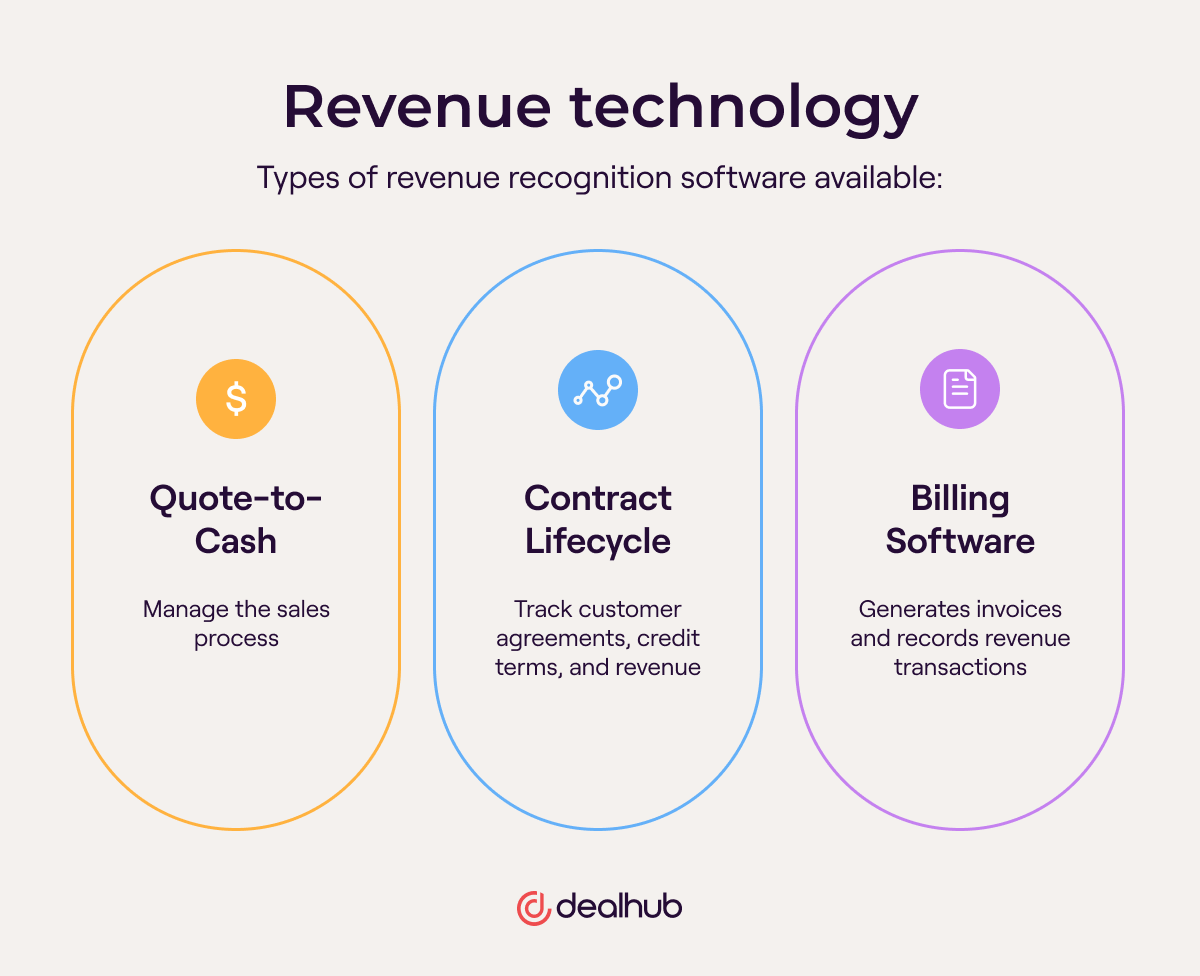

Revenue Recognition Technology

Revenue recognition automation involves the use of business software to streamline the revenue recognition process.

This software helps businesses track contract information and customer credit terms, generate invoices, record revenue records adjustments, and accurately report their financial results.

There are a few different types of revenue recognition software available, including:

- Quote-to-Cash: Quote-to-cash tools help businesses manage the sales process from generating quotes to receiving payments.

- Contract Lifecycle Management: Contract management software helps businesses track customer agreements, credit terms, and revenue recognition adjustments made to their financial statements.

- Billing Software: Billing software generates invoices and records revenue transactions. DealHub’s billing platform provides automated invoicing and revenue recognition adjustment features that can help businesses save time and money.

Technology plays a critical role in an organization’s ability to record revenue correctly. Since accounting and bookkeeping are cumbersome processes, automation is essential for businesses to accurately report their financial results.

People Also Ask

What is an example of accrued revenue?

Accrued revenue is income that has been earned but not yet received in cash or recorded on an invoice. For example, a digital marketing agency that completes its contracted work with a client in February but receives payment in March would record the revenue as accrued in February and then as cash received in March.

Is accrued revenue an expense?

Accrued revenue is a form of income, not an expense. It is money that has been earned but not yet received in cash or recorded on an invoice.

Is accrued revenue an asset?

Accrued revenue is revenue that wouldn’t otherwise show up in the general ledger. At the end of an accounting period, the receiving company (i.e., the product or service provider) records accrued revenue as an asset. However, the company using the product or service will record it as an accrued expense, which is a liability.

What is the journal entry for accrued revenue?

Regarding accrued revenues, revenue journal entries require a credit to the revenue account with a corresponding debit to accrued revenue.

Are accrued revenues on income statements?

The income statement records accrued revenues as “earned revenue.” This means the revenue has been earned but not yet received. The amount is reported in the current period as an adjusting entry to accurately record all revenues.