Therefore, businesses need a robust subscription billing platform that can overcome challenges and capitalize on the benefits of subscription-based models. Such a platform simplifies billing operations, improves cash flow, increases customer satisfaction, and enables data-driven decision-making. In this article, we’ll explore the four essential features that the best subscription billing platform should have to ensure success.

How a subscription billing platform builds recurring revenue

Before we delve into the key features a platform must have, let’s review how a subscription billing platform assists in the process of building recurring revenue.

First and foremost, it automates the billing process, saving valuable time and resources. With automated invoicing, businesses can generate accurate and timely invoices for various recurring billing models, including:

- Flat-rate pricing

- Tiered pricing

- Usage-based, and

- Freemium models

The best subscription billing platforms also reduce errors significantly compared to manual invoicing. Imagine the time and effort saved when your invoices are generated automatically. Once automation is in play, sales teams can eliminate manual errors and delays. With a billing and subscription management platform that supports automated invoicing, you can streamline your billing process, enhance accuracy, and promptly send invoices to customers. This not only saves valuable time – it also strengthens cash flow by expediting the payment collection process.

In addition to automating invoicing, a subscription billing platform provides a centralized system for managing customer subscriptions. It enables businesses to track and monitor subscriptions and renewals, upgrade or downgrade plans, and seamlessly manage cancellations. When your sales team has a clear overview of your customer base and subscription status, they can proactively engage with clients, address their needs, and optimize revenue opportunities.

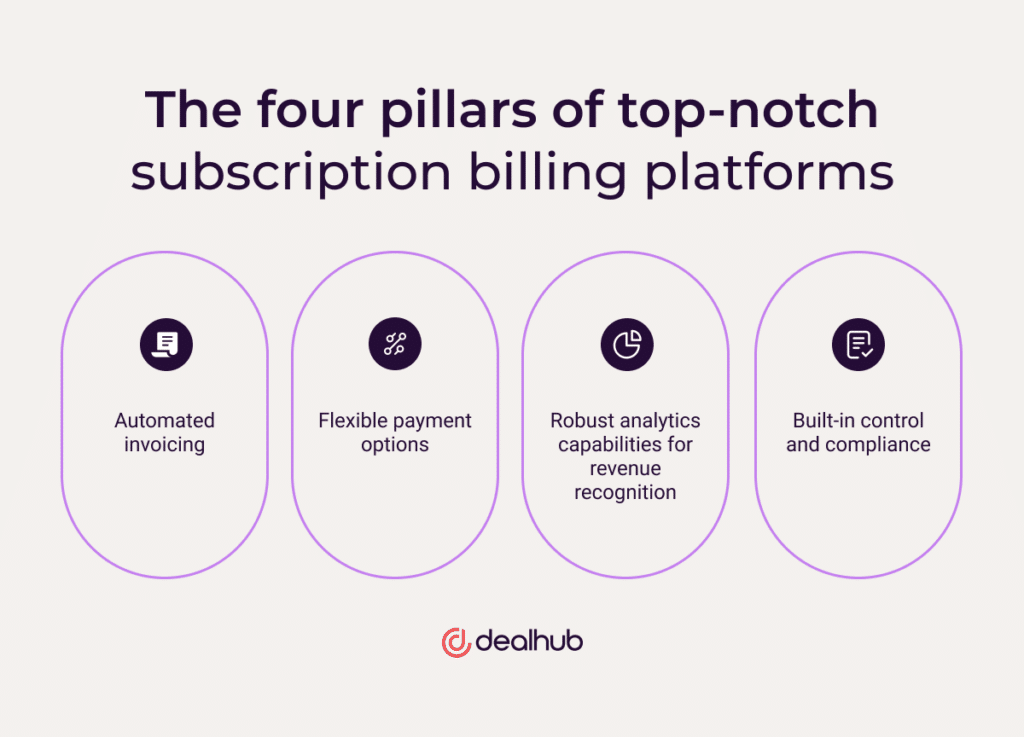

The best subscription billing platforms have these 4 features

The best subscription billing platforms are designed to address the unique challenges businesses face in managing recurring revenue models. Let’s take a closer look at how key features of software subscription billing solutions can solve these challenges and deliver substantial benefits via these four essential features.

1. Automated invoicing

Manual invoicing that relies on a salesperson actioning items and handling admin is time-consuming, error-prone, and causes delays. On the other hand, a subscription billing and recurring billing platform automate the entire invoicing process to ensure accurate and timely delivery of invoices. Whether you have a large customer base or a complex billing structure, automated invoicing saves sales representatives from the tedious tasks of manually generating and sending invoices.

Furthermore, automated invoicing is more flexible since it supports a variety of recurring billing models. Whether you charge a flat rate for your services, have tiered pricing based on usage or features, offer a freemium model, or any combination thereof, a robust subscription billing and recurring billing platform can handle it effortlessly. It adapts to your billing needs, generating invoices aligning with your pricing structure.

By automating invoicing, businesses benefit from improved cash flow. Prompt and accurate invoicing means faster payment collection, reducing the time between generating an invoice and receiving payment. This accelerated cash flow positively impacts a business’s income while allowing the company to allocate resources effectively and invest in growth initiatives.

2. Flexible payment options

In today’s digital landscape, customers expect a business to provide them with options when it comes to payment. A subscription billing and recurring billing platform offering diverse payment methods align with client expectations, enhancing customer satisfaction and reducing churn.

With more flexible payment options, businesses can accommodate many customer preferences simultaneously and give them a sense of control. That’s why your SaaS subscription billing platform should support a range of payment methods. By giving them the freedom to pay with credit cards, digital wallets, or bank transfers, customers can arrange payment in a way that’s comfortable for them. And, by offering the payment methods customers already use and trust, you remove any barriers to subscription adoption and retention.

A subscription billing platform should support recurring payments, allowing customers to set up automatic payments. This feature ensures a seamless and hassle-free payment experience, reducing the risk of payment failures due to expired cards or forgotten manual payments. That way, businesses can maintain a steady revenue stream and improve customer retention rates by simply streamlining the payment process.

3. Robust analytics capabilities for revenue recognition

Businesses need to harness the power of data to maximize the potential of a subscription-based model. A SaaS subscription billing platform with strong analytics capabilities empowers businesses to act based on actionable insights into customer behavior, subscription trends, and revenue metrics.

Businesses can gain a profound understanding of their customer base by collecting and analyzing data on customer usage, preferences, and engagement. This knowledge enables a company to further develop its service or cater its offerings to align with client expectations. It also provides insights that lead to more targeted marketing efforts, personalized offerings, and effective customer retention strategies. For example, if the analytics reveal that a particular group of customers is underutilizing certain features, businesses can develop targeted campaigns to encourage feature adoption and upsell opportunities.

Robust analytics capabilities aid in accurate revenue recognition as well. By tracking and analyzing revenue data in real time, businesses can ensure compliance with accounting standards and regulations. This level of financial transparency instills customer trust and safeguards businesses from potential legal and financial implications.

The best part: analytics-driven insights optimize pricing strategies and identify areas of revenue leakage. By identifying trends, patterns, and anomalies in the data, companies can adjust their pricing tiers, introduce new plans, or implement targeted promotions to drive revenue growth. These data-driven decisions are crucial to staying ahead of the competition and maximizing the value of the subscription-based model.

4. Built-in control and compliance

Effectively managing subscription billing requires control and compliance. A reliable subscription billing platform should allow businesses to quickly set up and manage their billing processes across all departments. Look for features that enable you to define pricing structures, manage subscriptions, apply for discounts or promotions, and configure billing cycles effortlessly.

Moreover, compliance with industry regulations is vital for businesses operating in subscription models. Ensure your SaaS subscription billing platform adheres to industry standards, such as GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard). Any platform you choose should provide robust security measures to protect sensitive customer information to protect both a client’s data privacy and your organization’s regulatory compliance.

Comparing subscription billing platforms

When handling a subscription billing platform comparison, it’s essential to consider a few critical factors in order to make an informed decision:

- Ease of use: A user-friendly interface and intuitive navigation are crucial for maximizing productivity across the sales team and minimizing training time when onboarding. Choose a platform that can efficiently manage and automate your billing operations without requiring extensive technical expertise.

- Integrations: Evaluate the platform’s integration capabilities with your existing systems, such as CRM (Customer Relationship Management) and accounting software. Seamless integration ensures a smooth flow of data and reduces manual effort.

- Implementation time: When it comes to sales, time is of the essence, and a lengthy implementation process can disrupt operations. Opt for a billing and subscription management platform that offers a quick and straightforward implementation, allowing sales teams to start generating revenue without unnecessary delays.

- A low-code solution: Look for a platform that can customize options through a low-code approach. This allows you to adjust the platform to your business needs and make changes without relying heavily on technical resources or coding expertise.

Conclusion

When managing subscription billing, it is crucial for businesses to embrace subscription-based models. This approach will help drive sales and increase efficiencies. However, before jumping in, it’s important to take time at the outset to run a subscription billing platform comparison, do a POC, and zero-in on features that will make setup and adoption a snap.

In the long run, a billing and subscription management platform becomes invaluable by automating invoicing, offering flexible payment options, and providing robust analytics capabilities. The key features of software subscription billing enhance cash flow, increase customer satisfaction, and enable data-driven decision-making, paving the way for sustainable growth and long-term success.

When comparing platforms, consider factors such as ease of use, integration capabilities, implementation time, and low-code design to find the perfect fit. Once you embrace the power of a subscription billing platform, you’ll unlock the full potential of your subscription-based model. That doesn’t just make your sales teams more efficient over time – it makes it possible to incrementally grow sales and continuously adapt to changing market expectations.