CROs and CFOs are currently encountering a myriad of challenges and hurdles in the realm of revenue management. One major issue they face is the lack of visibility into comprehensive revenue data. Without access to accurate and real-time information, it becomes difficult for CFOs and CROs to make informed decisions and identify emerging trends.

The absence of a centralized and transparent system for tracking revenue can hinder their ability to analyze the performance of different revenue streams, product lines, or market segments. This lack of visibility can lead to missed opportunities for optimization and growth. It also makes it challenging to identify potential issues or bottlenecks within the revenue generation process.

Furthermore, the inability to effectively track and analyze revenue trends can limit the ability of CFOs and CROs to forecast and plan for the future. Without a clear understanding of revenue patterns and drivers, it becomes challenging to set realistic targets, allocate resources effectively, and make strategic investments.

To overcome these challenges, CROs and CFOs are increasingly seeking solutions that provide comprehensive visibility into revenue data. They are looking for advanced analytics tools and robust reporting capabilities that can provide real-time insights and enable them to identify trends and patterns. By leveraging such technologies, CROs and CFOs can make data-driven decisions, optimize revenue streams, and drive sustainable growth for their organizations.

Revenue tech stack trends and stats

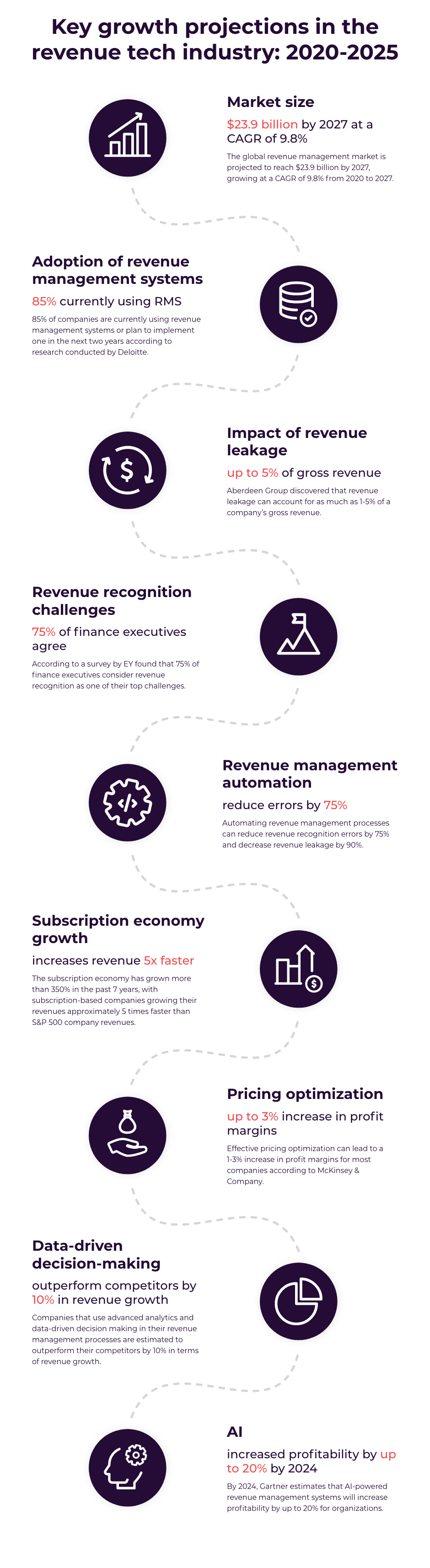

Revenue tech stack trends and stats refer to the latest developments and statistics in the world of technology solutions designed to optimize revenue generation and management processes. These trends and stats have a significant impact on financial leaders, including CFOs and CROs, as they seek to improve revenue outcomes and drive financial performance. Here are some key trends and stats to pay attention to and their impact:

Adoption of Revenue Operations (RevOps): Organizations are increasingly adopting a RevOps approach, which focuses on aligning sales, finance, and customer success teams to streamline revenue generation processes. This trend impacts financial leaders as it requires collaboration and integration across departments, leading to better visibility into revenue data and improved coordination in achieving revenue goals.

Rise of sales engagement platforms: Sales engagement platforms are gaining prominence as they enable sales teams to automate and personalize outreach to prospects and customers. These platforms provide valuable insights into buyer behavior and help optimize sales processes. Financial leaders benefit from the increased efficiency and effectiveness of sales teams, leading to improved revenue outcomes.

Emphasis on revenue intelligence: Revenue intelligence platforms leverage artificial intelligence and analytics to analyze customer interactions, identify buying signals, and deliver actionable insights. Financial leaders can leverage this technology to gain a deeper understanding of customer behavior, optimize pricing strategies, and identify upsell and cross-sell opportunities, ultimately driving revenue growth.

Focus on customer experience (CX): Customer experience has a direct impact on revenue, and organizations are investing in technology solutions that enhance CX. Financial leaders recognize the importance of delivering exceptional customer experiences to drive repeat business and customer loyalty, which ultimately impacts revenue generation and long-term financial success.

Integration of CRM and billing automation: Integration between customer relationship management (CRM) systems and billing automation platforms is becoming increasingly important. This integration allows for seamless data flow and improved lead management, enabling financial leaders to gain a holistic view of customer interactions and marketing ROI, leading to better decision-making and revenue optimization.

These revenue tech stack trends and stats highlight the growing importance of technology solutions in driving revenue growth and improving financial outcomes. Financial leaders who embrace these trends and leverage the right technologies can gain a competitive advantage, enhance revenue performance, and drive sustainable business growth.

These statistics highlight the growing significance of revenue management and the potential impact it can have on a company’s financial performance and growth. Staying informed about these trends can help businesses make informed decisions and leverage revenue technology to optimize their revenue streams.

Best practices for building a model for successful revenue management

Building a successful model for revenue management requires implementing best practices that can drive growth and optimize financial performance. Here are the top 5 best practices to consider:

-

Establish Clear Revenue Goals: Define specific revenue targets aligned with your business objectives. Set measurable and achievable goals that consider market conditions, industry benchmarks, and growth projections.

-

Implement robust data analytics: Leverage advanced data analytics tools and technologies to gain valuable insights into your revenue streams. Analyze historical data, customer behavior, market trends, and other relevant factors to make informed decisions and identify growth opportunities.

-

Continuously monitor and optimize pricing: Regularly review and adjust pricing strategies based on market dynamics, customer preferences, and competitive landscape. Consider dynamic pricing models, segmentation, and value-based pricing to optimize revenue generation.

-

Continuously monitor and optimize pricing: Regularly review and adjust pricing strategies based on market dynamics, customer preferences, and competitive landscape. Consider dynamic pricing models, segmentation, and value-based pricing to optimize revenue generation.

-

Embrace revenue management technology: Invest in advanced revenue management software and tools that automate processes, enhance data accuracy, and provide real-time visibility into key metrics. Leverage technology to streamline revenue operations, improve forecasting accuracy, and enable data-driven decision-making.

By following these best practices, businesses can establish a solid foundation for revenue management and increase their chances of achieving sustainable growth and profitability.

How to grow revenue with a unified RevOps – FinOps tech stack

Growing revenue with a unified Revenue Operations (RevOps) and Financial Operations (FinOps) tech stack requires a strategic approach.

A unified RevOps and FinOps tech stack can significantly enhance revenue generation for organizations by providing a centralized and streamlined view of revenue data. This consolidated data allows for the identification of trends and the monitoring of performance, enabling informed decision-making.

Furthermore, a unified tech stack offers automation and optimization capabilities, freeing up valuable time to focus on strategic initiatives. It facilitates revenue operations by enhancing visibility into revenue data, enabling trend identification, performance tracking, and facilitating better business decisions. Additionally, it enhances the customer experience by providing a seamless and consistent journey across various channels. Integrated e-commerce platforms, online payment systems, and mobile apps create an intuitive and user-friendly experience, reducing friction and eliminating barriers to purchase.

The benefits of a unified tech stack extend to cost reduction as well, as it eliminates the need for multiple disparate systems. By consolidating operations into a single platform, organizations can achieve greater efficiency and cost savings. A connected revenue tech stack is that it improves data integration and visibility. If you integrate different revenue management systems, like CRM, enterprise resource planning (ERP), and pricing software, you can get a holistic view of your revenue-related data.

This integration also allows for seamless data flow, provides a comprehensive understanding of customer behavior, pricing trends, demand patterns, and market dynamics, and eliminates data silos.

Overall, a unified RevOps – FinOps tech stack empowers organizations to drive revenue growth through improved visibility, enhanced customer experience, and optimized operational efficiency.

Challenges of implementing and adopting revenue tech stack

Implementing a unified tech stack doesn’t come without its challenges.

Integration complexity is one such challenge. Integrating multiple systems and technologies into a cohesive revenue tech stack can be complex and time-consuming. It requires careful planning, data mapping, and coordination between different teams and departments. Compatibility issues, data inconsistencies, and technical complexities may arise during the integration process.

Data quality and consistency is another. Implementing a revenue tech stack relies heavily on accurate and consistent data. Organizations may face challenges in ensuring data quality, completeness, and integrity across various systems and sources. Data discrepancies and errors can hinder the effectiveness of the tech stack and impact decision-making.

Added to that is the resistance to change. Adopting a new revenue tech stack often involves changes in processes, workflows, and technologies. Resistance to change from employees and stakeholders can pose challenges during implementation. Overcoming resistance and gaining buy-in from teams requires effective communication, training, and demonstrating the benefits of the new system.

Another one to add to the list is scalability and flexibility. As organizations grow and evolve, their revenue tech stack should be able to scale and adapt to changing needs. Choosing a tech stack that is flexible, modular, and capable of accommodating future growth is essential. Ensuring that the tech stack can integrate with new technologies and support evolving business requirements is critical for long-term success.

Revenue tech stack essentials

Let’s dive in and explore the must-haves for driving revenue growth in today’s digital landscape.

First up, we have the Customer Relationship Management (CRM) system. This powerhouse serves as the backbone of your revenue tech stack, giving you a centralized hub to manage customer information, sales opportunities, and interactions.

Next, let’s talk about sales engagement and productivity tools. These handy helpers are designed to make your sales team’s life easier by automating tasks, boosting productivity, and providing valuable insights. Think email automation, sales dialers, meeting schedulers, and analytics platforms.

But we can’t forget about sales enablement tools! They equip your sales team with the resources, content, and training they need to engage prospects effectively and seal the deal. Sales playbooks, content management systems, and training platforms are some examples.

Now, let’s zoom in on the Configure, Price, Quote (CPQ) software. This nifty tool simplifies the quoting and proposal process, ensuring accurate and customized quotes in a flash. It’s a game-changer for minimizing errors and speeding up the sales cycle.

Analytics enthusiasts, listen up! Revenue analytics and business intelligence tools are here to provide you with invaluable insights into sales performance, revenue metrics, and customer behavior. With these tools, you can identify trends, optimize pricing strategies, and make data-informed decisions.

Marketing automation tools are another crucial component of the revenue tech stack. They help you generate and nurture leads, run effective marketing campaigns, and align your marketing and sales efforts seamlessly.

Of course, we can’t neglect the financial side of revenue management. Billing and invoicing systems step in to streamline recurring billing, subscription management, and revenue recognition processes.

To keep everything running smoothly, integration and data management tools are essential. They ensure that your various revenue tech stack components work together seamlessly and maintain data quality, consistency, and compliance.

Let’s not forget about customer success and support! With the right tools, you can manage customer relationships, track success metrics, and provide top-notch support throughout the entire customer journey.

Lastly, API and integration frameworks tie it all together, enabling connectivity and interoperability with other critical systems in your organization.

Remember, the specific tools and technologies in your revenue tech stack may vary depending on your industry, company size, and unique needs. But armed with these essentials, you’ll be well on your way to driving revenue growth and achieving success in the digital realm.

How to thrive in the new sales environment

Optimize your RevOps platform

RevOps (Revenue Operations) is an important strategy that aligns finance, sales, and customer success teams to drive revenue growth. If you are looking to optimize your RevOps platform, it is best to focus on data integration, sales process automation, and analytics and reporting.

For instance, data integration can ensure seamless data flow across different systems, allowing for better visibility and data-driven decision-making.

Unify your revenue tech stack

Unifying your revenue tech stack is another key part of the process and involves integrating and aligning your sales, marketing, and customer success tools. You should evaluate your current tech stack, consolidate redundant tools, and choose integrated solutions that make sense for your business.

Ensure smooth and seamless data flow between different tools and departments through APIs and integrations.

Measure and adjust

Continuous measurement, improvement, and adjustment are essential for success. Define key performance indicators that align with revenue goals and objectives and regularly track them.

Use the data collected through your RevOps platform and revenue tech stack to identify trends, gain insights, and make data-driven decisions. Embrace experimentation, test new sales approaches, and be open to trying new technologies and methodologies.