Introduction

In recent years, in the midst of an uncertain global economy, the software industry continues to thrive thanks to a massive acceleration in the digital transformation of nearly every industry.

This extended to Sales and Revenue Operations teams who continue to seek out new and more efficient ways to accelerate revenue and close deals. For them, quick and easy implementation of best-in-class solutions and automated processes means less revenue leakage, better pricing management, less manual overhead, and quicker revenue expansion.

This benchmark report, created in partnership between DealHub and Pavilion, gathers industry data from some of the leading practitioners in B2B revenue execution. It can be used as a basis of comparison for your organization’s tech stack, pricing strategies, and business outcomes.

DealHub works with some of the most exciting technology companies in the world, and has enriched this report with additional insights from their data lab.

Summary of Key Insights

1. Connecting the sales stack is a priority

- Companies with consolidated tech stacks spend less annually per rep on sales tools.

- Revenue operations is key to optimizing the buying process.

- Common barriers to adopting critical pricing software include onboarding complexity, time-to-go-live, and time-to-value.

2. Price quote automation is critical to revenue optimization

- 33% of sales reps have the autonomy to provide discounts, yet 80% are not very confident about their margins.

- Global companies and those with extensive product catalogs use CPQ-guided selling to onboard sales reps, manage price quote complexity, and reduce revenue leakage.

3. Subscription revenue is poorly managed

- Pricing and plan changes, as well as contract consolidation, are key challenges to subscription management and auto-renewals.

- Without CPQ integration, subscription-based companies are susceptible to revenue leakage and error-prone manual processes.

4. Timing can make or break a deal

- Guided selling reduces the time-to-send for sales proposals. For example, 95% of SMBs with a CPQ can send a proposal within an hour, compared to 56% of those without a CPQ.

- Leveraging a CPQ significantly increases the success rate for quotes and proposals, and accelerates time-to-closed-won.

State of the Sales Stack

A majority of sales reps use fewer than 11 sales tools

More than 1,000 sales tools are featured in the Sales Technology Landscape, meaning that buyers have an overwhelming array of options for supporting their sales teams with the technology to close more deals.

However, 89% of surveyed companies report using fewer than 11 sales tools. This suggests that the majority are choosing to consolidate sales spend and focus on connecting their stack through buying tools that serve multiple functions.

Tech consolidation is crucial because it decreases training and implementation time for sales reps and admins while reducing costs. In addition, a connected sales stack streamlines the processes for every business user.

Revenue Operations helps maintain an efficient sales stack

Companies with 11-20 sales reps spend an annual average of $1,417 per rep on sales tools, which is lower than any other group we surveyed. This means that a company with 16 sales reps would pay around $23,000 for their sales stack, which is considered highly cost-effective.

This efficiency is often attributed to the practice of hiring a Revenue Operations practitioner once a team surpasses 10 sales reps.

Revenue Operations is responsible for the selection and management of sales technologies. As companies grow, managing the sales stack becomes more complicated – not only due to the need to acquire more tools, but also to keep those tools connected.

Larger companies regain control of their stack

As seen in Figure 2, companies with more than 100 sales reps spend an annual average of $1,850 per rep on sales tools, compared to $2,068 for companies with 51-100 reps.

As a company grows beyond 100 sales reps, the CFO or procurement manager may encourage operations teams to consolidate sales stack spend by eliminating legacy tools.

Investing in a single platform instead of using separate solutions enables the bundling of mission-critical sales tools. But this is only viable if the platform meets best-in-class criteria and demonstrates robust scalability.

If such is the case, the immediate benefit is cost consolidation and greater ease of use.

Contract lifecycle management is an afterthought

86% of companies surveyed do not use Contract Lifecycle Management (CLM) software.

CLM software features include: creating the contract, adding it to a complete proposal, managing changes throughout the negotiating process, and signing finalized agreements.

When this software is not deployed, sales reps need to create contracts manually, attempt to track versions, redline via email with internal and external stakeholders, and manually update the CRM after every change in the contract.

This dramatically increases the duration of the buying cycle, thereby increasing time-to-revenue.

Onboarding complexity is a barrier to adopting price quote software

28% of surveyed companies say onboarding complexity is the biggest barrier to adoption for the following software tools: Sales Proposals, Configure Price Quote (CPQ), Document Generation, Contract Lifecycle Management (CLM) and Subscription Management. Among the surveyed companies, only 4% have deployed all five of these solutions.

Sales tools that are purchased separately require separate implementation and adoption by Revenue Operations and by each sales rep. In contrast, sales tools that fulfill multiple functions require just one period of implementation and education – thus dramatically simplifying the onboarding process.

DealHub delivers all of the above tools as part of one revenue platform, setting a 100% sales adoption rate as the standard. DealHub is easy to use, quick to implement, and includes all the core components of sales cycle execution.

Pricing Challenges & Understanding Margins

Margins are the leading pain point in pricing

Survey participants were asked which blind spot they wish they could solve when it comes to pricing – and the most common challenge is understanding margins.

Determining company margins generally requires the ingestion of data from multiple sources, which often creates blind spots and room for error.

Gaining a better understanding of margins helps sales leaders stop revenue leakage and enables them to take measured risks – such as creating new pricing packages and even new business models.

The top 5 pricing blind spots our survey respondents wish they could solve: |

|---|

1. Understanding margins |

2. Discount approval workflow |

3. Competitive pricing |

4. Optimal price point |

5. Pricing for services |

Most sales reps need guidance with price margins

80% of sales reps report not being “very confident” about their company’s margins.

Eager reps often discount list prices to close deals quickly and achieve quota – yet the vast majority do not understand their company’s margins.

Without automated processes and guardrails to limit or cap discounts, they may inadvertently hurt company margins and create revenue leakage. In worst-case scenarios, companies will operate at a loss.

Sales teams are more confident about margins than operations teams

47% of sales teams are “very confident” about knowing their company’s margins, in contrast with only 30% of operations teams.

This is a peculiar finding since operations teams generally have a more granular view into sales and revenue data.

Although sales professionals may be confident in their knowledge of margins, they should ensure this confidence is grounded in facts. For example, they should know the threshold at which discounts no longer correlate with an increase in win rate.

Company-wide understanding of margins = effective growth

11% of surveyed companies require their C-Suite to approve discounts, 30% require VPs to approve discounts, and 33% give sales reps the autonomy to discount.

Every company has a different approval workflow depending on its product and organizational structure. And although the C-Suite may be the most knowledgeable, they’re typically not involved in these approvals. So as companies scale and things evolve, it’s critical that everyone remains aligned on margins.

Understanding margins for each product enables professionals to approve discounts and make informed decision more quickly. Knowledge about margins is power.

CPQ software enables effective margin execution

45% of companies with a CPQ are “very confident” about their margins, as opposed to only 34% of companies without a CPQ.

Those with a CPQ are clearly more confident than those without – yet they still do not have an overwhelming amount of confidence. This is because not all CPQs display the margin per product or item.

Knowing the margin per item is essential because it enables sales reps and discount approvers to be more aggressive and creative in discounting specific bundles to win deals – rather than applying a standard discount rate.

Managing Complex Pricing With CPQ

CPQs enable global sales teams

In this survey, 61% of the companies with a CPQ report having more than two office locations.

Managing a global sales team comes with many challenges; there are different cultures, languages, time zones, currencies, and pricing structures to deal with.

CPQ software makes it easy to support different currencies and languages while maintaining a standardized process. Meanwhile, operations teams can configure global pricing so sales reps can quickly send local and personalized quotes.

Large product catalogs call for a CPQ

Among surveyed companies, 69% of those with more than 1,000 products in their catalog have a CPQ.

This is not surprising; as more products are added to a catalog, it becomes increasingly difficult for sales reps to fully understand and recall permutations of the product and pricing.

“It was taking, on average, 9 to 12 months for a rep to actually learn the [400 products] in the product mix. And even after that time, they would still get variations in that product mix”.

Bruce Harris, Director Internal Applications

Velocity of Sales Quotes & Proposals

SMBs with CPQ software send quotes faster

84% of SMBs with a CPQ can send a quote within 30 minutes, compared to 57% of SMBs without a CPQ.

Meanwhile, 95% can send a quote within one hour, compared to only 75% of SMBs without a CPQ.

CPQ software for enterprise organizations has been in the market for many years. But many of these legacy CPQs are considered slow to implement and challenging to maintain and use.

DealHub offers a best-in-class CPQ with full implementation in a matter of weeks. And as companies scale up from SMB to enterprise, they’re able to dynamically adjust their configurations.

Required time to send a quote (SMB)

Enterprises with a CPQ send out quotes faster

Enterprises take a bit longer than SMBs: 43% of enterprises with a CPQ can send a quote in less than 30 minutes, compared to 35% of enterprises without a CPQ.

Sending quotes quickly is important, but shouldn’t come at the cost of accuracy. An inaccurate quote hurts a company’s credibility if retracted, and hurts a company’s bottom line if not retracted – potentially at a huge cost.

With DealHub, sales reps for both SMB and enterprise can create accurate price quotes in eight minutes, on average.

Required time to send a quote (enterprise)

SMBs with a CPQ send out proposals within 1 hour

52% of SMBs with a CPQ are able to send out a proposal in less than 30 minutes, compared to 45% of SMBs without a CPQ.

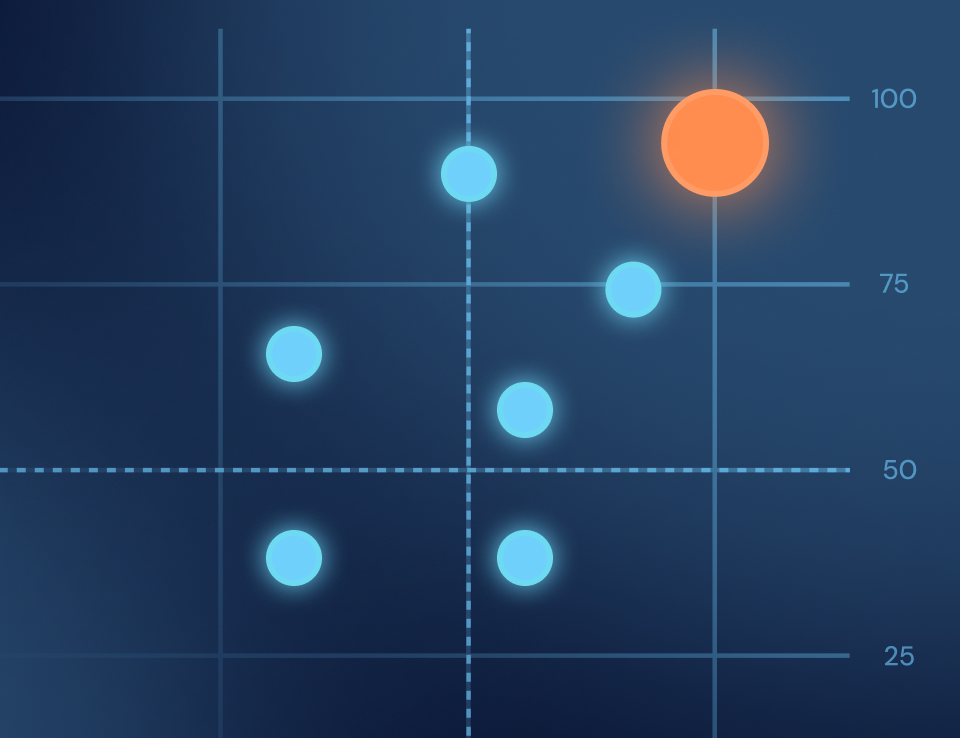

Meanwhile, 95% can send out a proposal within one hour, compared to only 56% of those without a CPQ.

While a quote can be discussed over the phone or sent over email, sales proposals need to be personalized and shareable for buyers, have the right contract lawyers in place, and include timelines.

Companies with a CPQ can send proposals faster because they can generate quotes quickly and accurately through guided selling. Buyer information syncs automatically from the CRM to the proposal and contract, and templates can be selected based on industry parameters.

Required time to send a proposal (SMB)

Enterprises with a CPQ send out proposals much faster

32% of enterprise companies with a CPQ can send out a sales proposal in less than 30 minutes, compared to 7% of those without a CPQ.

Meanwhile, 90% can send a proposal within four hours – compared to only 43% of those without a CPQ.

Many enterprise companies sell to various industries, making it harder to personalize each sales proposal with the right products, terms and conditions. Using a CPQ can significantly reduce time and effort while still enabling personalization.

DealHub further accelerates deals by fast-tracking the time required to send quotes, gain approvals, and generate relevant documents.

Required time to send a proposal (enterprise)

Challenges & Solutions Around Subscriptions

Subscriptions are a key source of revenue

75% of companies earn the majority of their revenue from subscriptions, but only 24% of them use subscription management software. So is their subscription process optimized for success?

This is an important question because subscription management is expected to remain a cornerstone of successful revenue and sales strategies for the foreseeable future.

Subscription management allows for seamless handoffs between sales and customer success teams. By distributing the price quote and legal documentation in a standardized and visible manner in the CRM, it enables a repeatable process and predictable revenue pipeline.

What percentage of your revenue do you expect to come from subscriptions in 2025?

Plan changes can lead to revenue leakage

41% of surveyed professionals report plan changes as their #1 subscription revenue challenge.

Pricing and packaging are not static and may change frequently. HubSpot, for example, typically raises its prices in some way every six months.

Sales reps are not always fully updated on plan changes, and may inadvertently use legacy pricing from a price list they download and use offline.

Subscription management software provides an easy way to guide sales reps so they always select the optimal product and pricing from an up-to-date playbook.

Contract consolidation leads to friction

Buyers tend to deepen their relationships with vendors over time. They may purchase more licenses, extend the term of their existing contract, or request changes to specific terms and provisions of an agreement.

These changes require going back and updating original contracts. Companies that don’t leverage technology to manage such requests often find it difficult to handle them efficiently.

Without the right automated system in place, teams must manually enter changes into the CRM and important updates may get lost in the shuffle.

The disconnect between CPQ and subscription management

Companies with and without CPQs have different pain points when it comes to subscription management.

Of the companies surveyed, 24% of those with a CPQ reported that a disconnect between subscription management and their CPQ is a significant pain point. (And it is no coincidence that among those people, almost none of them have a subscription management solution in place.)

DealHub understands this pain point and connects subscription management with a CPQ through its Revenue Platform.

Companies without a CPQ struggle with automatic renewals

Meanwhile, companies that do not use a CPQ struggle significantly with automatic renewals. This is because price quotes not synced to a CPQ must be searched for and manually populated or re-generated.

Consolidate Your Spend, Connect Your Stack

DealHub’s award-winning Revenue Platform offers the most complete and connected revenue stack for your organization. Our platform connects every stage of the revenue lifecycle so teams can easily move opportunities through the funnel and quickly and efficiently close new deals and subscriptions.

Our platform includes:

![]()

DealHub integrates with Salesforce, Microsoft Dynamics, and HubSpot CRMs.

Our Digital DealRoom Accelerates Revenue

The DealHub data lab assessed more than 193,000 of our customers’ deals and $25 billion in revenue processed through the DealHub platform.

It resulted in this significant finding: sales win rate increases by up to 3X when sales teams use our Digital DealRoom as opposed to traditional documents like PDFs and Word files.

A DealRoom is a single, collaborative engagement platform to host and send all of the critical collateral needed to close a deal – Sales Proposals, CPQ, eSign, CLM, and Subscription Management.

Because it’s easy to use and quick to implement, our DealRoom helps sales teams achieve fast adoption and gain a competitive advantage in every deal.