Flexible Pricing

Table of Contents

What is Flexible Pricing?

Flexible pricing is a strategy that allows businesses to change their prices in response to changes in demand or other market conditions or as a result of negotiation between buyers and sellers. This type of pricing can help businesses maximize their profits and avoid losses during periods of low demand.

Flexible pricing can also help companies to compete more effectively by responding to changes in their competitors’ prices.

There are a few ways businesses can use flexible pricing. Some companies may choose to offer discounts or promotions in response to changes in the market. Others may raise or lower their prices based on the current demand for their products or services. The evolution of digital pricing strategies and technology enables companies to use this pricing strategy to grow revenue.

Synonyms

- Dynamic pricing

- Market-based pricing

- Differential pricing

- Negotiable pricing

- Intelligent pricing

- Price optimization

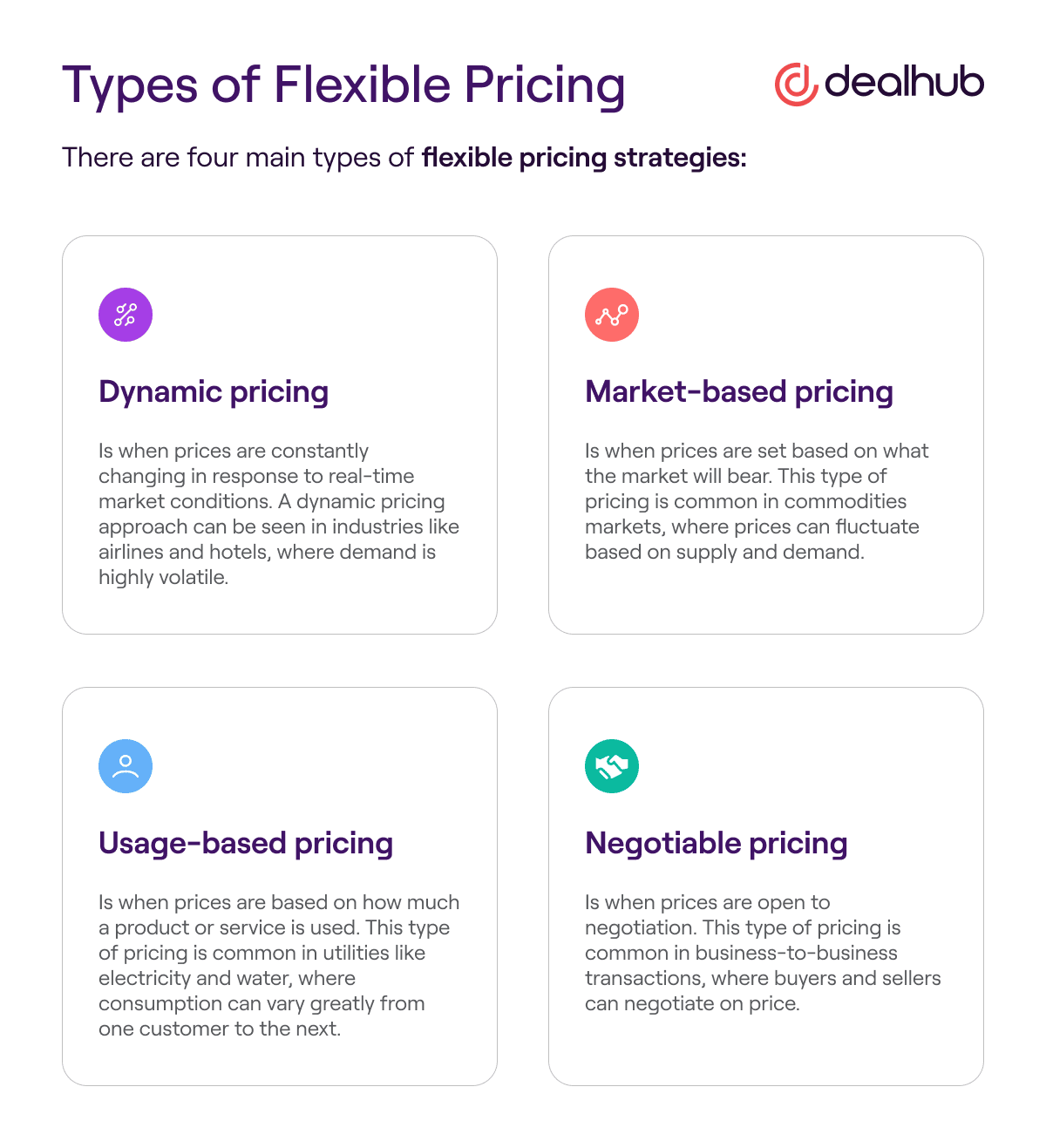

Types of Flexible Pricing

There are four main types of flexible pricing strategies: dynamic, market-based, usage-based, and negotiable.

- Dynamic pricing is when prices are constantly changing in response to real-time market conditions. A dynamic pricing approach can be seen in industries like airlines and hotels, where demand is highly volatile.

- Market-based pricing is when prices are set based on what the market will bear. This type of pricing is common in commodities markets, where prices can fluctuate based on supply and demand.

- Usage-based pricing is when prices are based on how much a product or service is used. This type of pricing is common in utilities like electricity and water, where consumption can vary greatly from one customer to the next.

- Negotiable pricing is when prices are open to negotiation. This type of pricing is common in business-to-business transactions, where buyers and sellers can negotiate on price.

While there are four main types of flexible pricing, there are many variations and permutations. For example, some companies use a combination of two or more flexible pricing models to best suit their needs.

And as technology advances, new types of flexible pricing models will surely emerge. However, no matter what flexible pricing model a company uses, the goal is always to optimize revenue and profit by responding to market conditions in real time. With the right strategy in place, flexible pricing can be a powerful tool for any business.

Flexible Pricing Examples

Flexible pricing enables companies to charge different prices for the same products or services based on factors like time, location, or customer.

For example, a business might charge higher prices during peak hours or lower prices for customers who book in advance.

Flexible pricing can be a great way to increase revenue and profits while still providing value to customers.

Other examples of flexible pricing include:

- Offering discounts for bulk purchases

- Charging different prices based on customer type (e.g. businesses vs. individuals)

- Offering discounts for loyalty or repeat business

- Introducing seasonal pricing (e.g. charging more in the summer)

- Offering discounts for paying in cash

Advantages of Flexible Pricing

There are many benefits of flexible pricing, which is why it is becoming increasingly popular among businesses. Flexible pricing allows businesses to better match their prices to what the market is willing to pay, rather than sticking to a set price point.

This can help maximize sales and profits and ensure that customers are getting good value for money. Flexible pricing can also help businesses respond quickly to market changes, such as sudden increases or decreases in demand. This can make it easier to maintain a healthy bottom line and ensure that customers always have access to the products and services they need.

Let’s look at the advantages and disadvantages of this pricing strategy for sellers and customers.

Advantages for Sellers

There are several advantages of implementing intelligent pricing built into an ERP or CRM platform.

- First, it allows businesses to respond quickly to demand or market conditions.

- Second, it helps stimulate demand by keeping the price competitive.

- Third, a flexible pricing policy can help businesses to better manage inventory levels and optimize revenue.

- Finally, a flexible pricing model can help to build customer loyalty by providing customers with the option to purchase items at a lower price point if they are willing to wait for a specific time period.

Advantages for Customers

The main benefit of this pricing method for customers who are price sensitive is that it maximizes value due by reducing costs or paying for only what they use. Additionally, flexible pricing models often come with additional benefits, such as discounts or freebies, that can further enhance the value proposition for customers.

Disadvantages of Flexible Pricing

Disadvantages for Sellers

Flexible pricing models can be disadvantageous for sellers for many reasons.

- First, predicting the final selling price can be difficult, making it challenging to budget and forecast revenue accurately.

- Second, flexible pricing models can lead to price wars between sellers, eroding profits.

- Third, buyers may be hesitant to purchase from a seller who uses a flexible pricing model, as they may perceive that the seller is not committed to a set price.

- Finally, businesses may have difficulty managing their cash flow if they constantly change their prices.

Disadvantages for Customers

Flexible pricing models can be disadvantages for customers for a few reasons.

- First, if prices constantly change, it can be difficult to budget or predict costs.

- Second, some customers may feel they are being taken advantage of if they buy something when the price is high and then see the price drop soon after.

- Finally, if prices are too volatile, it can discourage customers from buying altogether. While there may be some advantages to flexible pricing for businesses, such as being able to respond to market demand or taking advantage of short-term spikes in interest, ultimately, it is the customer that has to decide whether the disadvantages outweigh the advantages.

Technology to Enable Flexible Pricing

Flexible pricing is an emerging strategy that uses technology to adjust prices dynamically in response to market forces. This can be done in real-time or near-real-time, making it a highly effective way to set competitive pricing to maximize revenue and profits.

Several technologies enable businesses to implement a flexible price policy, including demand forecasting, price optimization, competitive price monitoring, and dynamic pricing algorithms. In addition, CRM and CPQ help businesses customize prices and create accurate quotes based on complex pricing models. By harnessing the power of these technologies, companies can stay ahead of the competition and seize new opportunities in the market.

People Also Ask

What is the difference between fixed pricing and flexible pricing?

When it comes to setting prices for goods and services, businesses have two main options: fixed pricing and flexible pricing. As the names suggest, fixed pricing (or sticky pricing) involves setting a single, unchanging price for a product or service. In contrast, flexible pricing allows businesses to adjust their prices in response to changes in supply and demand.

Why is it important to have flexible prices?

There are many reasons why businesses may implement a flexible pricing strategy if it suits the company’s business model. First, adjusting prices based on demand ensures businesses provide the best deal value while maximizing their profits. Second, flexible prices also allow businesses to compete better in the market, as they can adjust their prices to match or beat their competitors.

Finally, flexible prices give businesses the ability to respond to changes in the market quickly and effectively, which can be crucial in today’s ever-changing economy.